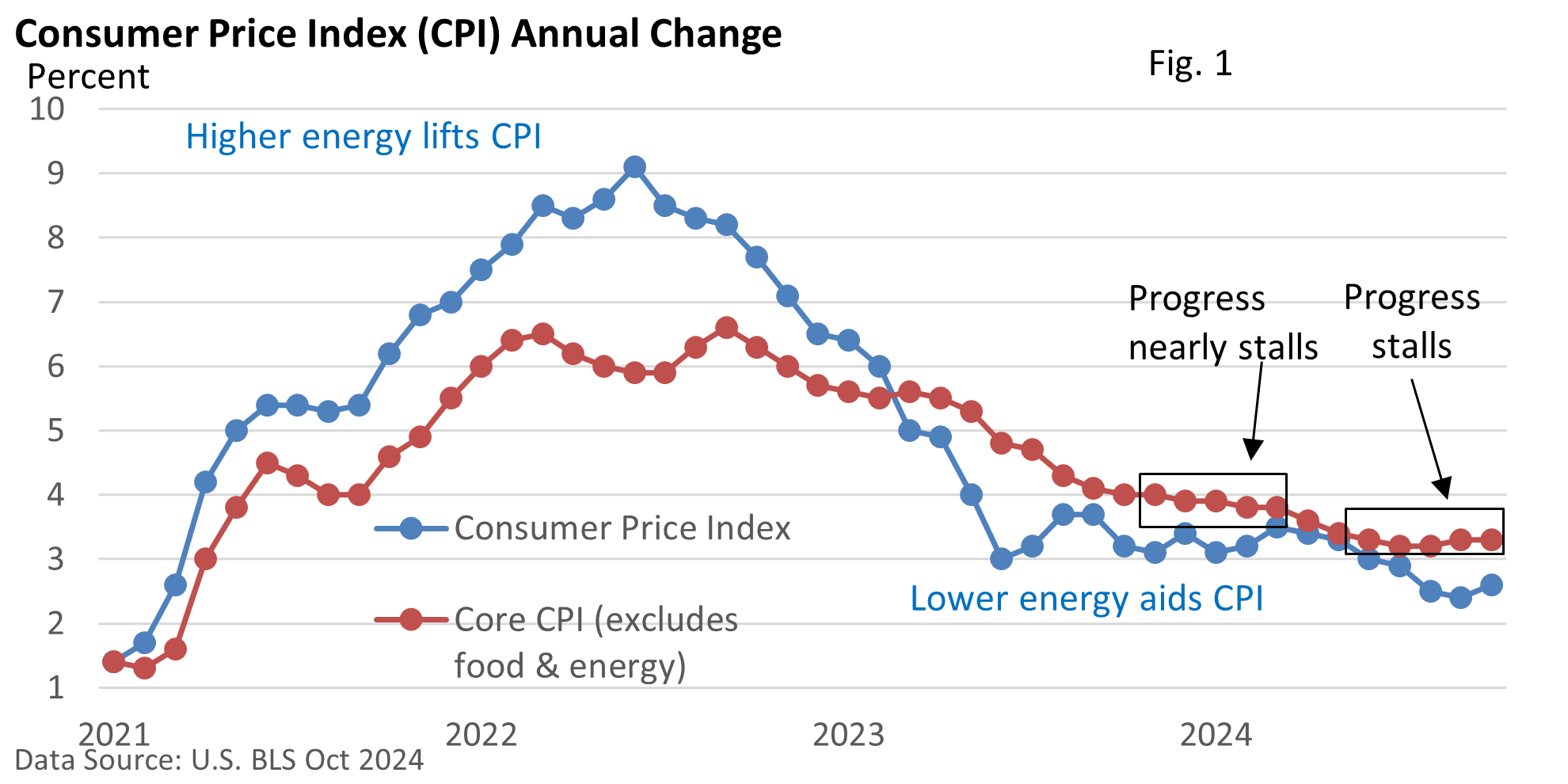

The Consumer Price Index (CPI) rose 0.2% in October, according to the U.S. Bureau of Labor Statistics. The core CPI, which excludes food and energy, rose 0.3% last month. The CPI is up 2.6% compared to one year ago, and the core CPI is up 3.3%.

After reviewing the details, let’s look at the trends. As previously mentioned, the annual core rate was 3.3% in October, which remains the same as it was five months ago.

First, let’s address a disconnect regarding inflation. Investors and the Federal Reserve are more focused on the inflation rate and its dramatic slowdown since peaking in 2022.

