Prosperity Partners Blog

Pandemic Distortions

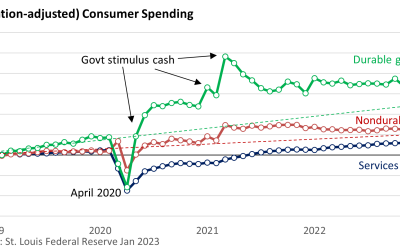

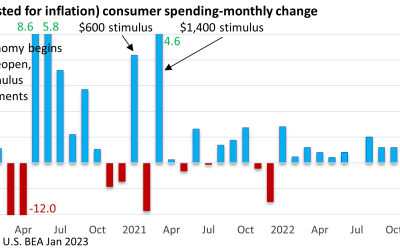

The economic distortions tied to that pandemic and the government’s massive response to prop up the economy have been far-reaching. Before continuing, let’s look at some facts and definitions. Consumer spending accounts for 70% of the total economy, according to the U.S. Bureau of Economic Analysis (BEA).

The No-Landing Scenario

‘No landing’ is a recently coined term that implies the economy won’t slow. The term is now being used amid an unexpected pickup in economic activity.

The Long and Winding Road to Lower Inflation

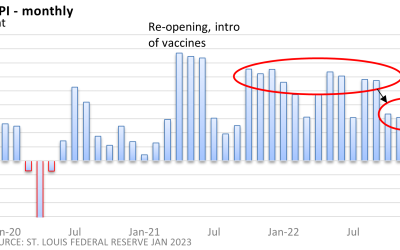

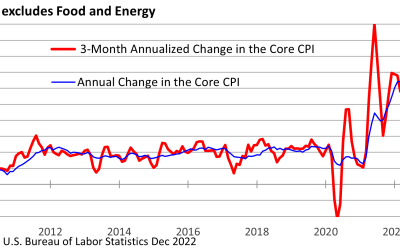

The Fed’s road to 2% annual inflation took a curious turn last week, disappointing some investors that had been expecting continued progress on inflation. The U.S. Bureau of Labor Statistics reported that the January Consumer Price Index rose 0.5% in January, while the core rate, which excludes food and energy, rose 0.4%.

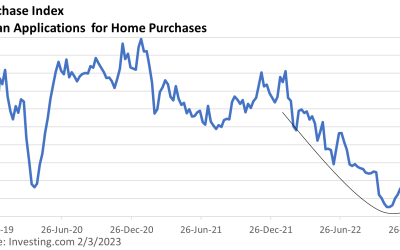

Housing Thaw

Rising interest rates are the result of the Federal Reserve’s campaign to snuff out inflation. The pain of rising rates has been felt in the financial sector. It has also been felt in housing. Housing sales tumbled since the beginning of 2022, as the jump in mortgage rates forced many buyers to the sidelines. Existing home sales fell a whopping 38% last year, according to the National Association of Realtors.

The Two Faces of Powell

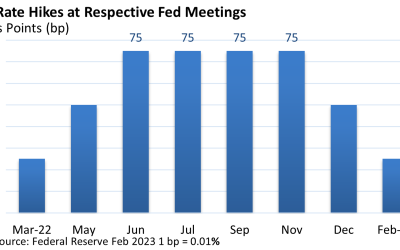

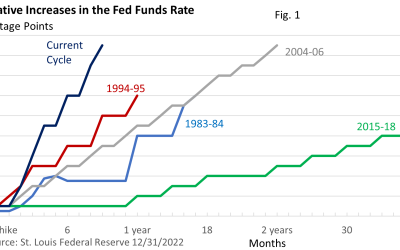

Last year, the Federal Reserve and Fed Chief Powell’s bite were probably worse than the bark. Rhetoric and commentary were forceful and were matched by a nearly unprecedented series of rate hikes, including four-straight 75 basis point (bp, 1 bp = 0.01%) increases.

2022 Annual Market Summary and Outlook

The market had a banner year in 2021, with the S&P 500 Index advancing over 25%, according to data from the St. Louis Federal Reserve. But tailwinds that fueled gains shifted dramatically in 2022; overall it was a tough year for investors.

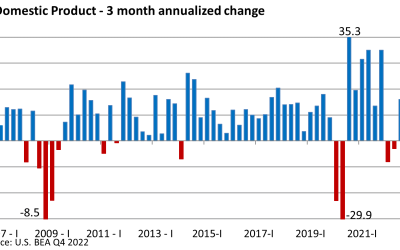

GDP: Looking in the Rearview Mirror

Gross Domestic Product (GDP) is defined by Investopedia as “the total market value of all the finished goods and services… in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.” It is a very broad measure of economic activity, but it is also a look in the rearview mirror.

10 Important Changes to Retirement Planning

At the end of last year, Congress passed the SECURE Act 2.0, a follow-up to an overhaul of retirement laws passed just three years ago. The changes make it easier to save for retirement and may stretch out your savings while in retirement.

Meaningful Progess

There has been meaningful progress on the inflation front. The annual rate of inflation has slowed, and the ever-visible price of gasoline is well off last year’s high. But as every child has asked on a long road trip, “Are we there yet?”

Stocks Rally on Hope Inflation Will Slow

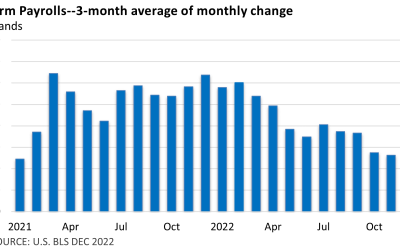

The U.S. Bureau of Labor Statistics reported another respectable employment number on Friday, illustrating that modest economic growth and a still-high number of job openings are boosting payrolls. But it was a smaller-than-forecast rise in wages that caught the attention of investors, and stocks rallied.

Shifting Forces

The market had a banner year in 2021, with the S&P 500 Index advancing over 25%, according to data from the St. Louis Federal Reserve. But tailwinds that fueled gains shifted dramatically in 2022. No longer were the economic fundamentals favorable.

Housing Activity Tumbles Off a Cliff

“The unfortunate cost of reducing inflation” could bring “some pain to households and businesses,” Fed Chief Jay Powell remarked in August. Pain is rarely distributed evenly. Some folks go unscathed, while others bear the brunt of the discomfort.