Weekly Market Commentary

The meeting held by the Federal Reserve last week was the most consequential gathering of central bankers this year. The Fed held the fed funds rate at 5.25 – 5.50% as expected, but in so many words, the Fed pivoted on its rate stance.

No longer is the Fed on hold with an upside tightening bias. For all practical purposes, its stance is neutral with a forecast to cut rates next year. We are likely at or near the peak rate for this cycle, Fed Chief Powell said at his press conference. The door is open to another near-term hike, but it’s barely open.

More importantly, he added, “When it will become appropriate to begin dialing back the amount of policy restraint that’s in place? That’s what people are thinking and talking about.”

It’s not that Powell declared victory on inflation. It was a shift in his tone. There was less emphasis on another inflation surge and more emphasis on the progress being made to bring inflation down. There was also a concern that keeping rates too high could pose risks.

In response, the Dow soared on Wednesday, closing up over 500 points to a new record high (CNBC). The 10-year Treasury yield plummeted 16 basis points (1 basis point = 0.01%) to 4.04%. The decline in yields continued into Friday.

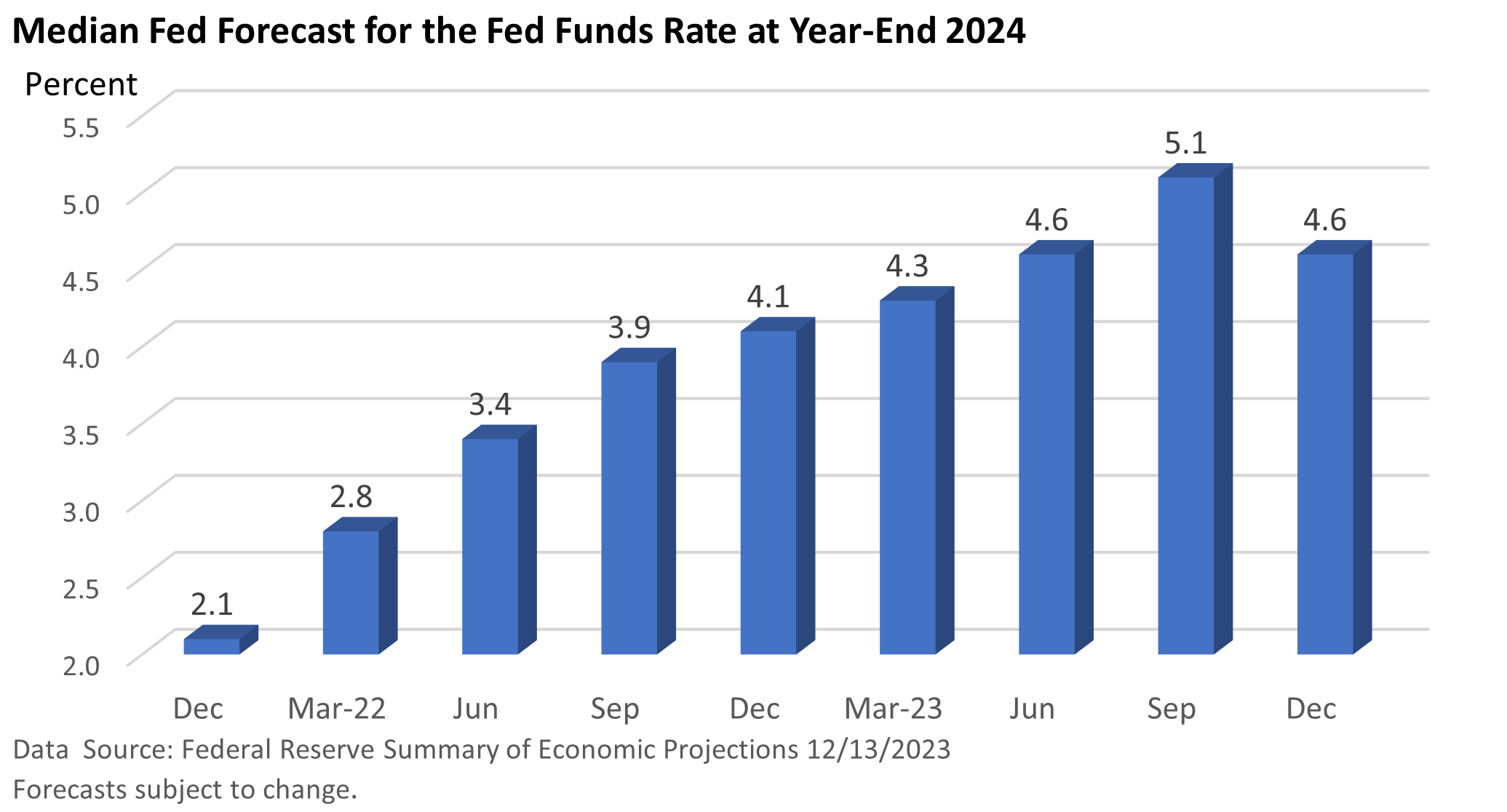

And, for the first time, the Fed cut its forecast for the 2024 fed funds rate. Based on the current rate, the new projection suggests a total of 75 basis points in rate cuts next year.

