Weekly Market Commentary

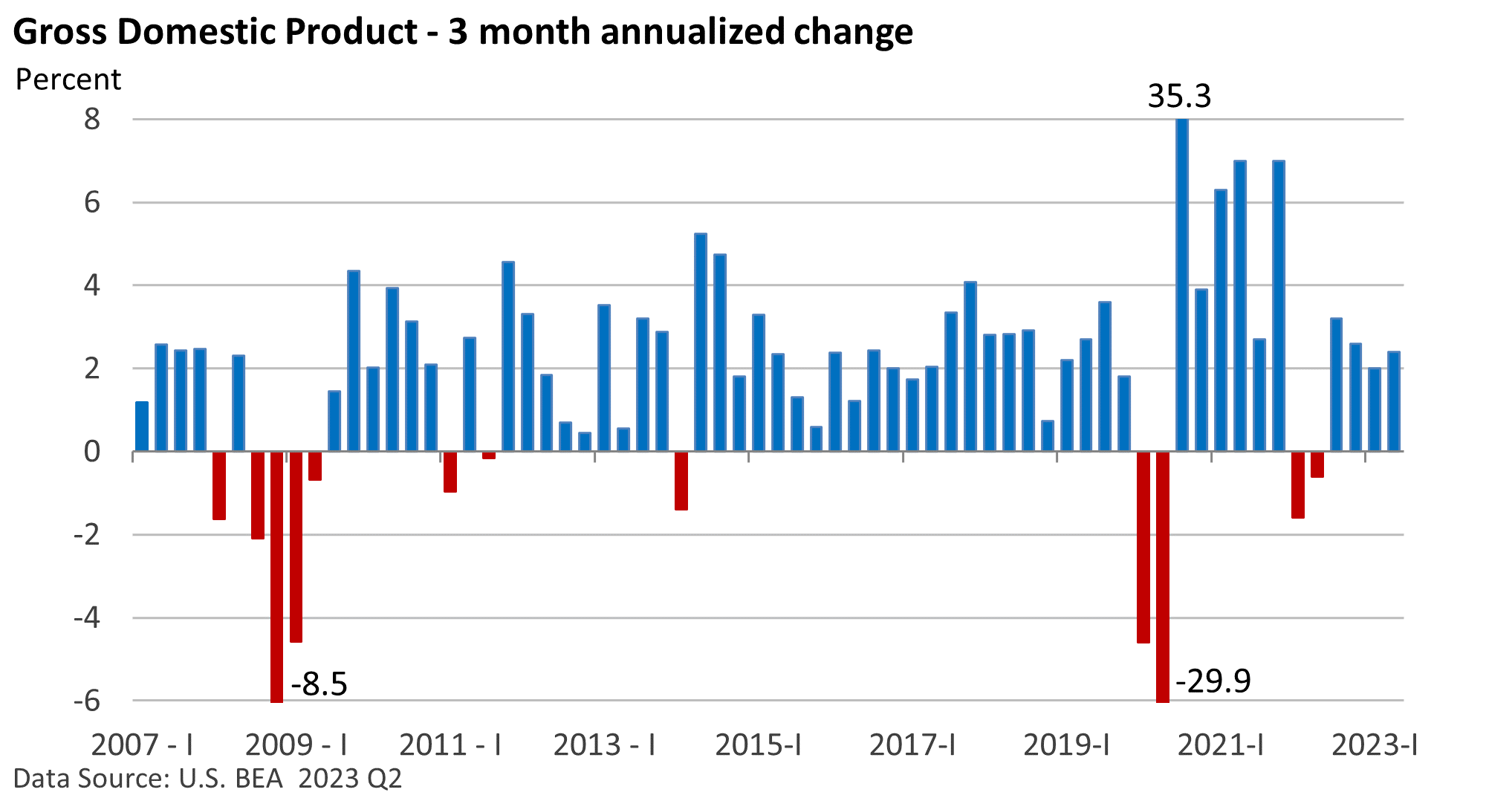

Gross Domestic Product (GDP) is a very broad measure of the value of goods and services in the economy over a certain period.

Last week, the U.S. Bureau of Economic Analysis reported that GDP rose at an annual pace of 2.4% in Q2, accelerating from Q1’s 2.0% and topping the forecast of 2.0% (Wall Street Journal).

Sometimes, we analyze the quarterly change and find that one-off factors aided or detracted from the headline number. This time, however, that was not the case.

