All indications point to a rate cut by the Federal Reserve this week. What’s behind the Fed’s rationale? Let’s look at three key metrics.

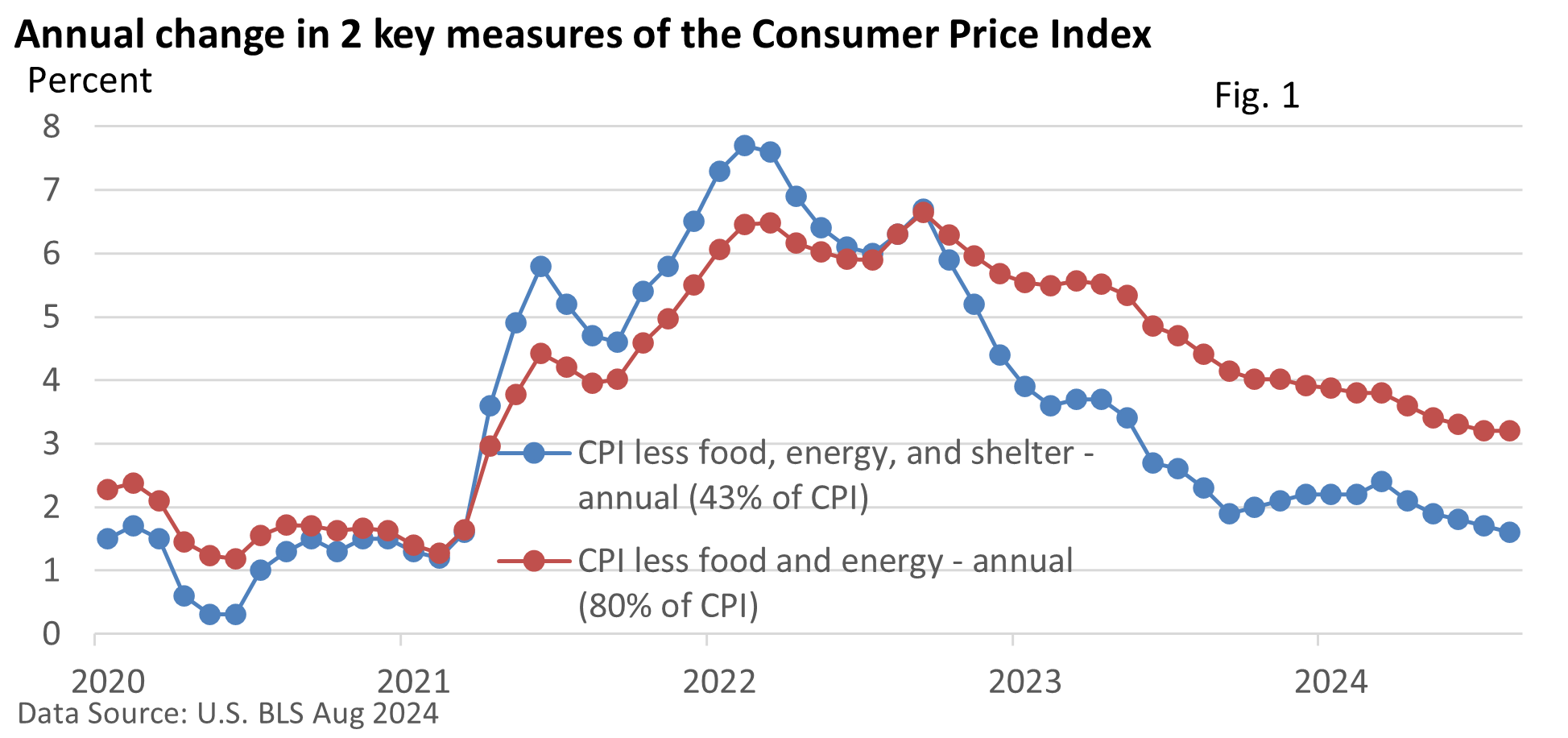

Aided by lower gasoline prices and stable prices for consumer goods, the rate of inflation has slowed dramatically.

Inflation has been the sole focus of the Fed over the last couple of years. The pendulum is now swinging towards employment.

