Weekly Market Commentary

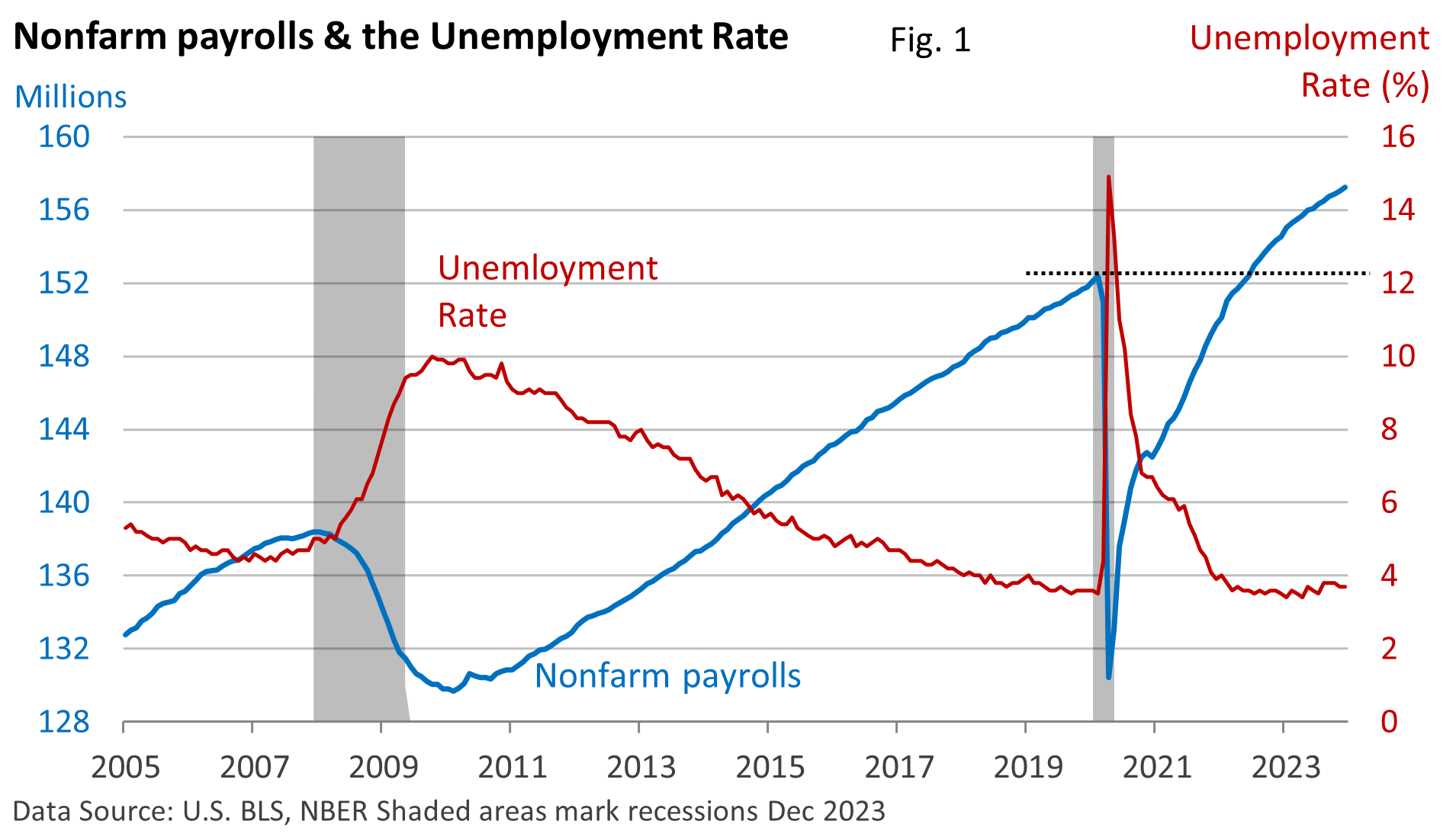

The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by 216,000 in December, while October and November were revised down by a total of 71,000. The unemployment rate held steady at 3.7% in December.

