Weekly Market Commentary

Rising interest rates are the result of the Federal Reserve’s campaign to snuff out inflation. The pain of rising rates has been felt in the financial sector. It has also been felt in housing.

Housing sales tumbled since the beginning of 2022, as the jump in mortgage rates forced many buyers to the sidelines. Existing home sales fell a whopping 38% last year, according to the National Association of Realtors.

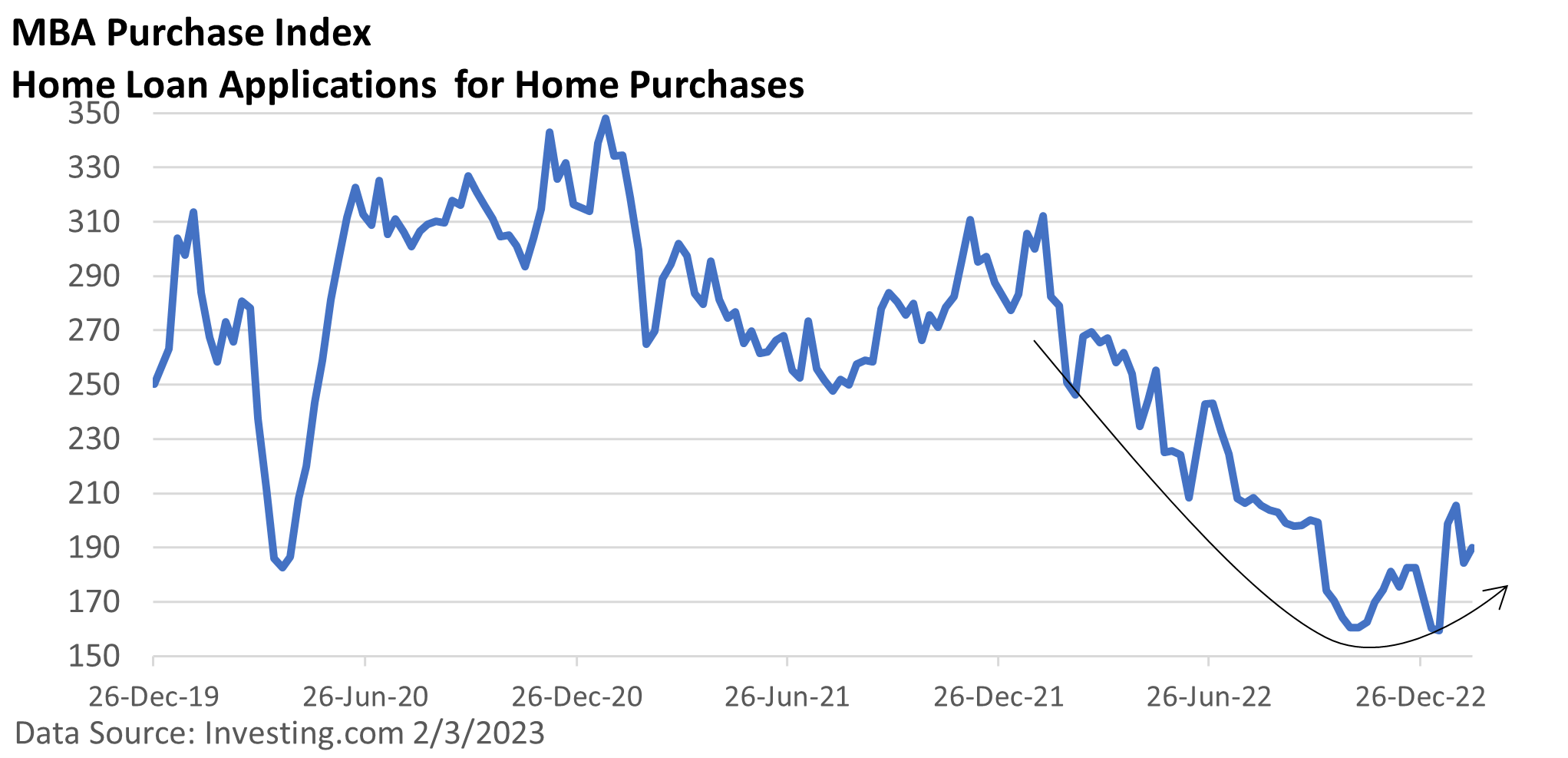

The decline was foreshadowed by a leading index for home sales called the Purchase Index from the Mortgage Bankers Association.

The Purchase Index is a weekly measure of home loan applications for home purchases, so it provides a reasonably accurate sneak peek of upcoming sales.

Tied to the spike in mortgage rates, the sharp decline in sales last year led to a modest dip in home prices in many locations.

So far, homeowners have been spared the pain of 2008 thanks to more realistic lending standards. No longer are buyers jumping into mortgage products they neither understand nor can afford.

Additionally, the spike in rates discouraged some from listing their homes, as they’d be trading in a very low rate for one that is much higher. That helped restrict supply on the market.

The Power of Rates

Freddie Mac’s weekly mortgage survey put the 30-year fixed mortgage rate at 3.11% as of the week ending December 30, 2021. The benchmark rate peaked at 7.08% in early November.

The 30-year fixed rate declined to 6.12% as of the week ending February 9.

Housing is rate sensitive. While rates are nowhere near the levels that sparked the buying frenzy in 2020 and 2021, the recent drop has sparked renewed interest in homes, according to data from the Purchase Index.

As the year unfolds, much will depend on the direction of mortgage rates.