Prosperity Partners Blog

January Barometer Flashes Green, a Sleepy Fed Gathering

The so-called January Barometer holds that the market’s performance in January—measured by the S&P 500 Index—tends to foreshadow how stocks will perform during the year. Since 1970, January finished higher 33 times and fell 23 times, excluding this month’s increase of 1.37% (MarketWatch data, excludes reinvested dividends).

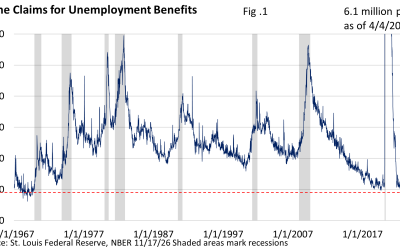

It’s Hard to Say Good-bye: What Persistently Low Layoffs Say About the Economy

Much has been made of the sluggish hiring environment, but less attention has been paid to an important counterpoint: the persistently low level of layoffs. Figure 1 highlights the number of individuals who go online or head to their respective state’s unemployment office and file for benefits following a layoff.

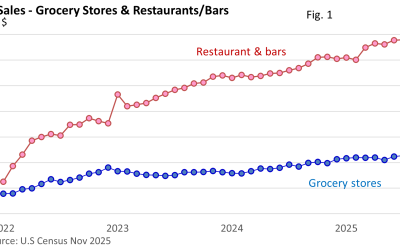

Forks, Knives, and Economic Clues

Let’s review one narrow economic indicator that provides a useful, though not standalone, measure of the overall economy’s health. The US Census categorizes it as ‘food services and drinking places.’ That can best be described as restaurants and bars.

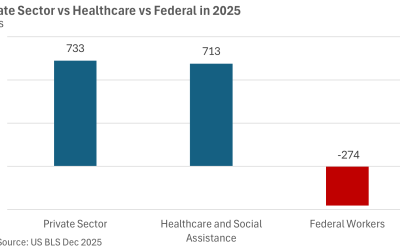

Soft December Hiring Underscores Tepid Year

On Friday, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls increased by 50,000 in December, underscoring a year of persistently sluggish job growth.

A Stock Market Three-Peat

The bull market that began in late 2022 continued through last year. The S&P 500 Index, which posted gains that topped 20% in both 2023 and 2024, recorded an advance of 16.39% last year.

An Uptick in the Unemployment Rate

The unemployment rate rose from 4.4% in September to 4.6% in November—see Figure 1. The US Bureau of Labor Statistics did not conduct its household survey in October due to the government shutdown. The household survey includes the unemployment rate

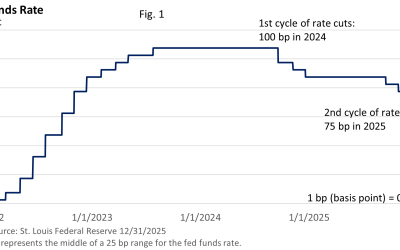

Fed Cuts Rates Again, Signals a Possible Pause

The Federal Reserve followed through on what was a widely expected rate cut, reducing the fed funds rate a quarter-percentage point (1 basis point = 0.01%) to a range of 3.50 – 3.75%.

Black Friday’s Spending Spree

A December 1 headline from Reuters sums up the start of the Christmas shopping season: US Holiday Shoppers Shake Off Economic Blues for Online Spending Spree.

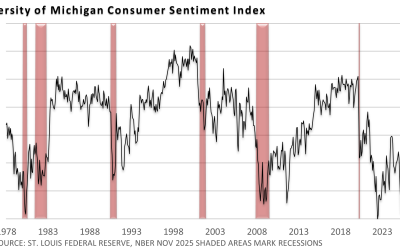

Data Disconnect

Retailers are ringing up solid earnings, but consumer confidence surveys tell a different story, suggesting the mood is far from upbeat. This disconnect raises a big question: if shoppers are still buying, as we will highlight in a moment, why do they feel so uneasy about the economy?

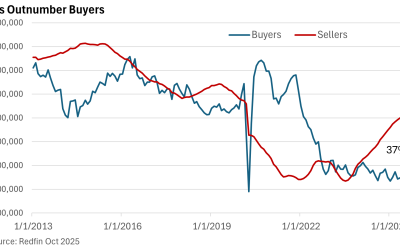

Buyer’s Market – With Strings Attached

Redfin reported last week that sellers are grappling with the strongest buyer’s market since the real estate brokerage firm began compiling records back in 2013. Sellers now outnumber buyers by 37%.

Investors Unfazed by Shutdown

The government shutdown lasted from October 1 to November 12. It was the longest on record. During that period, the S&P 500 rose from 6,688.46 (September 30) to 6,850.92 (November 12), or an advance of 2.4%. As we’ve noted in prior shutdowns, investors typically ignore political drama.

The Job Market’s Missing Pulse

The government shutdown has been and will always be prominently featured in the 24-hour news cycle. Travelers are feeling it, furloughed federal employees wonder when they will receive their next paycheck, and even the housing market is affected as some buyers are left in limbo.