Weekly Market Commentary

Investors eagerly anticipate the government’s monthly release of the CPI (Consumer Price Index). Why? Inflation affects everyone, and investors are no exception.

The Federal Reserve’s efforts to curb inflation led to a bear market in 2022. However, fewer interest rate hikes in 2023 and a more lenient stance by the Fed contributed to the market’s recovery in 2023.

Last week, the U.S. Bureau of Labor Statistics (BLS) reported that the CPI rose 0.3% in December. This is a rise of 3.4% compared to a year ago, which is higher than the 3.1% increase seen in November.

The core CPI, which excludes food and energy prices, also increased by 0.3%. Compared to one year ago, the core CPI is up 3.9%, slightly lower than the 4.0% increase in November.

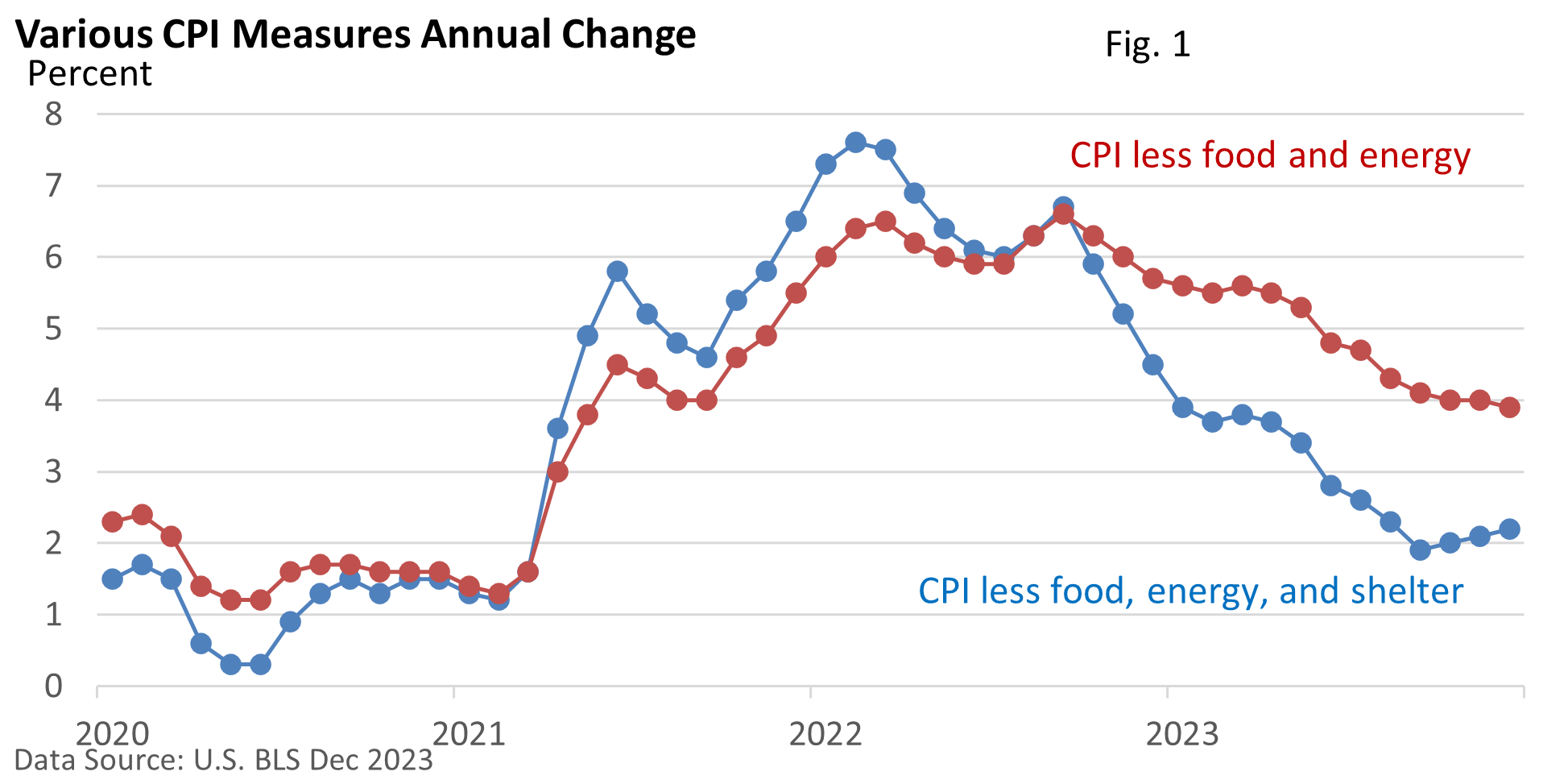

Progress on inflation is evident, but it has been slow and uneven.

In fact, progress on the core CPI, which excludes food and energy, has almost stalled over the last four months – Figure 1.

But Fed officials are hinting at rate cuts this year, and some measures of inflation are much better behaved.

If we exclude the cost of shelter, such as housing and rent, the inflation rate has remained around 2% for the past four months – Figure 1.

