On Thursday, the president said the pause could be extended.

However, a return to market calm has proven elusive. A 10% tariff remains in place on nearly all countries, while steel and aluminum face tariffs of 25%—the same applies to autos outside the US-Mexico-Canada (USMCA) trade agreement, according to Reuters.

Additionally, tariffs on China are set at 145%, as confirmed by the White House. Economic uncertainty is high, which keeps investors on edge.

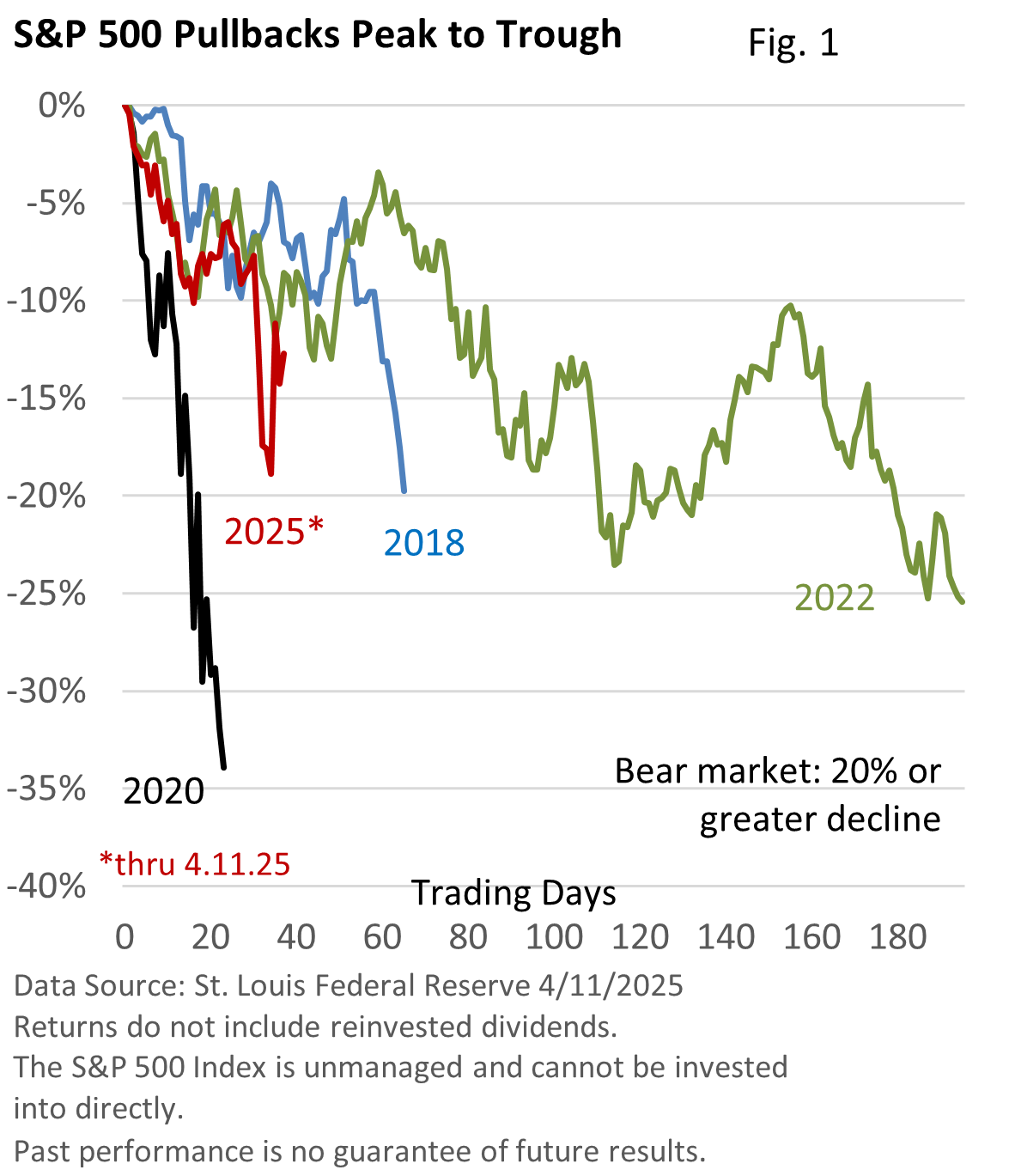

Figure 1 illustrates recent declines. The short sell-off in 2020 was the most intense, while the 2022 bear market, associated with high inflation and rapid rate hikes, was more measured.

Meanwhile, problems are bubbling to the surface in the Treasury market.

On Friday, April 4, the yield on the 10-year Treasury hit an intraday low of 3.86% (CNBC). It closed a week later at 4.48%.

Historically, economic and stock market tremors encourage investors to buy Treasury bonds, which pushes yields down.

Treasuries have been viewed as a safe-haven asset, as we saw in the 2008 financial crisis and the pandemic lockdown.

That’s not happening today. Why?

Markets are concerned about inflation, which can drive yields higher. There may be some selling among foreign holders of U.S. Treasuries. Hedge funds could also be selling bonds as they unwind leveraged positions to raise cash.

Furthermore, there may be some unease over any upending of the global order that has been in place since the end of WWII, if that is occurring.

Historically, the dollar has risen when global markets have been shaken. Today, the dollar has lost value amid outflows into other currencies.

Today’s situation is fluid. It only takes a headline to move stocks, as we saw on Wednesday.

Investors seek clarity, including a resolution of trade issues the market doesn’t perceive as harmful.

Alternatively, they are carefully monitoring any shift to a new trade equilibrium, which has been challenging thus far.