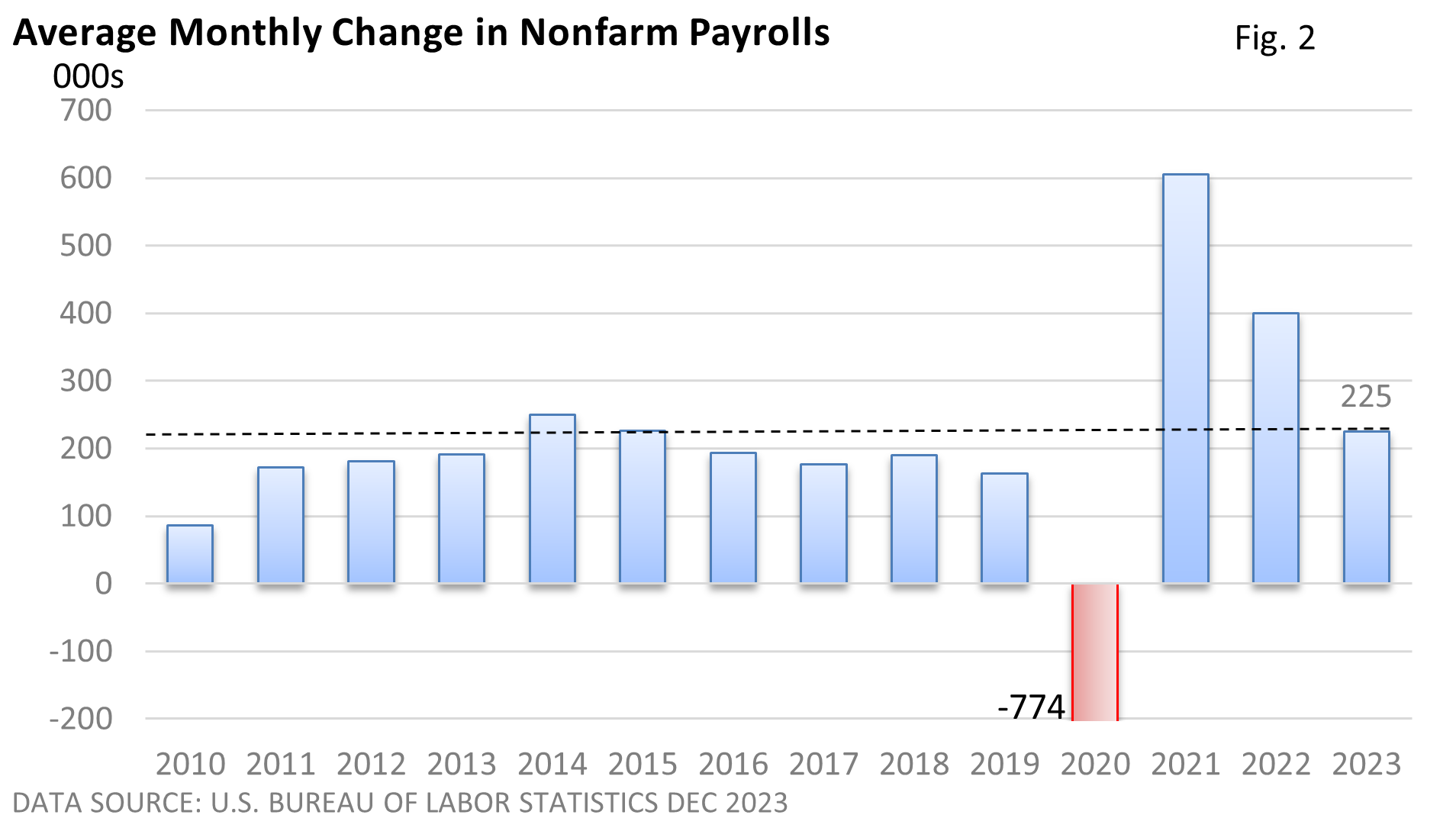

The economy is generating new jobs, but the number of new jobs being created isn’t overwhelming but is solid and respectable.

Figure 1 highlights that the unemployment rate has been holding in a low and steady range. The number of jobs has surpassed the pre-pandemic number, but growth has moderated. This is not surprising, given that the initial surge was driven by the reopening of the economy.

On average, the economy generated 225,000 net new jobs per month in 2023—Figure 2.

Yields turn the wheels

Figure 3 demonstrates that over the past five months, bond yields have played a crucial role in driving the stock market. As yields increased from August into late October, the S&P 500 Index pulled back about 10%. Following the peak in yields, the market rallied.

