Weekly Market Commentary

The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago.

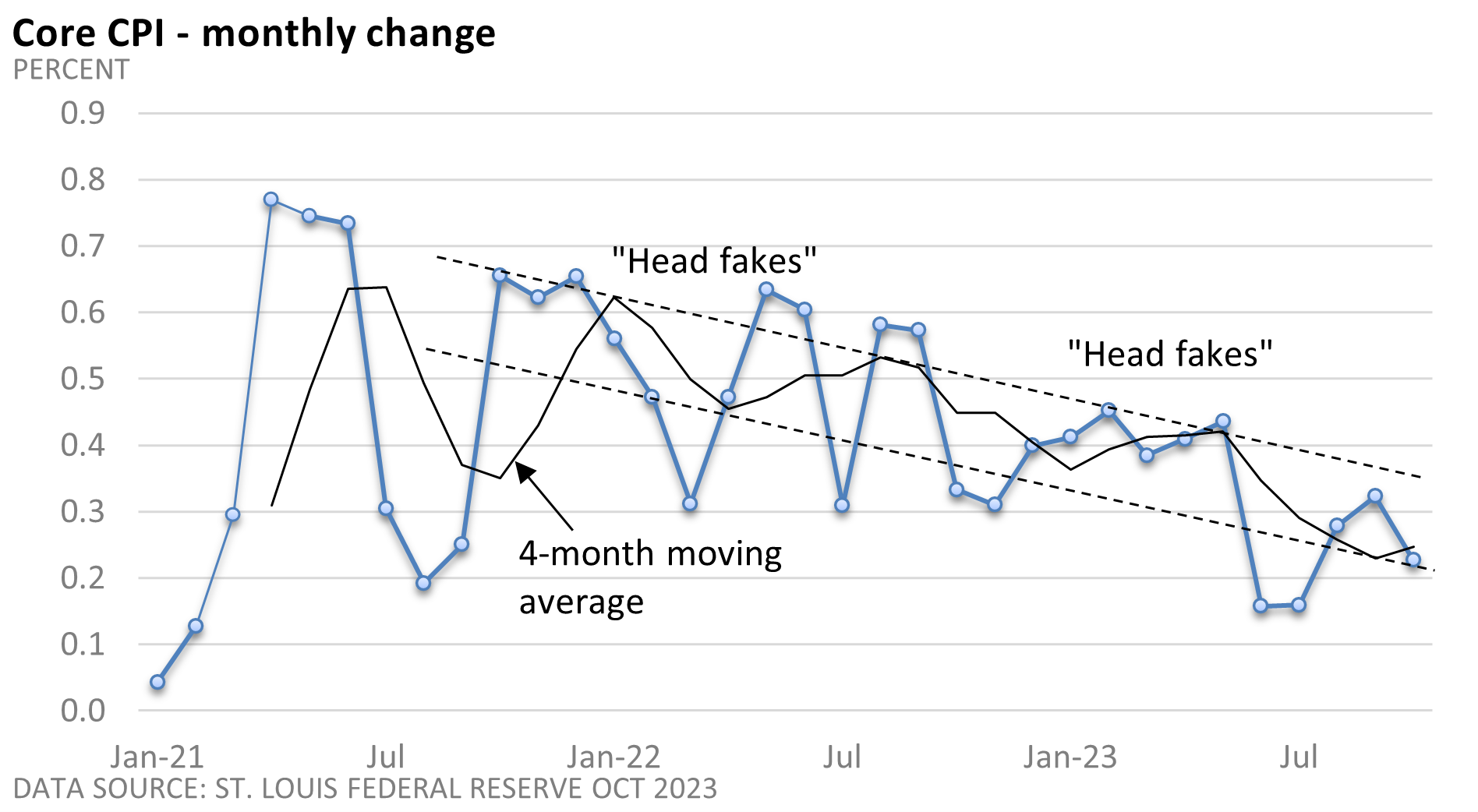

Excluding volatile food and energy prices, the core CPI rose 0.2%. The core CPI is up 4% compared to one year ago, which represents the smallest increase since September 2021.

Economists focus on the core CPI, which might seem puzzling given that food and energy are items that everyone purchases. These categories, especially energy, can experience wild fluctuations, and economic policy has less of an impact on them.

As of June 2022, energy was up 41% from the prior year. As of October, it decreased by 4.5% (U.S. BLS). Historical data show the headline CPI tends to return to the core rate.

While inflation remains well above the Fed’s annual goal of 2%, recent news is encouraging. But before we jump in, let’s cover a couple of terms.

When economists talk about a slowdown in inflation, they are not referring to a decrease in prices. Rather, they are talking about a deceleration in the rate of inflation.

Since the annual rate of the core CPI peaked at 6.6% in September 2022, it has slowed to 4.0% as of October (U.S. BLS). The overall CPI peaked most recently at 9.1%.

Don’t expect the general price level to fall back to pre-pandemic levels. Deflation, defined as an actual decline in the price level, has been very rare in the U.S. in modern times.

The graphic below highlights the change in the monthly rate. Progress has been uneven, but nonetheless, we’re seeing progress.

There have been head fakes over the last year but note that subsequent peaks have been trending lower. Fed Chief Powell even referenced “head fakes” in a recent speech.

Investors, however, have warmed to the slowdown in the rate of inflation. No one has a clear view of the future, but the improving trend raises the odds that the Fed is done hiking interest rates.

That’s an important reason why stocks have rallied this month.