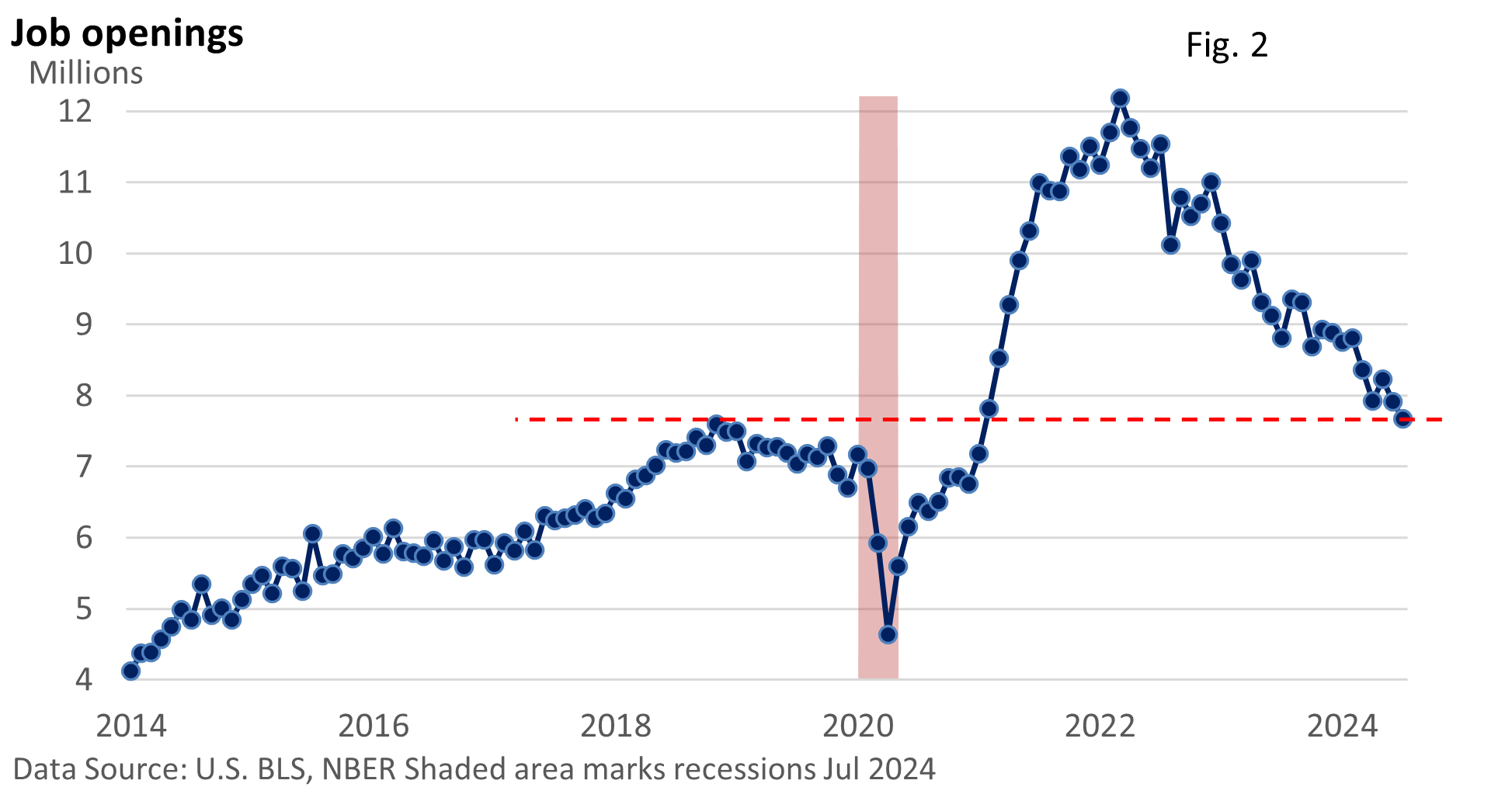

Figure 2 highlights that job openings remain elevated but have fallen significantly over the last couple of years. Fewer openings equal longer job searches.

But we’re not seeing a collapse in the labor market either. Openings are sitting at the peak of the prior cycle, and the National Federation of Independent Business reported last week that small business owners still struggle to find workers.

