Last month, the Federal Reserve reduced its key interest rate, and the consensus suggested (and still suggests) that the Fed will cut rates two more times before the year ends.

A closely watched tool from the CME Group is pricing in a quarter-point rate cut at the November 7th Fed meeting, and it favors another quarter-point rate cut at the December 18th meeting.

Of course, there is no guarantee that this will happen, but if the Fed reduced the fed funds rate last month, and the consensus signals additional rate cuts are in the pipeline, why have bond yields started to back up?

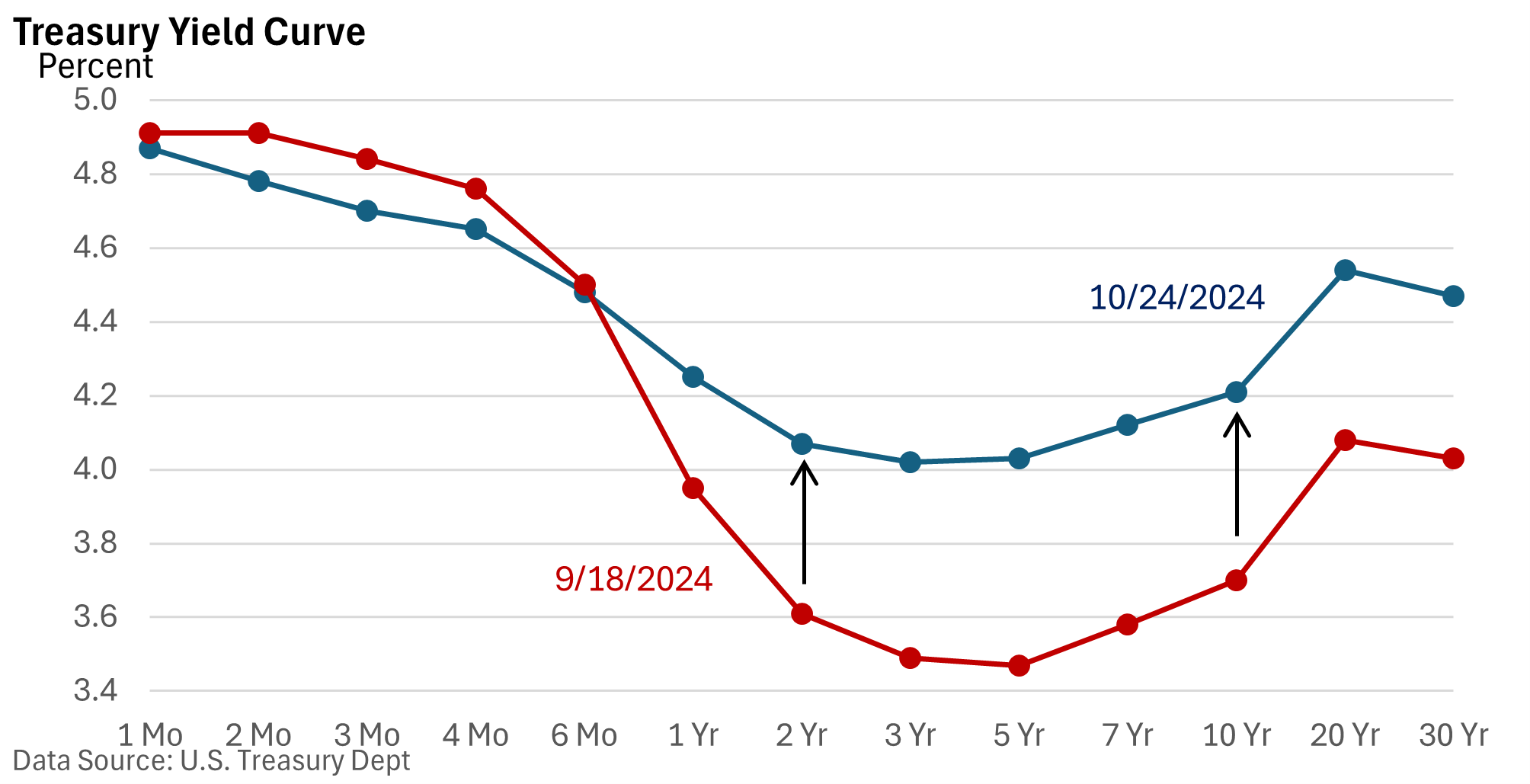

The graphic below plots yields on Treasuries from 1 month to 30 years. The red line represents yields on September 18, the day the Federal Reserve reduced the fed funds rate. The blue line displays yields about 5 weeks later—October 24.

Yields are down for short-term T-bills: 1 – 4 months. In contrast, yields are up significantly across much of the curve (1 year to 30 years). So, what gives?

- Bond investors are rethinking how aggressively the Fed will reduce interest rates. Talk of another half-percentage point cut in November is currently off the table. While odds favor a reduction in December, there is some chatter that the Fed could pause at the December meeting.

- Economic resilience—job growth in September was much better than expected, according to Bloomberg News, and the prior two months were revised higher. Recent data reflect an economy that is performing admirably, while the jobless rate remains low. Consequently, aggressive rate cuts aren’t needed right now.

- Large budget deficits translate into a greater supply of bonds that must be issued.

Consequently, investors have been re-pricing their outlook for bonds, surprising many who had expected yields to continue their decline or, at a minimum, stabilize near mid-September levels.

We may be having a completely different conversation later this year or early next year, as economic data can surprise either to the upside (as it is now) or disappoint. We’ll get a better read on Q3 on Wednesday when GDP is released. The October jobs report prints on Friday.