The Fed’s Favorite Gauge

There are two main ways to measure inflation: the Consumer Price Index and the Personal Consumption Expenditures (PCE) Price Index.

Although the CPI is more well-known, the PCE is the Fed’s preferred method of tracking inflation.

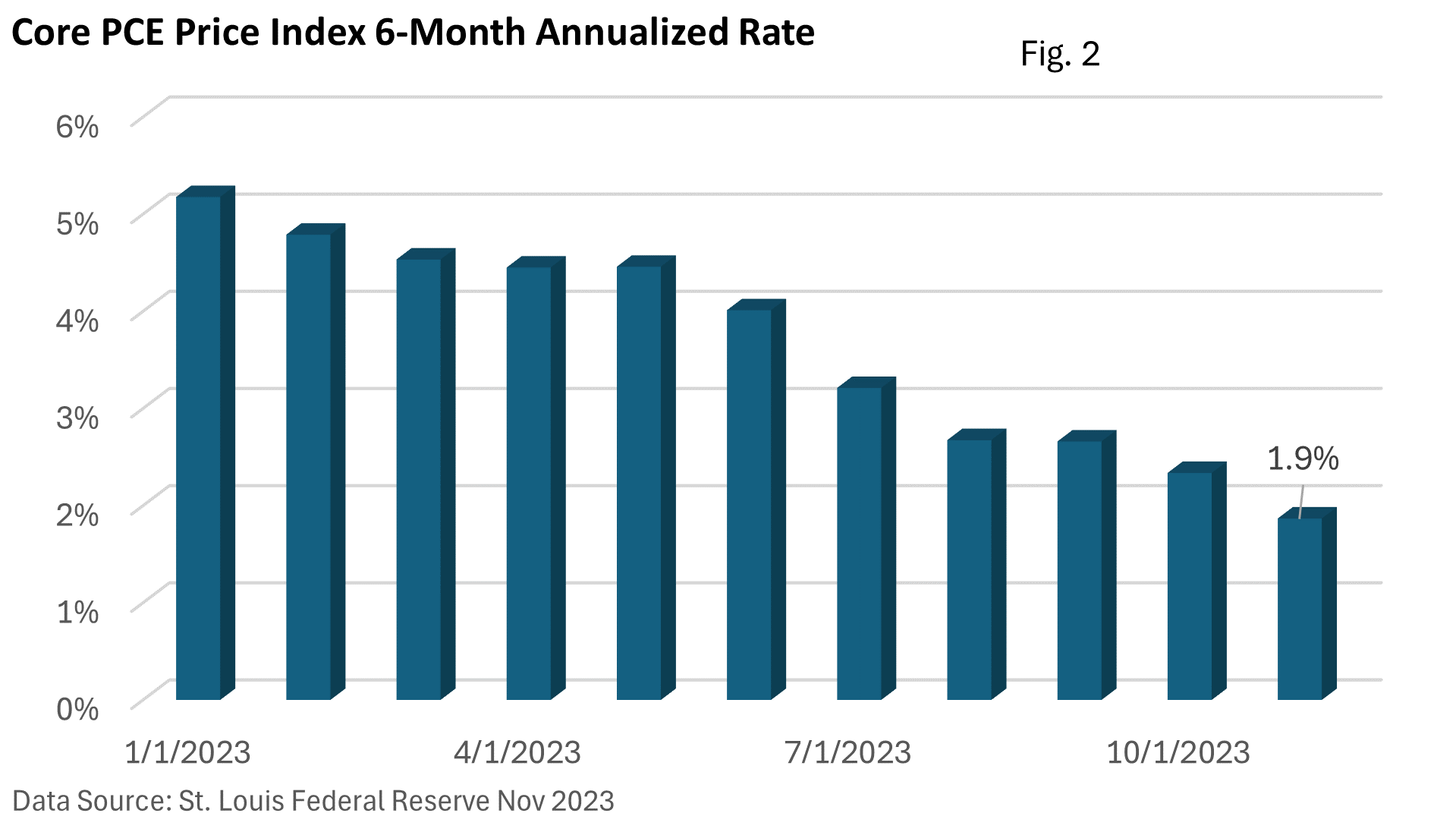

Recently, the PCE has decreased at a faster rate than the CPI. According to the St. Louis Federal Reserve, their methodologies differ, which often results in a higher CPI than the PCE. As of November, the core PCE Price Index was up 3.2% compared to the previous year.

The six-month annualized rate, which detects trends faster than the annual rate, illustrates that progress has been significant. In November, the rate was up 1.9% – Figure 2.

Practically speaking, the six-month annualized rate takes the actual change over six months and doubles it.

It’s not that the PCE is better than the CPI or vice versa. Both have their advantages and drawbacks. That said, they are both very comprehensive yardsticks.

Bottom line, a slowdown in inflation benefits everyone, including investors, as progress on the pricing front has nearly shut the door on further rate hikes, increasing the odds the Fed will cut interest rates this year.