Weekly Market Commentary

The dollar has soared to its highest level against the euro in 20 years. It has risen to its highest level against the Japanese yen in 30 years and recently hit a record high against the British pound, according to CNBC.

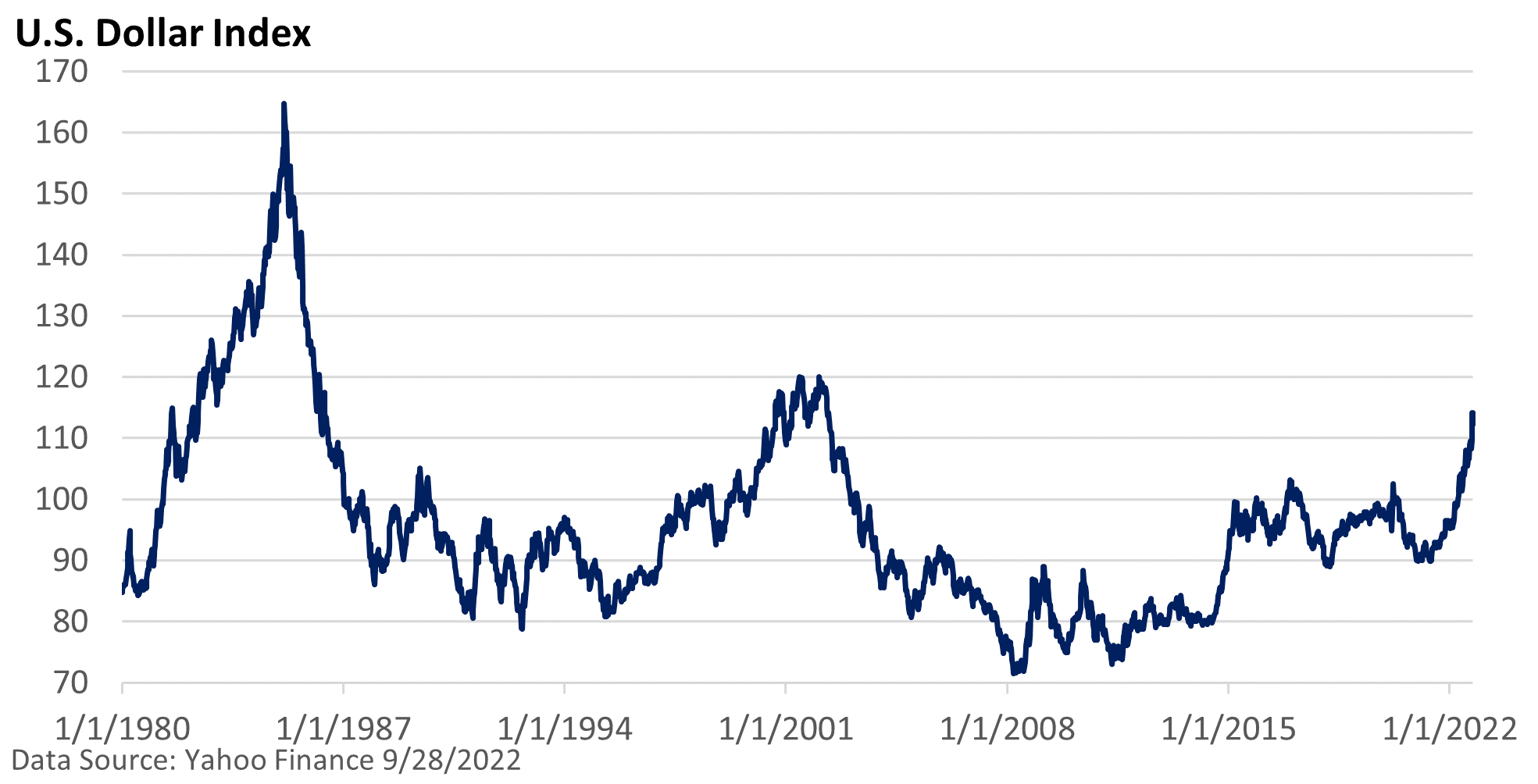

The U.S. Dollar Index is an index (or measure) of the value of the U.S. dollar relative to a basket of foreign currencies. As the graphic illustrates, the index is at a 20-year high.

What’s behind the surging greenback?

Interest rates in the U.S. have soared. Higher rates and talk of more rate hikes have attracted foreign cash that seeks a higher return.

Global uncertainty has also aided the dollar, as the dollar is the world’s reserve currency. The size and strength of the U.S. economy is unparalleled. The U.S. is still one of the safest places to park cash, and the dollar makes up a big share of foreign-exchange reserves.

Dollar strength advantages:

- A stronger dollar lowers the cost of imports.

- Global trade in commodities is usually priced in dollars. A strong dollar creates a headwind for commodity prices.

- It’s a great time for U.S. tourists traveling overseas.

Dollar strength drawbacks:

- A stronger dollar raises the price of exported goods, reducing competitiveness.

- Overseas sales of U.S. companies must be translated back into a more expensive dollar, which pressures revenues and earnings.

- A fast-appreciating dollar forces global central banks to react, which may create unwanted tensions in global finance. Emerging market economies may get hurt, too.

In the near term, the stronger dollar is probably being viewed favorably by Fed officials, at least privately, as fighting inflation is today’s aim.

Recently, investors are viewing the soaring greenback with apprehension, as some fret over tensions in global markets and added headwinds for earnings of firms that conduct a significant share of business overseas.