But let’s also recognize that forecasts are highly uncertain. In December 2021, the Fed had projected a fed funds rate of 2.1% by the end of 2024. The latest forecast is more than double that. Investors, however, celebrated the more dovish outlook.

But is inflation really in the rearview mirror? In some respects, it really depends on how you view the problem.

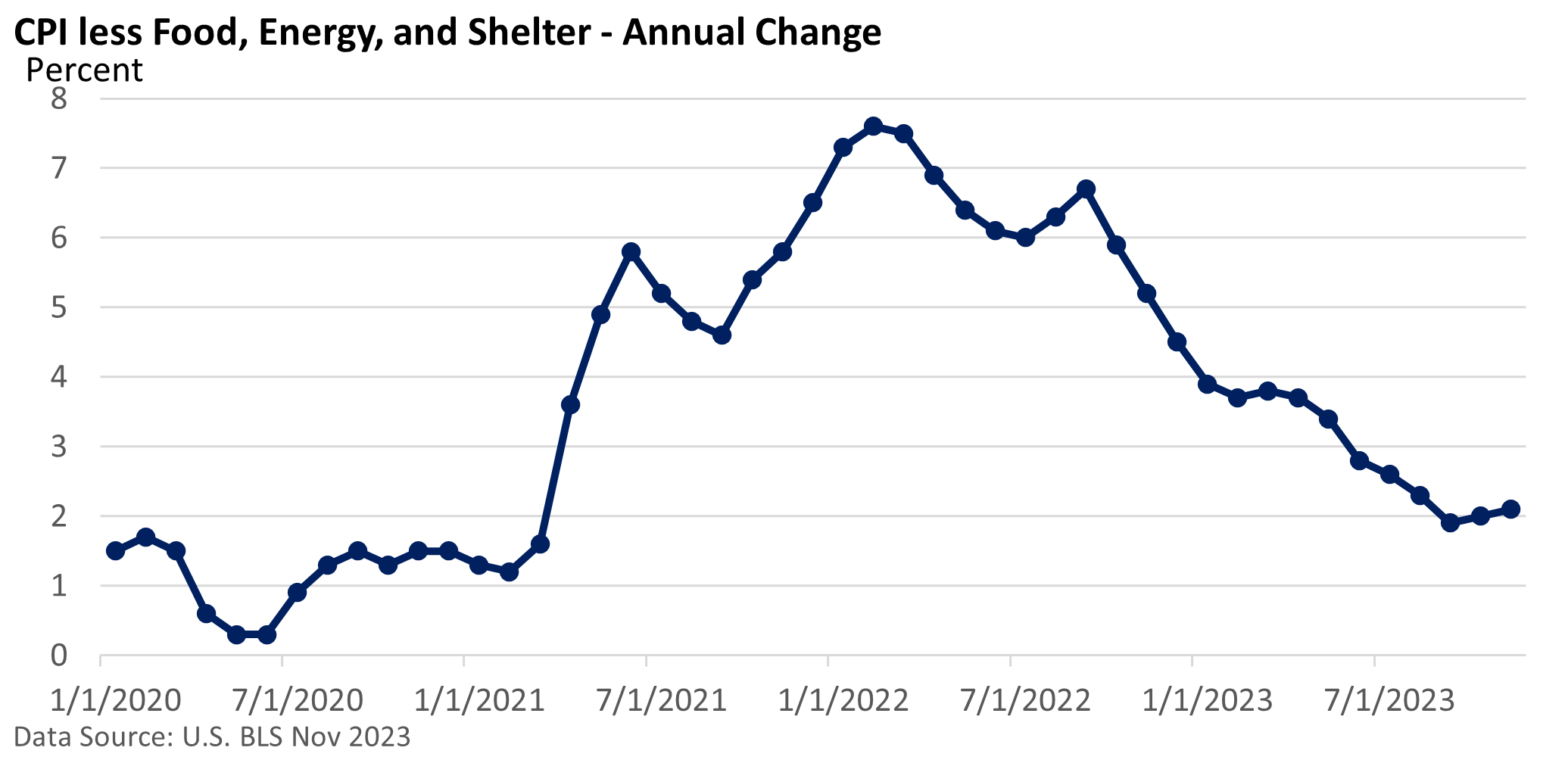

The illustration reflects the annual rate of the Consumer Price Index after removing food, energy, and shelter, which accounts for about 55% of the CPI, according to U.S. Bureau of Labor Statistics.

As of November, it’s at 2.1% and has averaged 2% over the last three months, which is the Fed’s 2% target.

If we remove used autos from the graphic, inflation is up a still muted 2.6%. If we view the CPI less food and shelter (and keep energy in the equation), prices are up just 1.0%.

Some analysts prefer to remove shelter (about 33% of the CPI) because most of the shelter component is compiled from a category called owners’ equivalent rent, which is an estimate of how much a homeowner could rent their home.

Additionally, anecdotal evidence indicates that apartment rental prices have stabilized in many markets, and that has been slow to show up in the CPI’s shelter category.

In a nutshell, how you slice and dice the CPI yields various results.

Last week, the U.S. BLS reported that the CPI slowed from a 3.2% annual rate to 3.1% in November, while the core CPI, which excludes food and energy, held at 4.0%.

Consumer goods inflation has decreased significantly, while services, which include the shelter component, have been more resistant and remain elevated.