Last week was packed with economic developments, as reports poured in from all directions.

We saw the release of second-quarter Gross Domestic Product (GDP) figures, the broadest measure of goods and services produced, alongside the July jobs report. As if that weren’t enough, the Federal Reserve held its policy meeting, and strong corporate earnings continued to roll in.

Yes, there was a flurry of activity, and the overall picture was mixed at best.

Trade flows continue to whipsaw the data. While the headline showed a solid 3.0% gain, it overstated actual growth—essentially the reverse of Q1, when a 0.5% decline understated underlying activity. As the Wall Street Journal noted, it was the “Weirdest GDP Report Ever.”

Bottom line—growth has moderated in 2025, and consumer spending has slowed.

Meanwhile, the Federal Reserve kept the fed funds rate at 4.25–4.50%. Despite ongoing economic concerns, the Fed remains focused on any inflationary pressures stemming from tariffs.

The Fed kept its September rate cards close to the vest, even as Fed Chief Powell repeatedly emphasized “downside risks to the labor market”—a phrase he repeated six times during his press conference.

Elsewhere, S&P 500 Q2 earnings continue to impress and are up over 11% versus one year ago, according to LSEG (as of Aug 1). That’s nearly double the estimate as of July 1. In part, the AI story is driving earnings for big tech companies, and that spills over into S&P 500 profits.

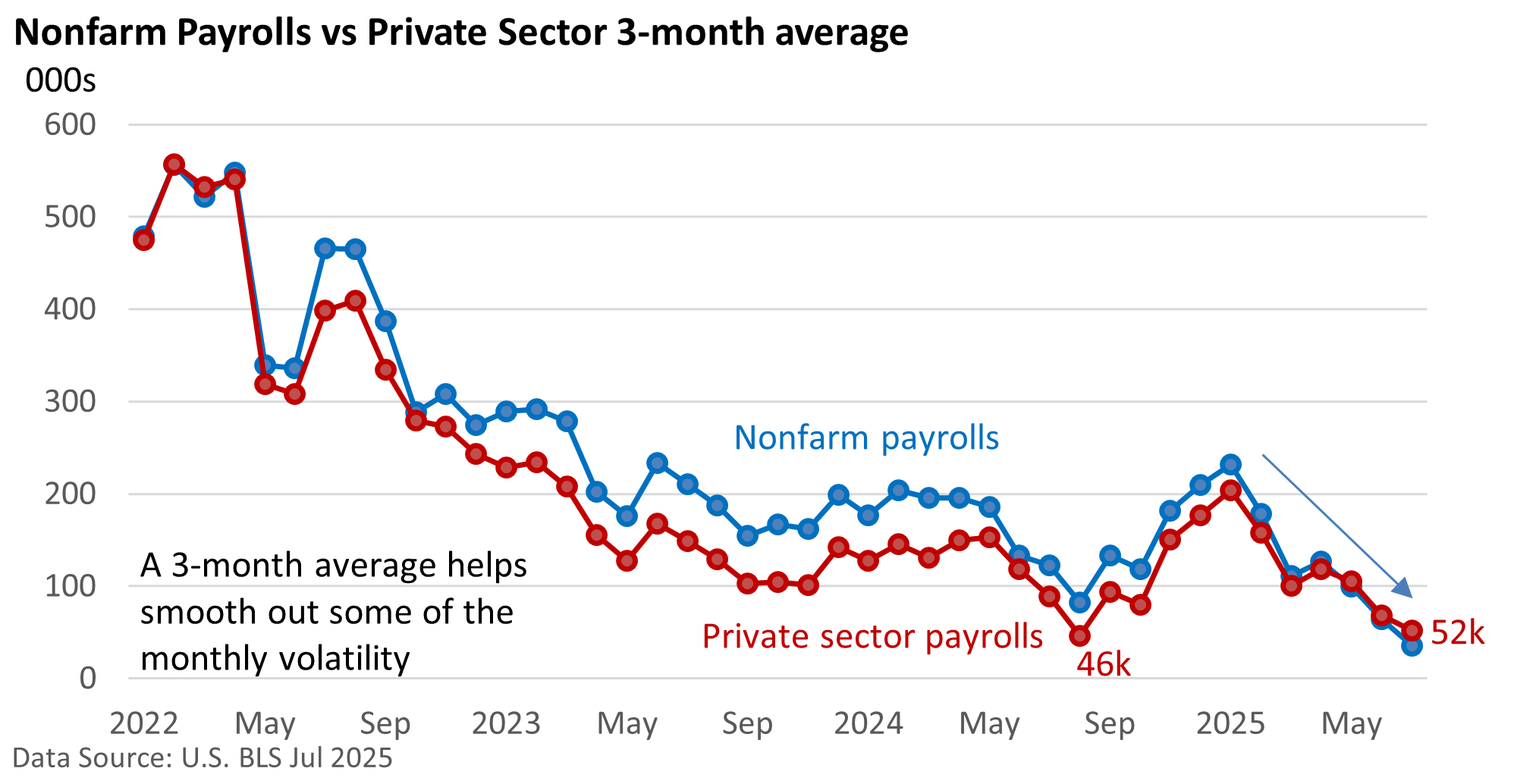

But July’s jobs report fell short of expectations. According to the US Bureau of Labor Statistics, nonfarm payrolls (includes all govt. jobs) rose a subdued 73,000 in July, with private sector gains totaling 83,000. On its own, that’s not terrible—certainly not impressive but not alarming either.

However, downward revisions to May and June—amounting to a combined 258,000—paint a more unsettling picture. Revisions are normal. The size of the revisions, however, was not. Even more striking, nearly all of July’s job growth came from a single sector: healthcare, which added 73,000 jobs. So far this year, 470,000 of the 588,000 private-sector jobs created have been in healthcare and social assistance, per to US BLS data.