Two days ago, the White House announced massive tariffs on virtually every other country. Here are a few thoughts, in no particular order and written with our best effort at restraint, on one of the largest tax hikes in U.S. history:

- The odds of a recession are way higher than they were yesterday morning.

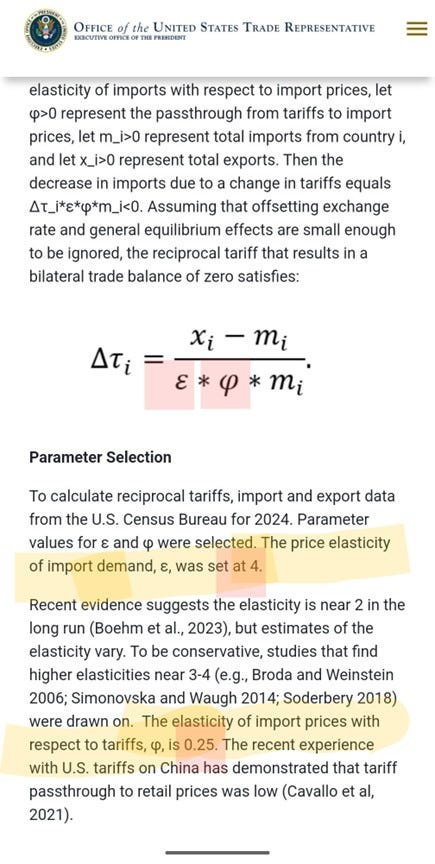

- These aren’t reciprocal tariffs. The rates are calculated as our trade deficit with a country divided by how much we import from that country. So, it’s (exports – imports)/ (imports).

- They then divide this figure—described as “Tariffs Charged to the U.S.A.”—by two as an act of “kindness.”

- White House economists pushed back when people cracked the formula, explaining that no, they actually used a complicated methodology with lots of Greek letters to calculate the rates. Except those Greek letters in the denominator stand for 4 and 0.25, so the formula is actually (exports – imports)/ ( 1 x imports). Which, yes, is the exact same thing as the (exports – imports)/ (imports).

- To show you how this works: in 2024 someone bought $3.4 million of (probably) shellfish from St. Pierre et Miquelon—an island nation with 5,800 inhabitants. St. Pierre et Miquelon—again, an island nation with 5,800 inhabitants—only bought $100,000 of things from the U.S. So now we have a 99% tariff on imports from St. Pierre et Miquelon.

- This formula also means that some countries who have no tariffs on the U.S., like Israel, now face rather large tariffs from the U.S. This will make it difficult for those countries to negotiate.

- The U.S. is the richest country in the world. Of course we buy more from other countries than they buy from us (also note that we run a huge surplus in exports of services).

- This raises the average tax on all imports from 2.5% in 2024 to nearly 19% in 2025, according to the Tax Foundation.

- Markets are not taking this well. As of this writing (about 10:00 EST), the S&P 500 is down about 4.%, the Nasdaq is down 5.0%, and the Dow is down 3.7%.

- Market analysts are surprised markets aren’t down more. This could be because the policy is so extreme that some investors are betting it has to be reversed soon.

- Has one policy announcement ever ever caused U.S. stocks to immediately lose trillions in market cap?

- JP Morgan estimates this will have the same effect on U.S. consumers as a $3.00/gallon tax on gasoline.

- The Budget Lab estimates that the average household will lose $3,800 in purchasing power as a result of tariffs announced during the first three months of 2025.

- There’s going to be a surge of buying activity in the next few weeks, especially for products like cars, which are going to get significantly more expensive.

- This will likely push inflation higher, with some analysts predicting core inflation returns to a 4.0%+ annual rate.

- Trump touted falling egg prices while announcing the tariffs. Egg prices are falling because we decided to import a bunch of eggs. Neither Alanis Morisette nor Shakespeare could fathom this level of irony.

- If this is an effort to reshore manufacturing, it will instead likely push allies toward China.

- Will companies try to build factories here, which usually takes 4+ years, or wait for 1) the administration to change course, 2) Congress to take back the power to implement tariffs either now or in 2026, or 3) the next presidential administration in 2028?

- We think the latter. Businesses won’t risk moving their production back to America given the probably impermanence of these tariffs.

- About 50% of U.S. imports are inputs to manufacturing. Massive taxes on manufacturing inputs are not an incentive to build a factory here.

- The tariffs on auto parts are delayed until May. Notably, it takes longer than one month to build a factory to manufacture those parts in the U.S.

- The clearest winner here is Democrats.

- Another potential winner is Americans’ opinion of free trade in the future.

- A third winner is anyone currently waiting to lock in a rate on a new mortgage; 10 year yields have fallen below 4% for the first time since October, and that will put downward pressure on mortgage rates.

- We’ve been saying lower mortgage rates would unfreeze the housing market. That could still be the case, but unprecedented economic uncertainty and potential economic contraction is not good for homebuying.

- Some people will say steel producers are winners, and steel producers certainly think they’re winners. We’re less sure, as this will have a large and negative effect on the demand for steel.

- This is particularly bad for U.S. based companies who shifted production from China to Vietnam, who will now have to pay a 46% tariff to get their products to the U.S.

- We import about $16 billion of textiles from Vietnam every year. Clothes are going to get much more expensive. There’s no future in which Americans are working in textile factories, especially not at the prevailing Vietnamese wage.

- So this is exceptionally bad for U.S. apparel companies. Nike, for instance, makes about 50% of its products in Vietnam (Nike’s stock is down about 14%). Read more here: “Trump’s ‘Liberation Day‘ tariffs make apparel stocks like Nike un–investable.”

- The administration is going to remove the exemption for de minimis shipping—no tariffs on imports costing less than $800—from all countries as soon as they create a system to tax de minimis shipments (I’m guessing this might take a while).

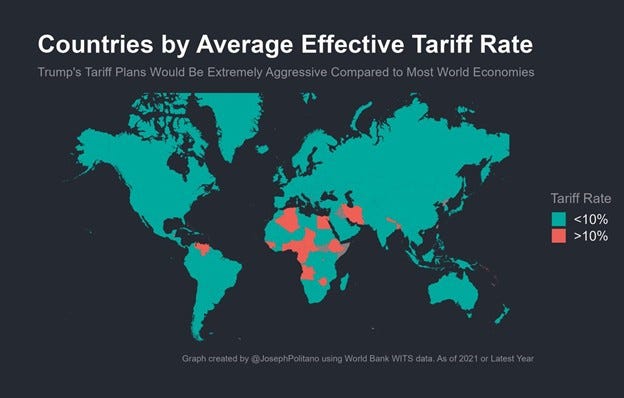

- This map by Joseph Politano shows the countries we’ll be joining with our new tariffs. Esteemed company!