January 2017

Good vs. Average

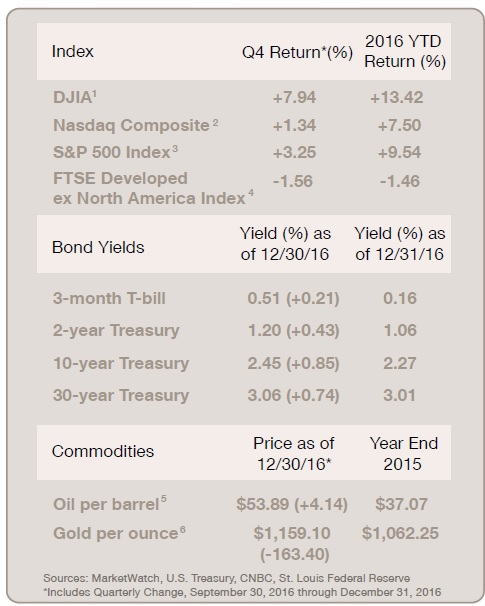

2016 was a very good year for diversifed portfolios as returns were boosted by exposure to diversifer asset classes, meant to provide additional risk adjusted return over time. This is a welcome turnaround from 2015, when most diversifer asset classes trailed large cap US stocks as represented by the S&P 500 Index. If you use the S&P 500 Index as your yardstick, then 2016 turned out to be an average year for stocks. Going back to 1928, the average annual return, including reinvested dividends, runs nearly 10% (NY Stern School of Business data). When the year had ended, the S&P 500 rose 9.54%. Throw in dividends and 2016 rose 11.96% (Morningstar). Mid-cap and smaller company shares topped 20%.. SEE MORE…..

A Look Back at 2016

The year finished on a solid note, but 2016 didn’t start out that

way. Falling oil prices, worries about China, an upward lurch in

junk bond yields, and overblown fears of a recession took a big

toll on investor sentiment. CNNMoney pointed out that the first

ten days of the year were the worst start for the Dow in its history

– that’s going all the way back to 1897. To compound the angst,

comparisons to 2008 were rife. However, this wasn’t 2008, there

wasn’t a subprime crisis that was brewing, and shares touched

bottom in early February (St. Louis Federal Reserve). SEE MORE….