Weekly Market Commentary

Recession fears are rampant. Interest rates are up, which discourages spending, and housing, a leading economic indicator, has fallen into a steep recession.

Reported on Friday, the Conference Board’s Leading Economic Index (LEI), which is designed to detect trends in advance, is down 8-straight months, including a sharp 0.8% decline in October.

Let’s back up for a moment. Congress’ response to the pandemic was to flood the economy with cash, including generous jobless benefits, tax credits, and stimulus checks. The extra cash boosted spending, but not all has been spent.

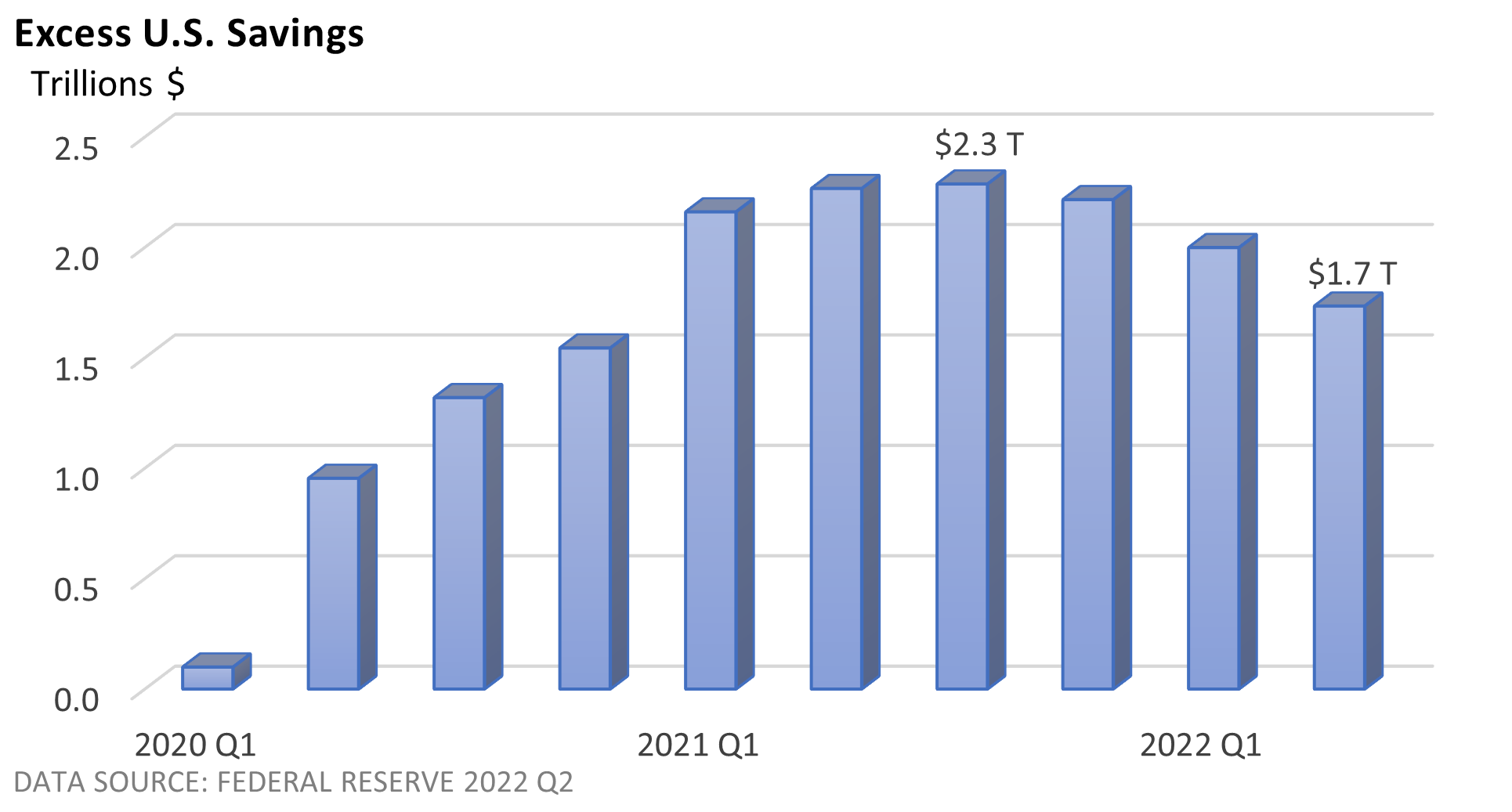

The Federal Reserve estimates that households still hold $1.7 trillion in government largesse, down from a peak of $2.3 trillion. It is excess savings over and above what households might otherwise have held if pre-pandemic trends had continued.

Why is this significant? Consumer spending accounts for 70% of the total economy, according to the U.S. Bureau of Economic Analysis.

Excess cash in the bank is aiding consumer spending, helping to bridge the gap of wage hikes that haven’t kept up with inflation.

A $1.7 trillion war chest is significant and could help mitigate some headwinds from Fed rate hikes and higher inflation.

But it could also complicate the Fed’s job, as it hopes to combat high inflation by slowing down the economy, bringing demand back in line with supply.

The Conference Board believes “a recession is likely to start around year-end and last through mid-2023.” However, economic forecasts are dicey, and the LEI does not make allowances for the mountain of cash that sits in savings.