Weekly Market Commentary

October’s slower-than-expected rise in the Consumer Price Index fueled a 5.53% rise in the S&P 500 Index on Thursday, which was the 15th-best trading day since 1953 when the 5-day trading week began, according to Bespoke.

Why the huge rally? If inflation has peaked, it takes some pressure off the Federal Reserve, as the ultimate peak in rates may not be as high.

On Thursday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index rose 0.4% in October, and the core CPI, which strips out food and energy, rose 0.3%. Analysts forecast a 0.6% and 0.5% increase, respectively, according to MarketWatch.

With inflation exceeding most forecasts this year, the softer reading was welcome. But is it too soon to declare victory?

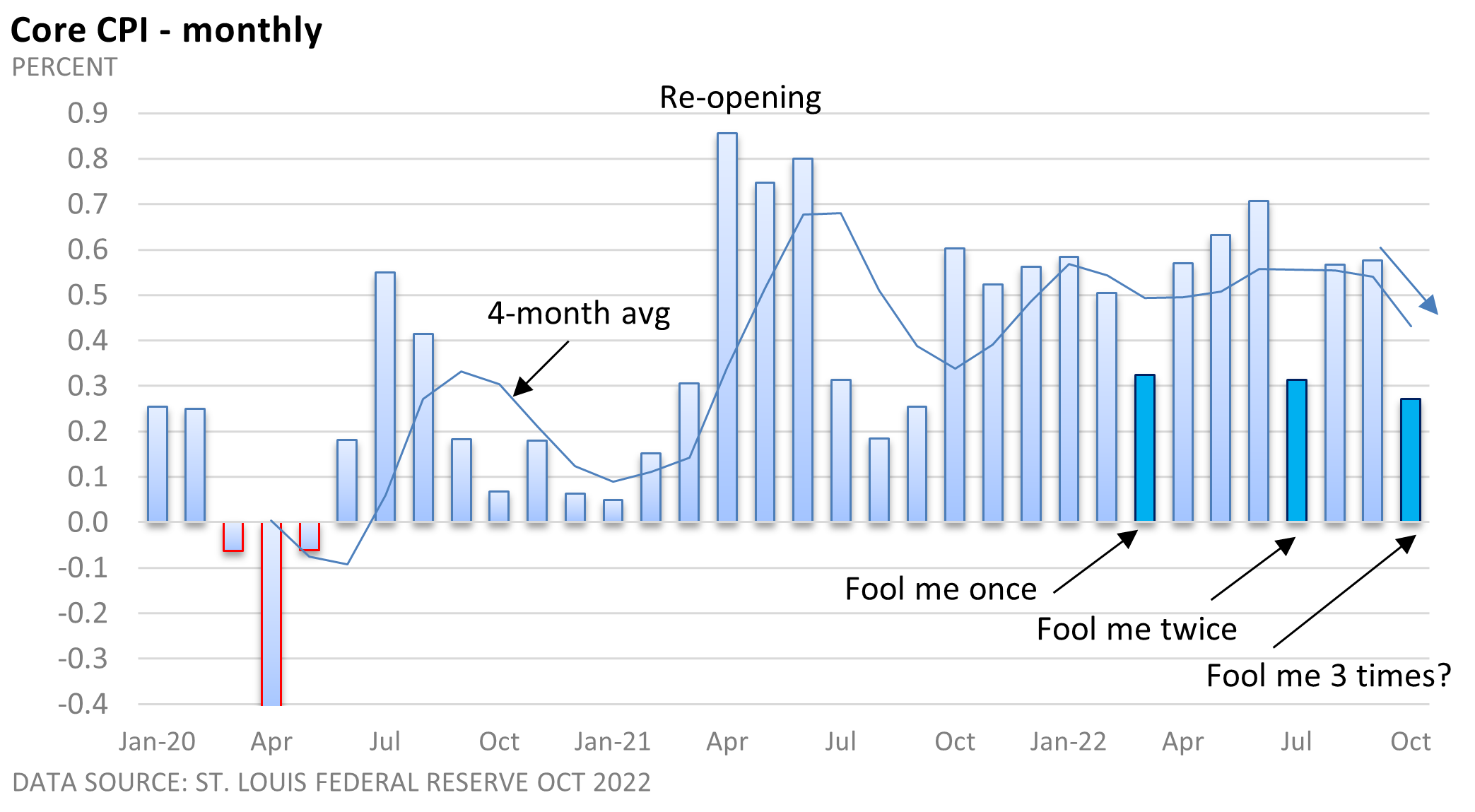

A soft reading in March was followed by a resurgence in April, May, and June. And a soft reading in July didn’t repeat in August and September.

A 0.3% monthly rise in the core CPI isn’t congruent with the Fed’s 2% annual target. Further, inflationary wage hikes have yet to abate.

Even if inflation has peaked, the Fed has indicated it plans to hold rates at elevated levels until it sees “compelling evidence that inflation is moving down, consistent with inflation returning to 2 percent (annually).”

Nonetheless, October’s reading is welcome and should be greeted with cautious optimism. We may look back on this month as the turning point, sudden or gradual, in the battle against inflation.