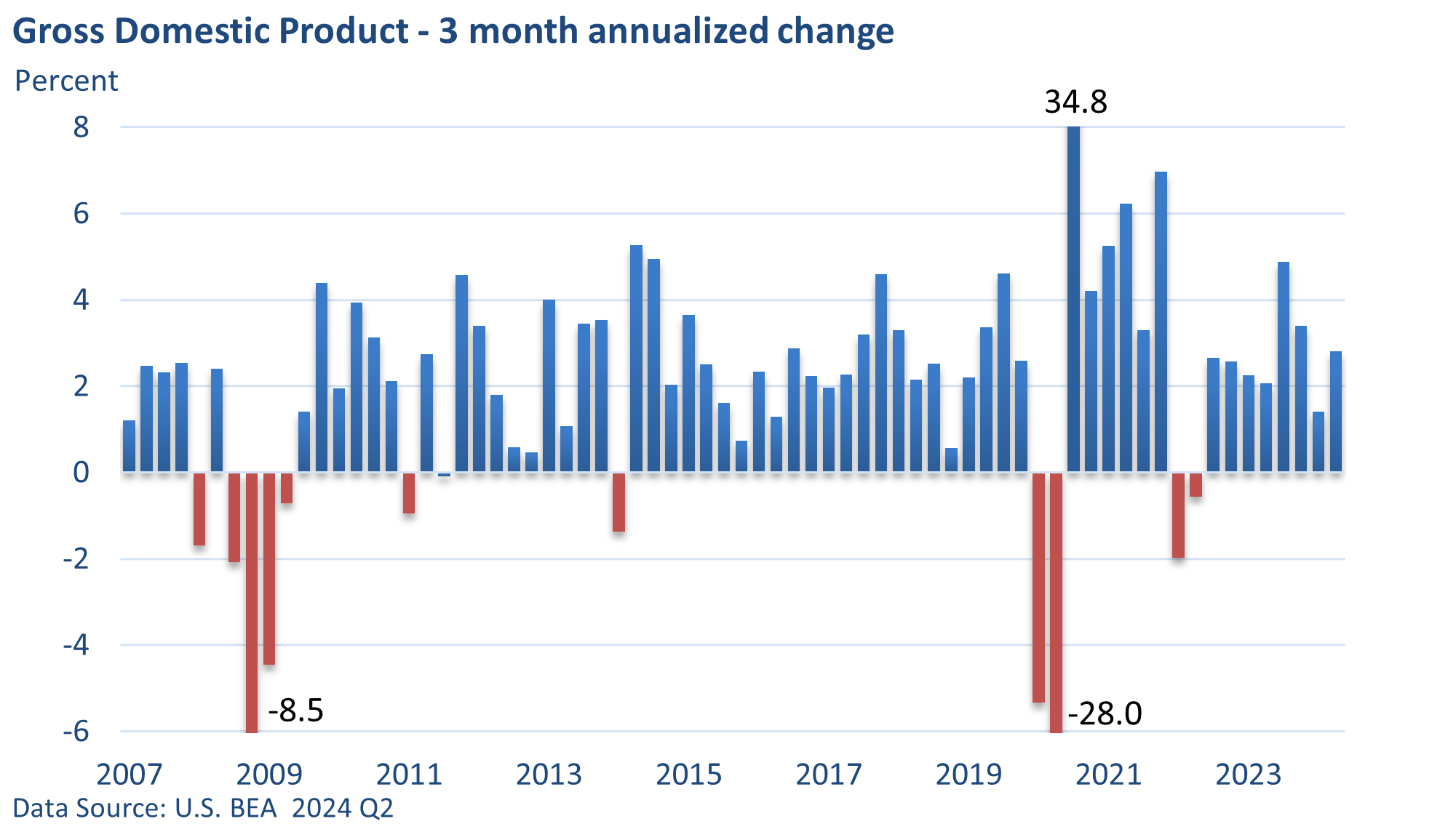

The U.S. Bureau of Economic Analysis reported that the Gross Domestic Product (GDP), the largest measure of goods and services, expanded at a brisk annualized pace of 2.8% in the second quarter.

That’s up from 1.4% in the first quarter and well ahead of Bloomberg’s estimate of 2.0%.

Respectable consumer and business spending offset weakness in housing construction. Stripping out inventories, trade, and government spending, a key measure of underlying demand rose 2.6% for the second straight quarter (Bloomberg).

The second quarter number is ‘backward-looking.’ It reviews economic activity from April through June, and we are set to enter August.

Still, the upbeat pace is encouraging and bodes well for the general economy and the Federal Reserve, which hopes to guide economic activity toward a soft landing.

The Fed is once again hinting at reducing interest rates since it is aware that maintaining high rates over an extended period could tip the economy into a recession.

Such a scenario would likely bring the rate of inflation down even faster, but the price would be high—millions of job losses.