Weekly Market Commentary

That ubiquitous phrase from one of America’s most extensive athletic footwear and apparel makers seems to have been adopted by most American shoppers.

The U.S. Census Bureau reported last week that retail sales jumped 0.7% in March, following a strong 0.9% rise in February.

These numbers add to a bundle of recent economic data that is throwing cold water on the idea that the Federal Reserve will proceed with its first rate cut in June.

Why are retail sales important? Consumer spending accounts for almost 70% of total U.S. economic activity. While retail sales exclude services, they include the goods you and I purchase at stores and online. Automobiles are also included.

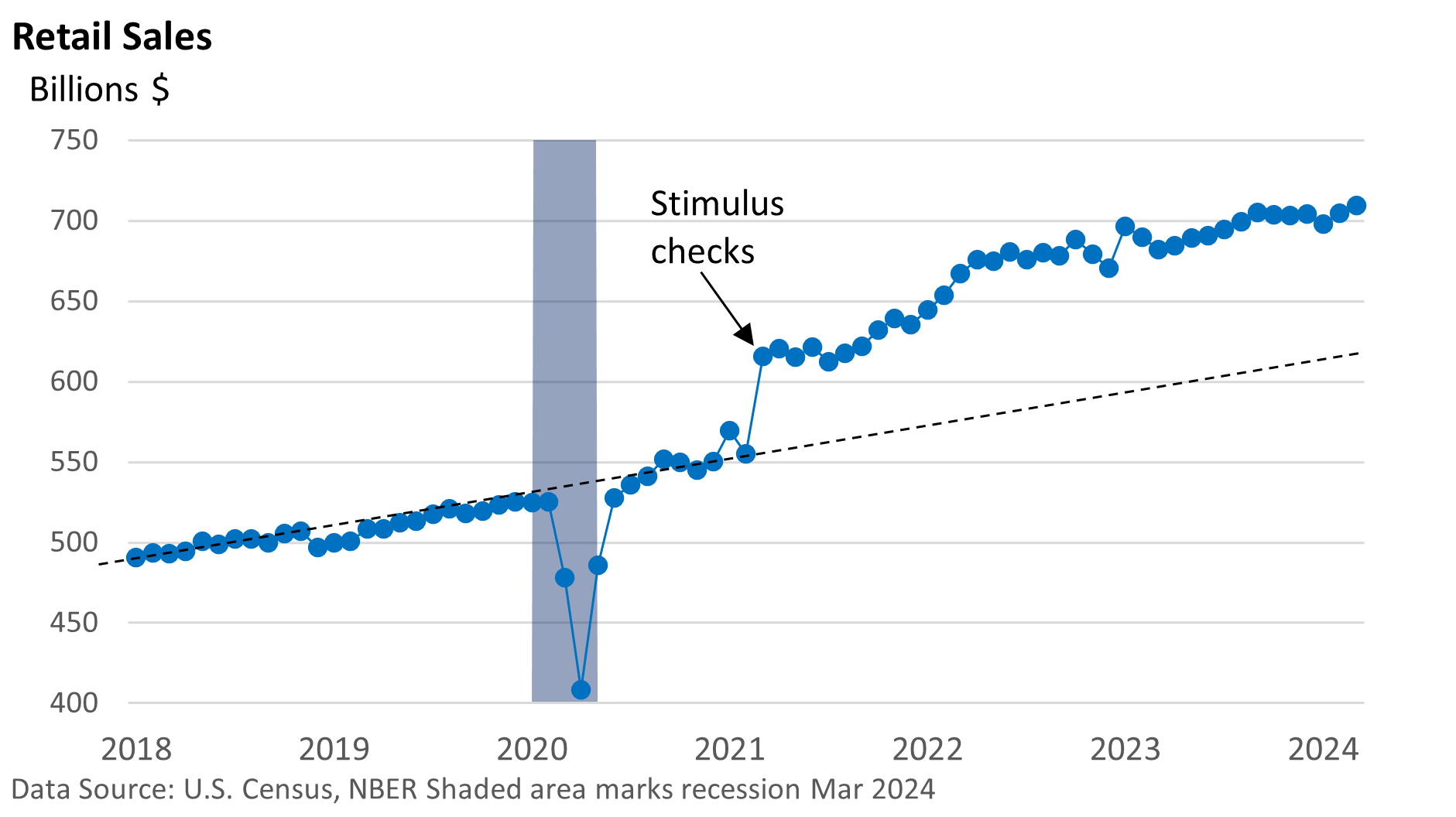

The graphic below illustrates the trend in retail sales since 2018. The lockdown and ensuing recession sent sales at most retailers down sharply. As you probably recall, some big box retailers, which were considered essential, did quite well.

Note the sharp jump in sales in early 2021. Recall that $1,400 per-person stimulus checks were sent to households via the American Rescue Plan (ARP). A family of four received up to $5,600 if within the ARP’s income limits.

Some saved or paid down debt; others went on a spending spree. The graphic illustrates that spending never returned to or approached pre-stimulus levels.

The stimulus checks did what they were designed to do at the time—stimulate spending.

However, as supply chain constraints were hampering global and U.S. production, strong consumer spending added to bottlenecks and contributed to inflation at the time.

Families haven’t received a stimulus check in quite a while. But businesses are hiring and families are spending. For now, the economy is expanding.