Although consumer spending slowed a bit, strong spending and investment by businesses more than made up for any slack. It’s also worth noting that the many recession predictions made since the start of the year continue to miss the mark.

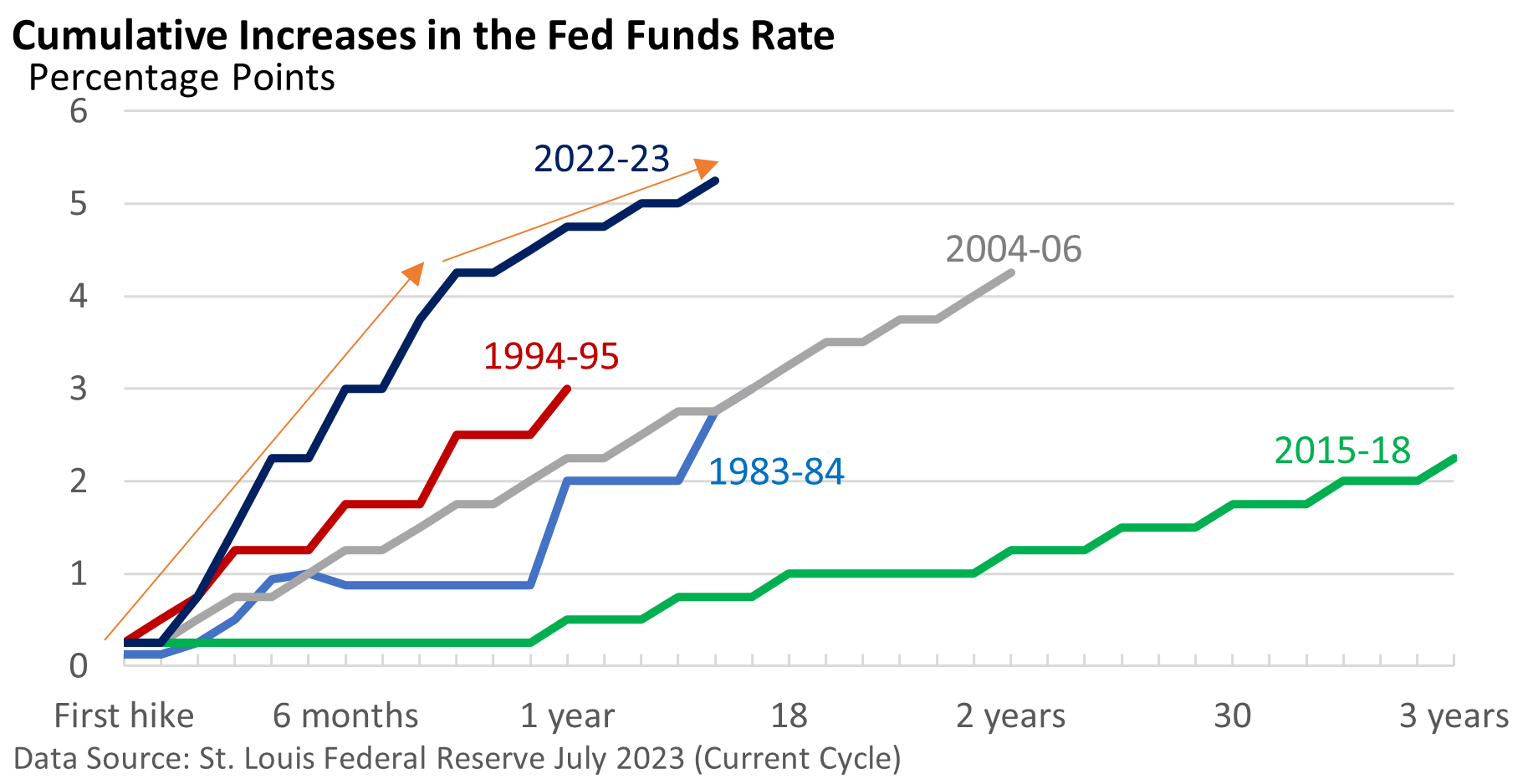

Meanwhile, the Federal Reserve hiked its key rate by 0.25 percentage points to 5.25 – 5.50%, the highest in 22 years.

The fast pace of rate increases last year has been replaced by a much more subdued posture, which has helped fuel the recent stock market advance.

The Federal Reserve didn’t shut the door on another rate hike (or hikes) this year, but it didn’t provide much detail on the timing or certainty of an increase. Much will depend on the economy and inflation. And that’s a bit of an unknown, even for the best economic forecaster.