Weekly Market Commentary

Here’s a paradox. What happens when an immovable object runs into an irresistible force? In today’s investing world, the Federal Reserve has been that immovable object, jacking up interest rates in order to quell inflation.

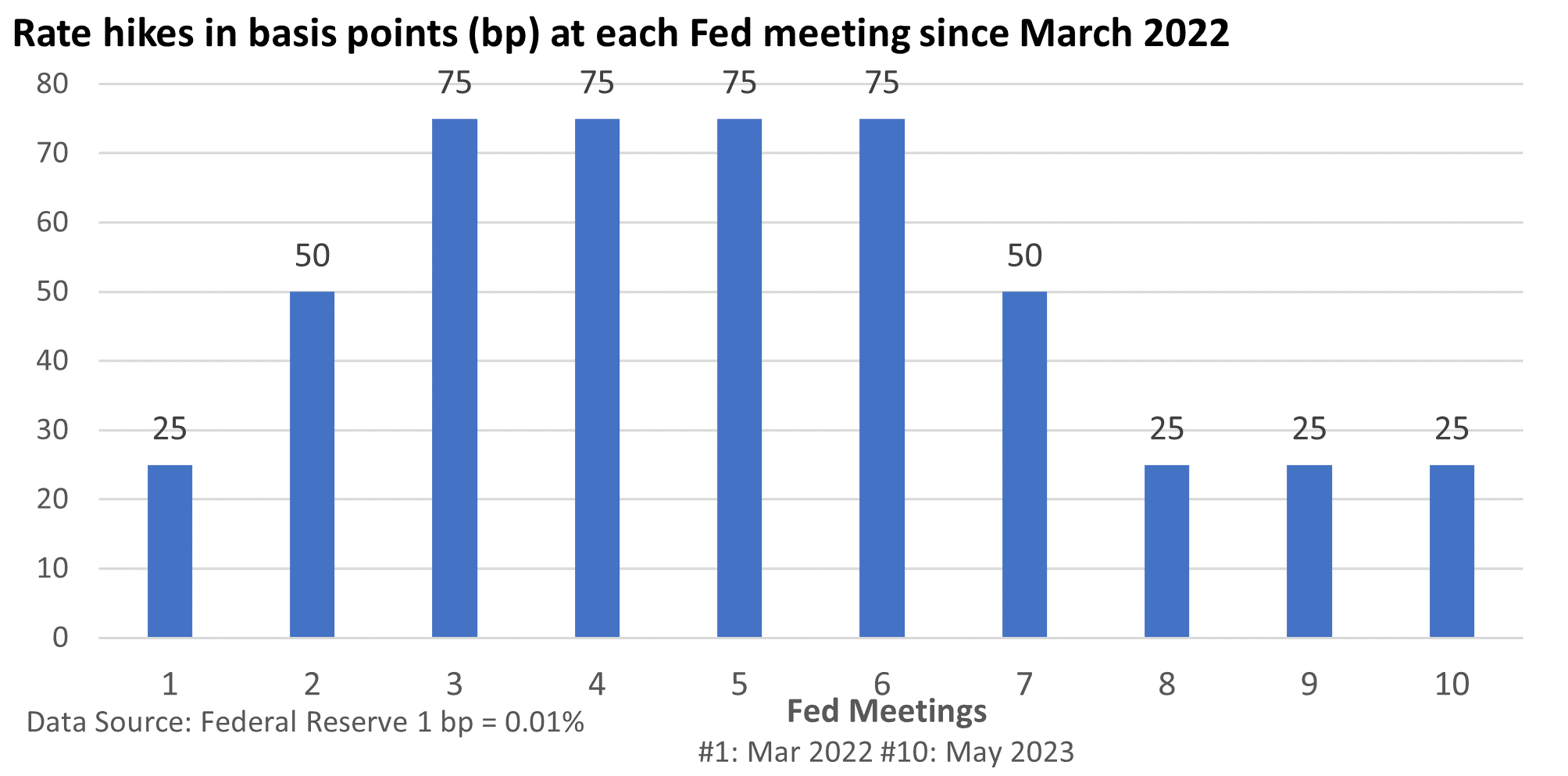

Today’s rate-hike cycle is the fastest since 1980. The Fed has raised the fed funds rate by 500 basis points (bp, 1 bp = 0.01%), or 5 percentage points, since March 2022.

But the Fed’s war on inflation appears to be on a collision course with a banking crisis that flared up again last week. It’s creating a new headache for the Fed. Raising rates conflicts with the goal of easing pressure on banks. It has forced a more cautious outlook from the Fed.

What happened? With a helping hand from the FDIC, the deposits and most assets of First Republic Bank (FRB) were purchased last week by JPMorgan Chase (JPM). End of crisis? Not so fast. The market went after another next regional bank.

It’s not based on the economic fundamentals. Instead, it’s psychology and fear in play.

“The tension between poor market sentiment and strong liquidity at regional banks is difficult to reconcile as investors take a draconian view of banks’ capital and operating models,” Bloomberg Intelligence analyst Herman Chan said. Others are less sure.

What happened Wednesday? The Fed hiked its key lending rate, the fed funds rate, by 25 bp to 5.00 – 5.25%. Rhetorically, it kept up its tough talk on inflation. It left the door open to another rate increase in June. Unlike prior hikes, the tone was much less definitive.

Investors are currently trying to price in about three 25 bp rate cuts this year, according to the CME FedWatch tool. But Fed Chief Powell pushed back.

We “have a view that inflation is going to come down, but it’ll take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates, and we won’t cut rates,” he said at his press conference.

That sparked Wednesday’s selloff, which continued into Thursday. It’s one more reason a well-diversified portfolio tailored to your long-term goals helps manage short-term volatility.

For now, the Fed is betting it can keep its attention on inflation while using other tools to support banks that are in need.