Everyday shoppers are relieved prices aren’t rising at 2022’s pace, but their primary focus has been on the current price level, which is much higher than pre-pandemic levels.

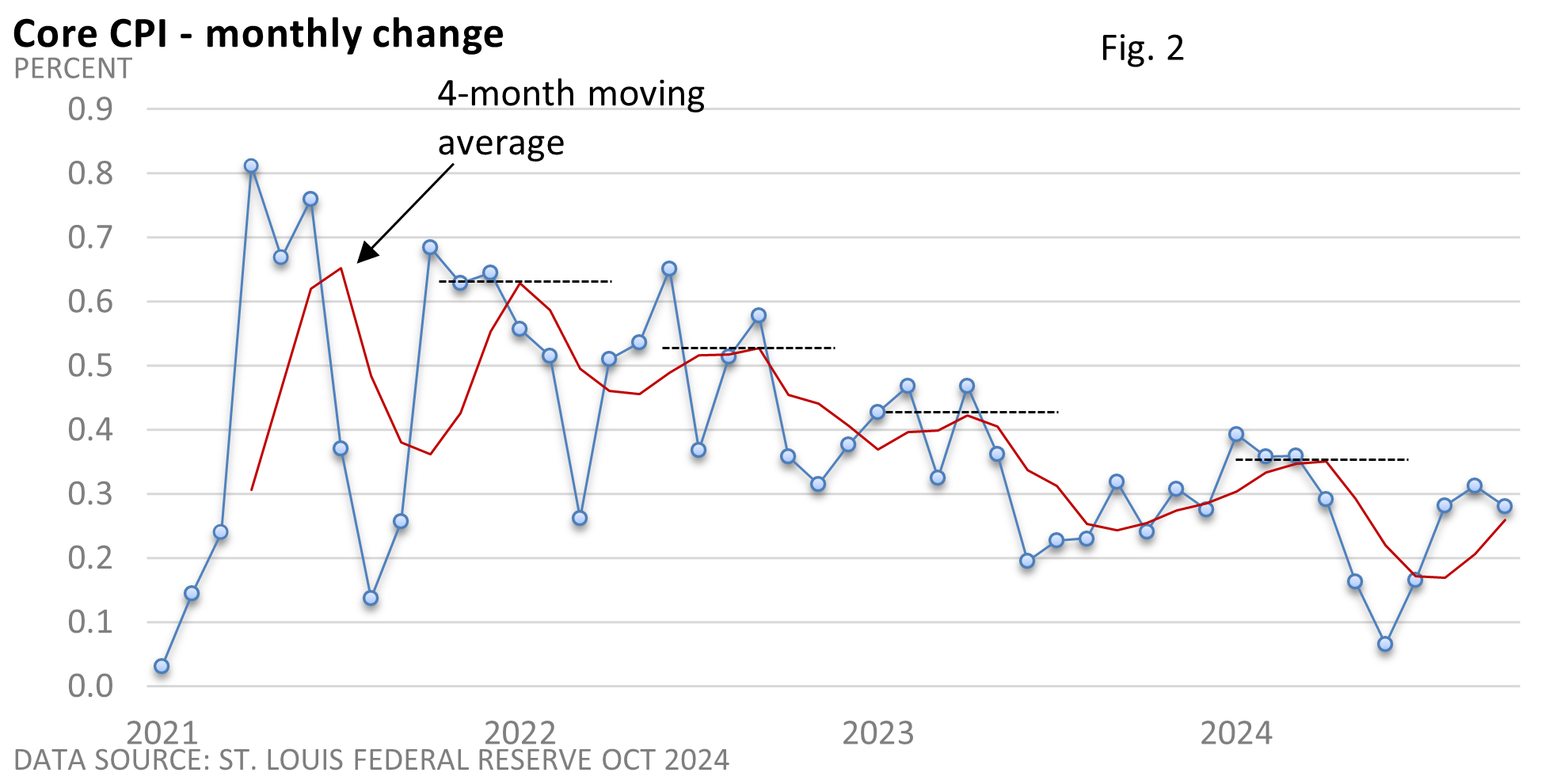

Figure 2 highlights the monthly change in the core CPI. The red line highlights the 4-month average, which helps smooth away the noise that can accompany the monthly numbers.

What do we see? The monthly figures for August—October 2024 are slightly higher than those from the same period in 2023, which might be concerning and worth monitoring. However, it’s important to note that the peaks and valleys in the 4-month average remain to the downside.

An interruption in that trend might be cause for alarm.