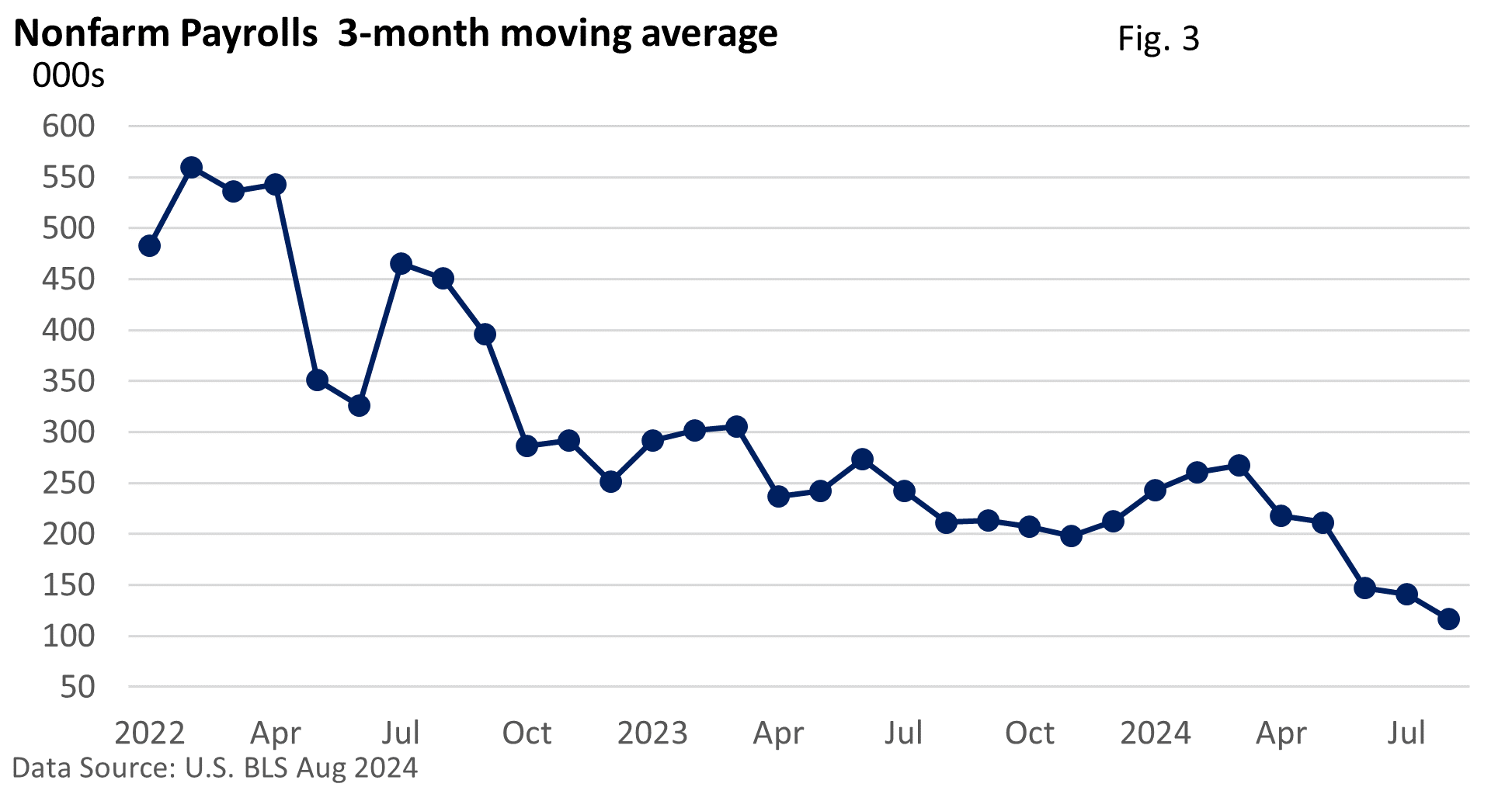

Finally, job growth has slowed—see Figure 3.

If the Fed leaves rates at today’s levels for too long, there is a fear layoffs will rise and a recession will ensue.

Why? According to economic theory, higher rates discourage businesses and consumers from borrowing and spending, more than offsetting any benefits that savers receive from today’s higher rates. Falling business activity increases layoffs, and the jobless rate jumps sharply.

The cycle feeds on itself until the economy is in a full-blown recession.

How much might the Fed reduce the fed funds rate this week? According to analysts surveyed by Investor’s Business Daily, a rate cut of a quarter-percentage point is expected, though some analysts believe a half-point might be forthcoming.

So, the Fed is likely to embark on a rate-cutting campaign. How many rate cuts and how deeply the Fed may reduce the fed funds rate in the coming months will depend in large part on how the economic outlook unfolds.