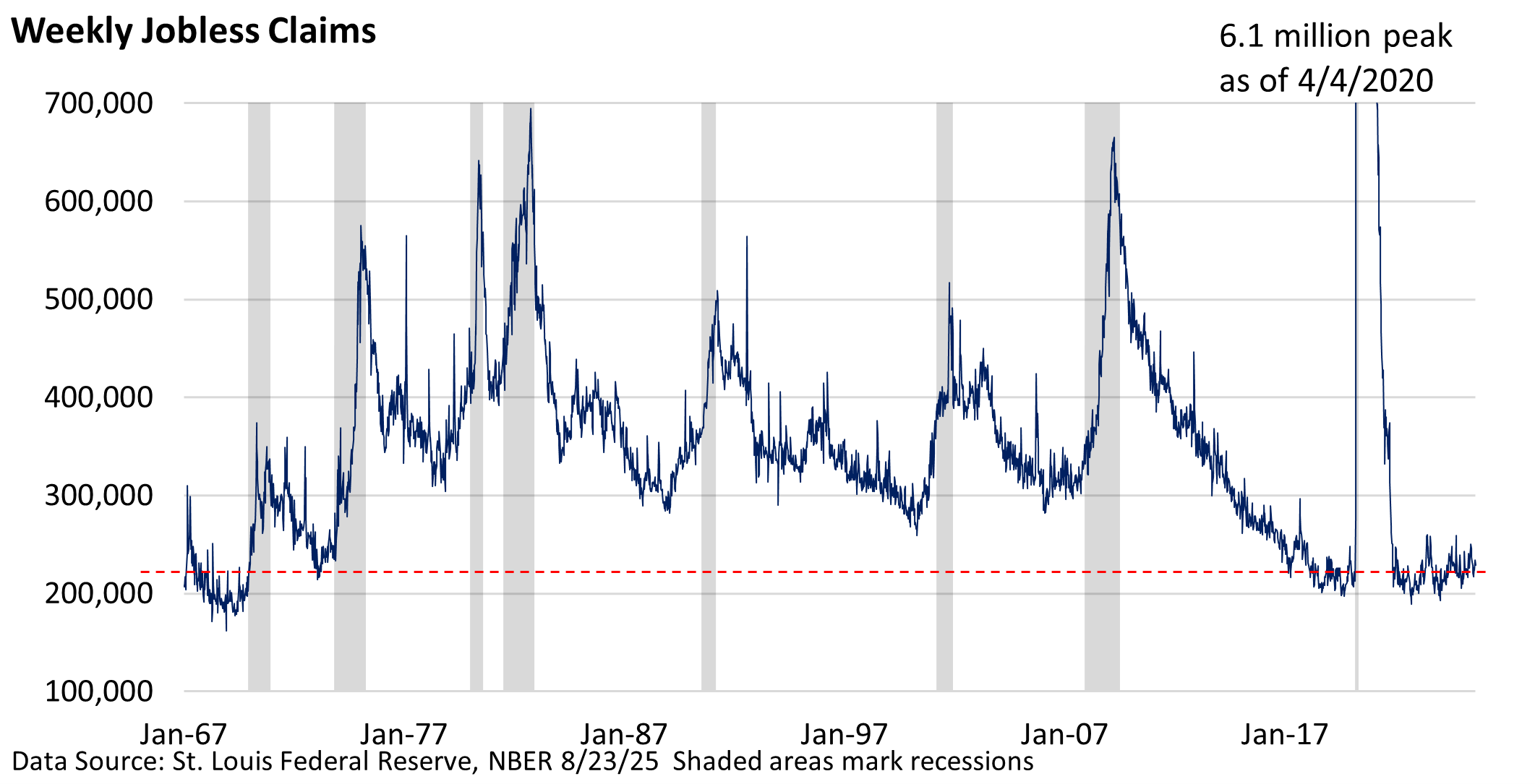

Initial claims for unemployment insurance measure the number of people filing for unemployment benefits for the first time. The data is released weekly, making it one of the most up-to-date indicators of labor market conditions. It is a key economic indicator because it offers a real-time snapshot of the health of the labor market.

A sudden rise can signal that layoffs are increasing, which may point to economic weakness or a slowdown.

Conversely, a sudden and unexpected decline could be a sign of economic strength. Like any economic indicator, it has drawbacks. At times, it can be volatile over a very short period, sending a misleading economic signal.

All that said, what are weekly initial claims telling us today? Simply put, layoffs remain low.

Granted, this is simply half the equation. It doesn’t tell us about hiring, which has slowed. From a broader economic perspective, initial jobless claims indicate that despite several high-profile layoffs, the overall low level of claims suggests that the economy continues to expand. Note: Laid-off federal workers file under a different system.

