Weekly Market Commentary

We often discuss the Federal Reserve and interest rates because both greatly impact investors. For starters, changes in interest rates have a significant impact on stock prices and income earned on savings.

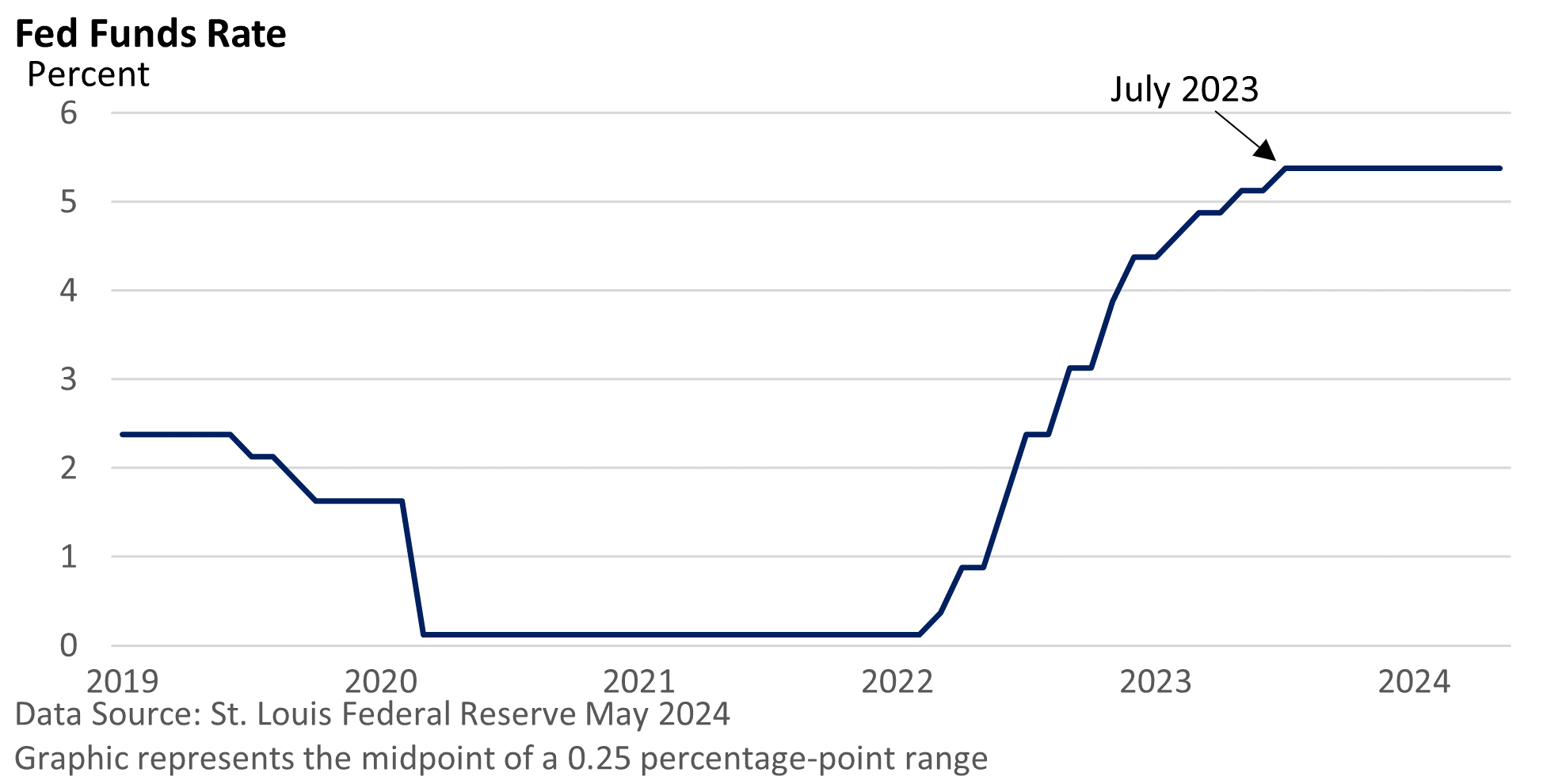

Sharply higher rates in 2022 pushed equities into a bear market. The pause in rate hikes in 2023, coupled with continued economic growth and the craze surrounding AI, led to a new bull market.

Wednesday’s Fed meeting left rates unchanged—no surprise. How Fed Chief Jay Powell might frame the meeting was uppermost on the minds of investors.

Given stubbornly high inflation, would Powell shift gears and take on a more hawkish tone, even signaling the possibility of another rate hike this year? Or would he emphasize that current interest rates are high enough to bring the rate of inflation back down?

Despite the recent uptick in the rate of inflation, Powell said, “It’s unlikely that the next policy rate move will be a hike.” The Fed, he said, would require “persuasive evidence” before hiking rates again, setting a high bar for another rate increase.

He made no mention of:

- Inflation becoming entrenched,

- The need to be vigilant against inflation, or

- The lessons and mistakes of the 1960s/70s.

And he sidestepped a question about whether Fed officials discussed a rate hike at the meeting.

But he said the Fed is in no hurry to reduce interest rates, though he did not rule out the possibility of a rate cut this year.

Overall, the Fed’s approach was less aggressive than some had feared.

Taking a 2024 rate hike off the table encouraged bullish sentiment, and he left the door open to an easier policy. But the Fed’s next move will largely be dependent on the economic outlook and inflation.