Weekly Market Commentary

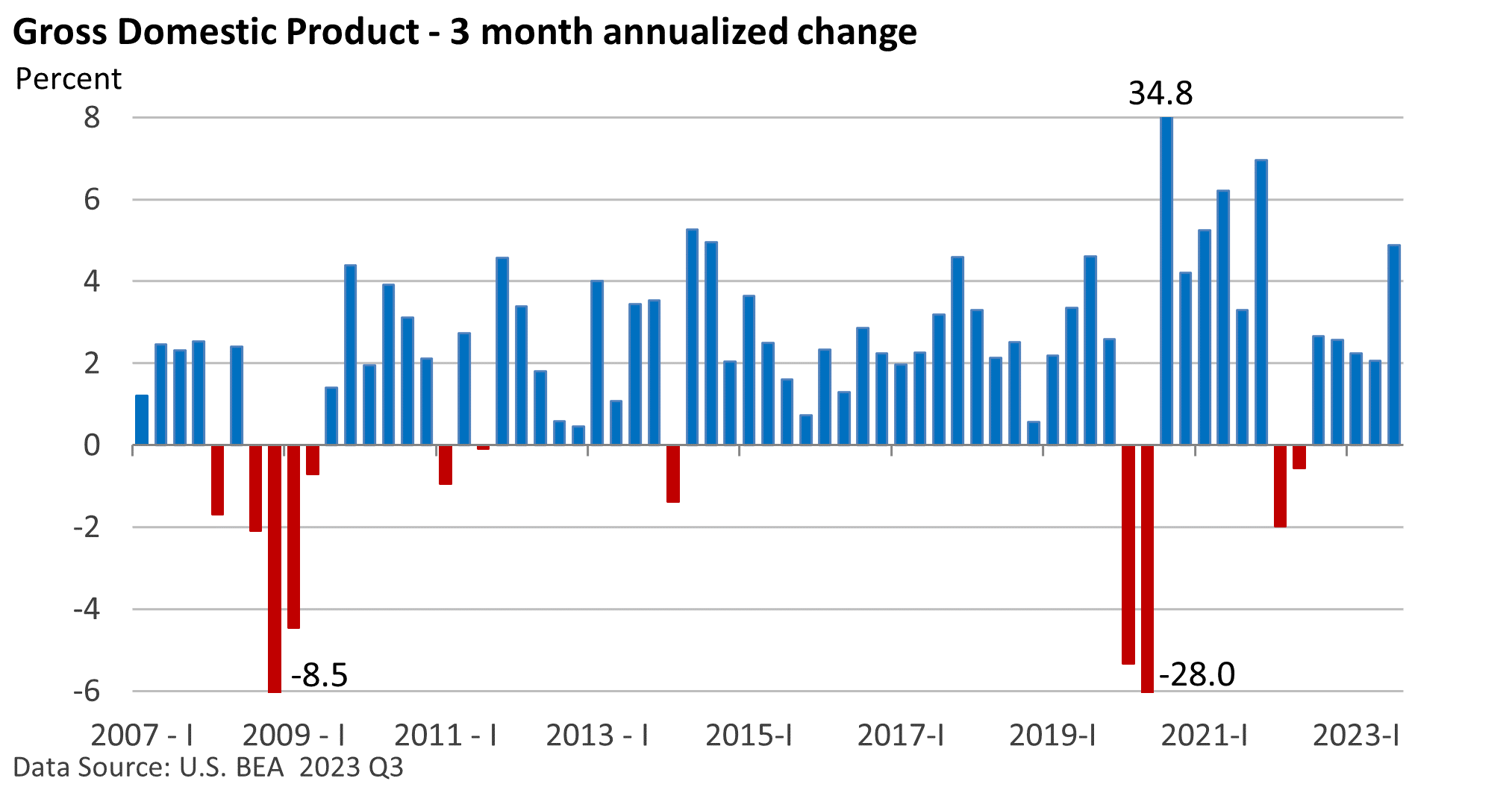

The U.S. Bureau of Economic Analysis (BEA) reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at an annual pace of 4.9% in the third quarter.

It’s the fastest growth rate since Q4 2021 when the economy was reopening, and consumers had plenty of stimulus cash in bank accounts.

When the quarter began, few saw a significant acceleration in economic growth.

According to the Atlanta Federal Reserve, the Blue Chip forecast of economic forecasters projected economic growth would nearly stall when the forecast was issued at the start of Q3.

The sharp rise in growth occurred mainly due to strong consumer spending, which makes up almost 70% of GDP (U.S. BEA).

Credit cards and cash still left in the bank from stimulus payments helped consumers go on a spending spree in Q3. But why Q3 and not the first half of the year? That’s not an easy question to answer.

Rising business inventories, along with increased government spending, including national defense, contributed to economic growth.

Government spending contributes to the federal deficit. But in the short term, higher spending increases the demand for goods and services, which aids GDP.

GDP is a backward-looking indicator, as are most government reports. It’s backward-looking because it highlights what happened in the past. In this case, GDP reviews activity between July and September. We’re about to enter November.

What will the economy do for an encore in Q4? Economic forecasting is problematic.

There is no shortage of worries. Consumer confidence is shaky, as we pointed out last week, but people are spending, and companies have been hiring.