Weekly Market Commentary

Inflation has bedeviled consumers and investors for over a year. The Federal Reserve waited far too long in responding to high prices, and its abrupt reversal in 2022 pushed equities into a bear market.

But the Fed’s kinder, gentler approach this year and a resilient economy have helped shares rally off last year’s low. While lower oil prices have pushed headline inflation down sharply, prices outside of energy have been stickier on the upside… until recently.

The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 0.2% in June. The core CPI, which excludes food and energy, also rose 0.2%, the slowest pace since February 2021.

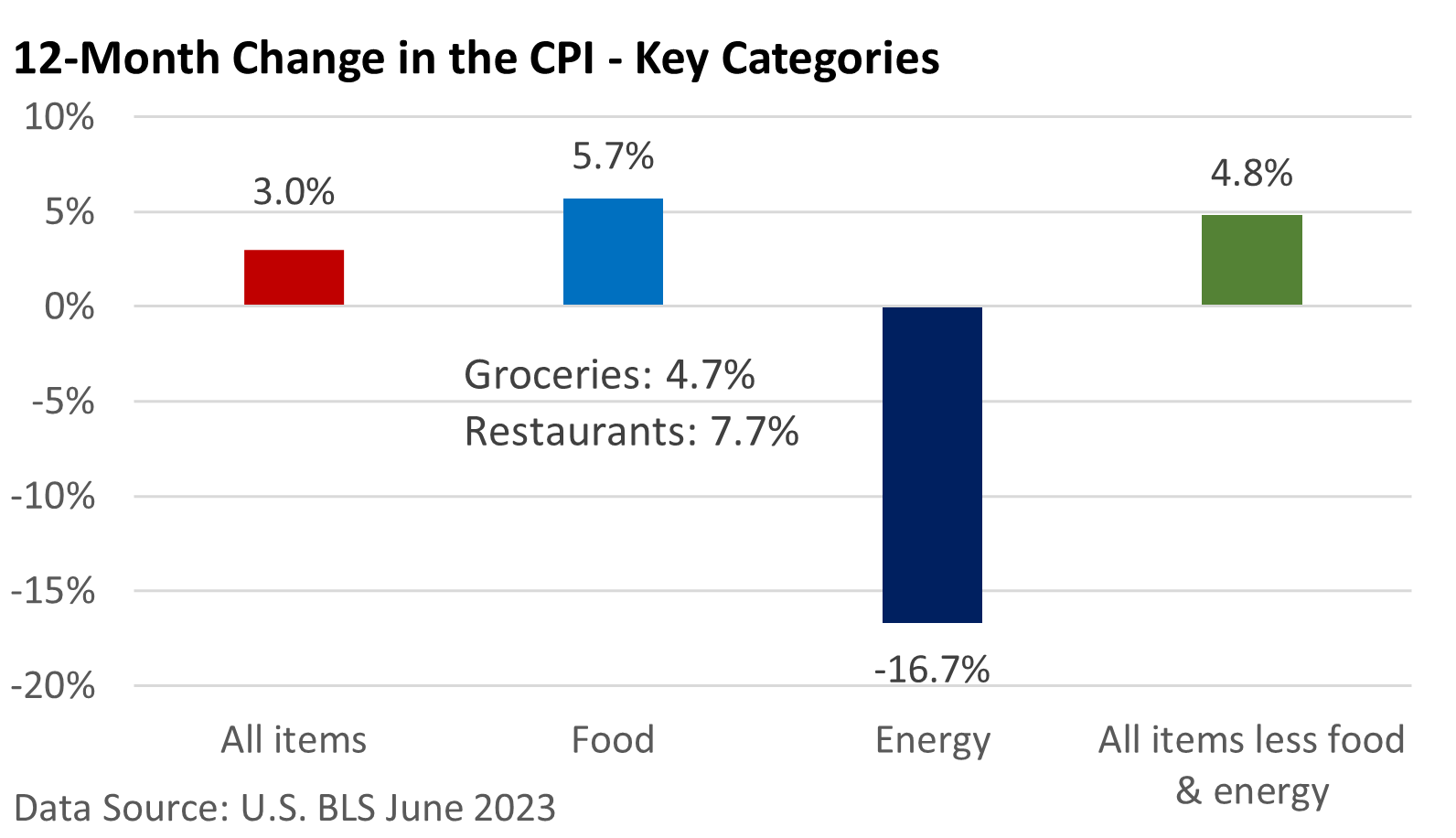

In June, the CPI rose 3.0% compared to a year ago, which is below the 4.0% rise in May. The core CPI decreased from 5.3% in May to 4.8% in June. While both readings are still above the Fed’s 2.0% target, which it defines as price stability, the trend is cautiously encouraging.

The following image provides a broad overview of the current situation.

Energy has led the way lower, helping bring down the headline CPI to 3.0% from its year-ago peak of 9.1%. But everyday items have been slower to respond.

For example, the core CPI has been gradually improving but remains at a still-elevated 4.8%. It reached its highest point of 6.6% nine months ago.

Food at home (groceries) is higher, but its rate has slowed sharply since the beginning of the year. Prices at restaurants, however, continue to gallop ahead.

Progress on headline inflation may grind to a halt, at least in the short term, as energy prices peaked a year ago and fell in July 2022 (that makes the year-over-year comparison more difficult).

Core inflation is tougher to get a handle on since the basket of goods and services measured has so many moving parts. But the general trend is cautiously encouraging. Investors see a slowdown in inflation as beneficial because it eases pressure on interest rates, which in turn supports stocks.

The Fed is not ready to declare ‘Mission Accomplished’ on inflation, and it has hinted at a rate hike at its July meeting. While we can’t predict their decisions with certainty, continued progress raises the prospect that the Fed is nearing an end to its rate-hike campaign.