Weekly Market Commentary

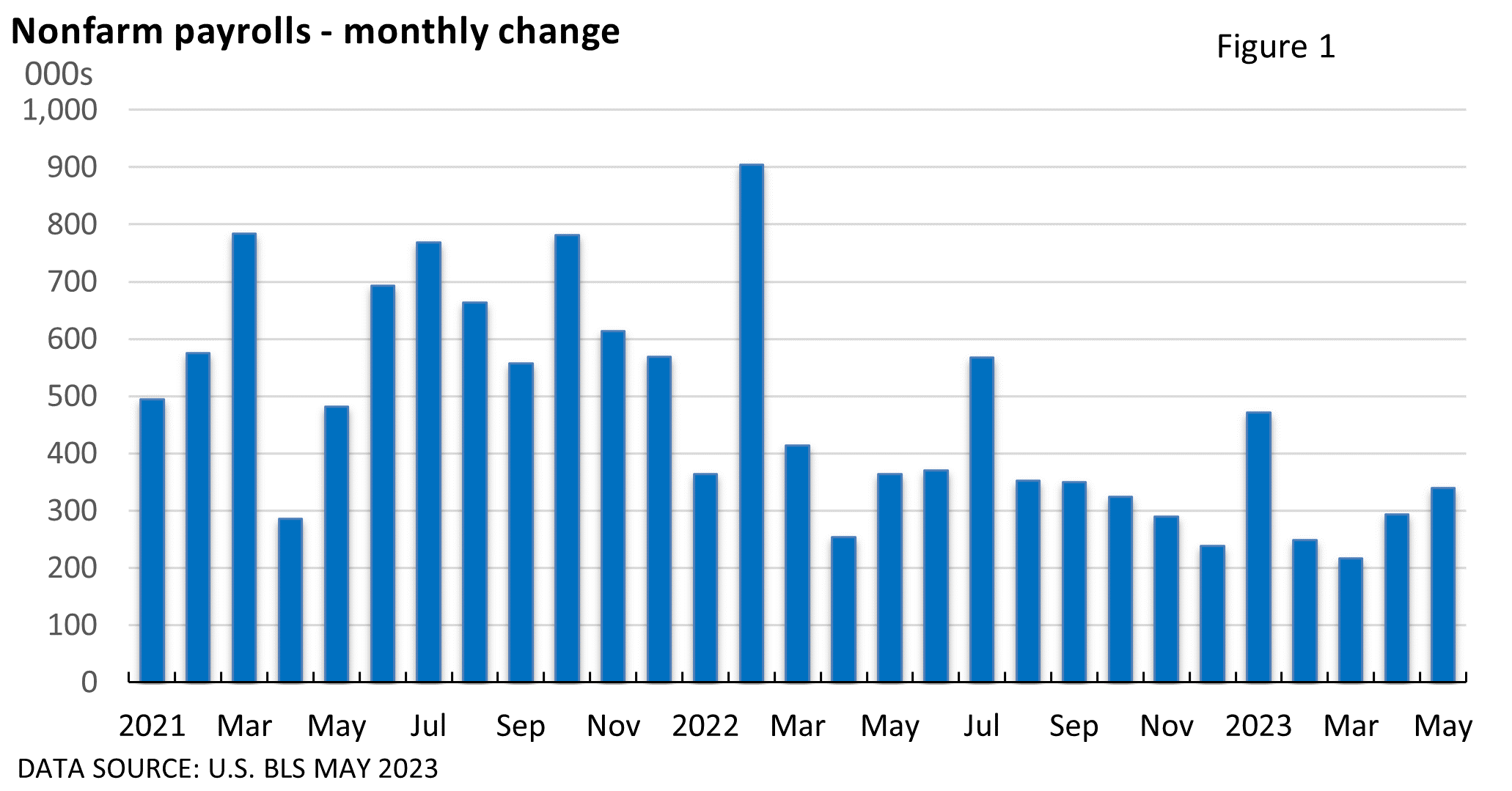

May nonfarm payrolls surged past economists’ projections of 190,000 per DJ Newswires, soaring by 339,000 (see Figure 1) as reported by the U.S. Bureau of Labor Statistics (BLS).

Surprised? Despite its strength, payrolls have mostly exceeded expectations in the past year. This serves as another reminder of the challenges of economic forecasting.

To put it simply, forecasting models are not always optimal due to the abundance of unknown variables.

Job growth has been robust, though economic growth has been modest at best.