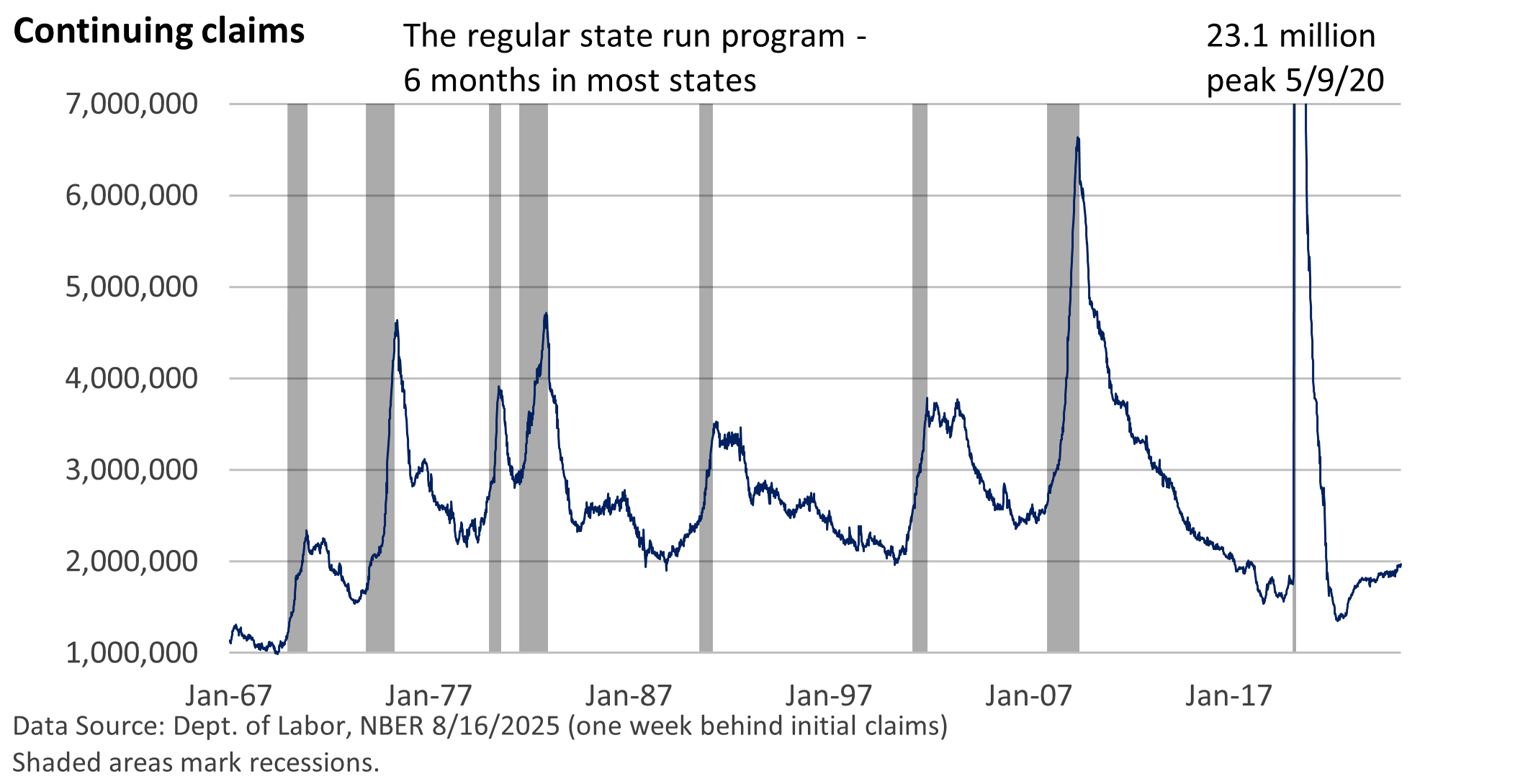

There’s one other piece of data that’s generated in the weekly report from the Department of Labor—continuing claims.

After one files for the first time following a layoff, state unemployment offices require the unemployed worker to file on a regular basis in order to receive benefits. Most states allow laid-off workers to file up to six months before losing benefits. A few states have a shorter period.

Tracking the number of people who regularly file for unemployment benefits—continuing claims—gives us insights into how long it is taking laid-off workers to find new jobs.

As the graphic shows, while the number who are actively looking for work is at a low level, continuing claims have ticked off the bottom, as those who are unemployed are spending more time searching before landing a new opportunity.

Despite some cracks that are appearing in the labor market, the data suggests that layoffs haven’t surged, and the economy is expanding.