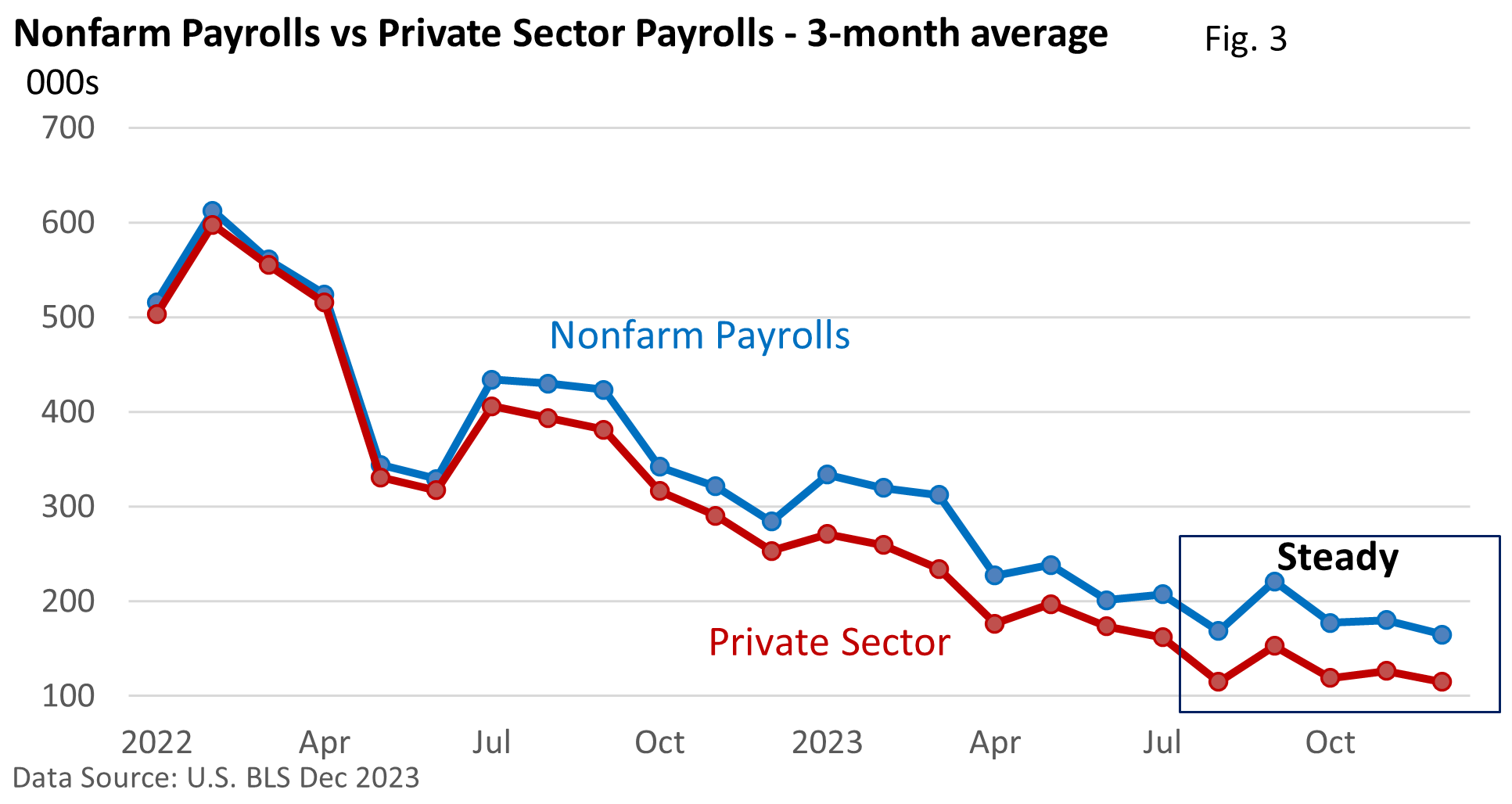

Jobs in education are responsible for roughly half the differential between total nonfarm payrolls and the private sector. Education remains just below its pre-pandemic peak.

There was little in the report that might encourage the Federal Reserve to start cutting interest rates in March, as some investors believe may happen. But there are two more employment reports and three readings on inflation before the March meeting.

The Fed’s tone has been the biggest shift over the last two years. No longer are we hearing how high the Fed may have to raise interest rates.

Though Fed officials haven’t ruled out the possibility of a rate hike this year, the new stance from the Fed and investors is centered around when and how much the Fed may reduce interest rates in 2024.