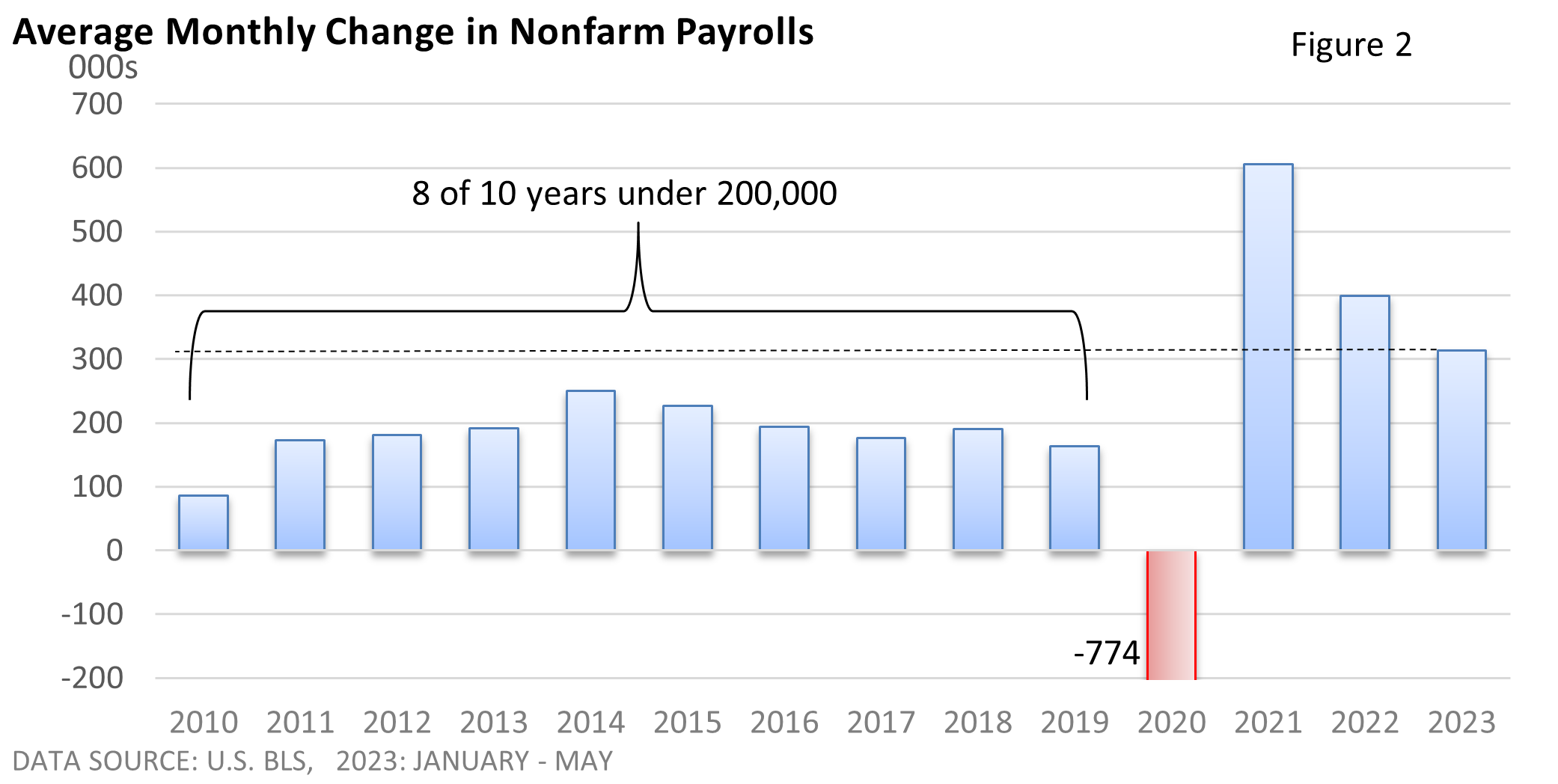

The current year’s average payroll growth of 314,000 far exceeds the payroll growth of the previous decade (as shown in Figure 2). This is partly due to the significant number of job openings available, making it easier for job seekers to secure employment.

You see, the economic fallout from the pandemic persists and continues to affect the data.

There is one issue to address. The unemployment rate rose from 3.4% in April to 3.7% in May.

Why is there a conflict between the rise in payrolls and the rise in the unemployment rate? The unemployment rate is measured by a separate survey called the household survey. Nonfarm payrolls are calculated via a survey of businesses called the establishment survey.

The U.S. BLS says the household survey is “more expansive” and includes “self-employed workers whose businesses are unincorporated.” The establishment survey does not.

Self-employed workers whose businesses are unincorporated declined by 369,000 in May.

The reason for the decline is not entirely clear and could be attributed to anomalies in the data. That said, the reduction accounted for the unexpected rise in May’s jobless rate.

Bottom Line

The resilient labor market and the Fed’s war on inflation should all but guarantee a rate increase at the Federal Reserve’s meeting next week.

However, Fed officials have hinted they will probably not raise interest rates in June, allowing it time to evaluate the cumulative effect of prior rate increases.

While we will receive one more inflation reading before the Fed’s June meeting, for the time being, the Fed seems to be saying it’s best not to be too concerned about positive economic news.

The strong jobs report and an expected one-meeting pause by the Fed helped send stocks sharply higher on Friday.