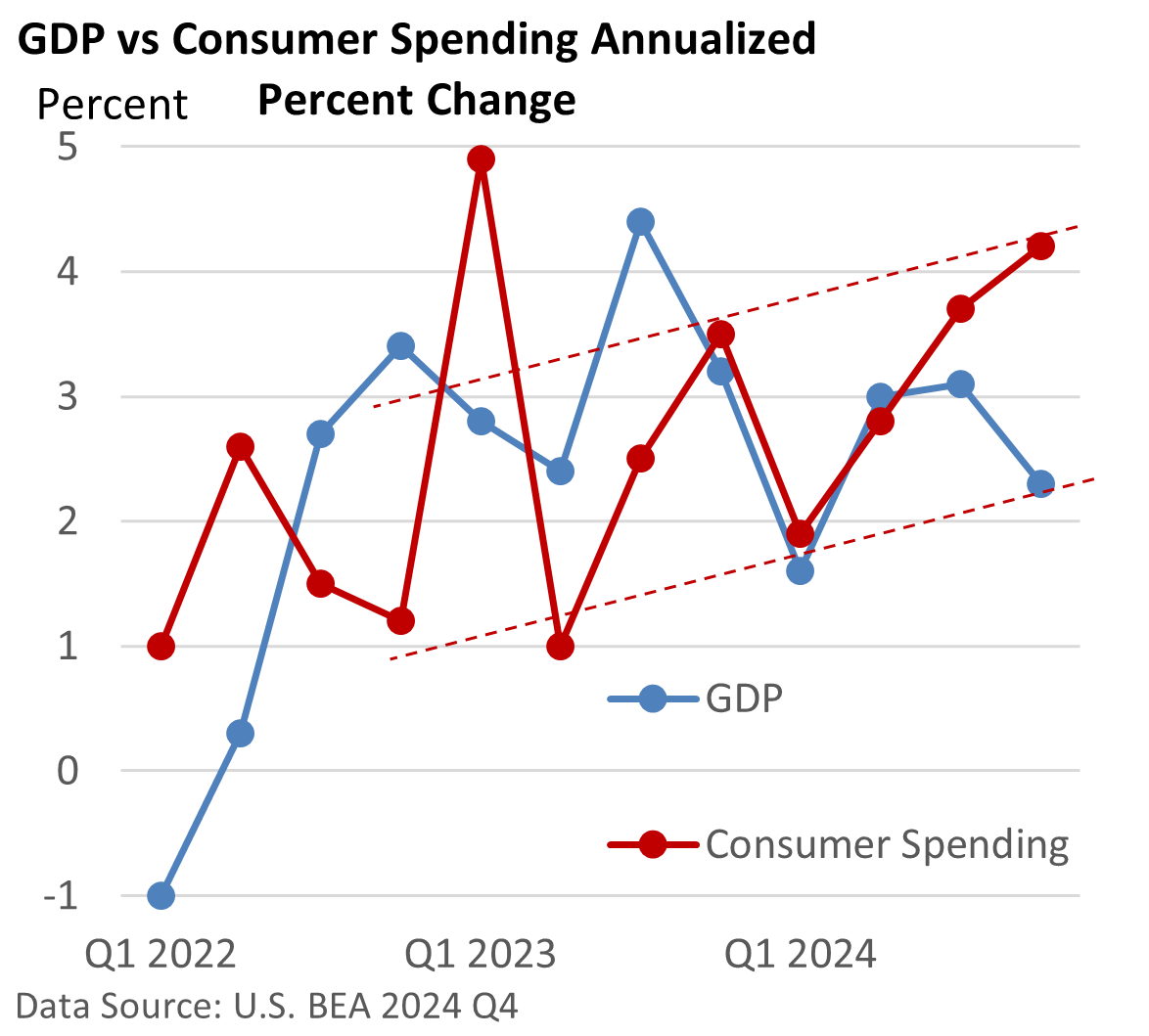

The U.S. Bureau of Economic Analysis reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at a 2.3% annualized pace in the fourth quarter. That’s down from 3.1% in Q3.

While a little lighter than expected, the decline can be traced to inventories. You see, inventories are a plug figure. If they rise, that adds to GDP. If the level falls, that decline detracts.

Bottom line. The drop in GDP subtracted 0.9 percentage points from GDP.

Had businesses boosted production to make up for stronger consumer spending, GDP would have risen 3.1% (assuming no change in inventories).

Consumer spending, which accounts for nearly 70% of GDP, rose 4.2% in Q4.

Note the trend in consumer spending. Over the last seven quarters, outlays have been gradually trending higher despite Federal Reserve rate hikes.

Generally, GDP has been expanding at a fairly stable pace since the third quarter of 2022.

Some of the growth in consumer spending may stem from consumers pulling forward purchases to avoid potential tariffs.

Strong holiday spending may also have helped.

Furthermore, the savings rate is low, and any attempt to bulk up on savings could pressure the economy.

However, there are no signs that consumers are beginning to favor savings over spending.

Meanwhile, and to no one’s surprise, the Fed kept its key rate at 4.25 – 4.50% last week.

The Fed’s stance and Fed Chief Powell’s remarks at his press conference can be summed up with a simple remark.

The Fed’s in no hurry to cut rates right now (Powell said it 5 times), as progress towards 2% inflation has stalled.

Solid economic growth gives the Fed some leeway as it holds off on further rate cuts.

But if progress on inflation resumes, the Fed is prepared to reduce interest rates again.