Weekly Market Commentary

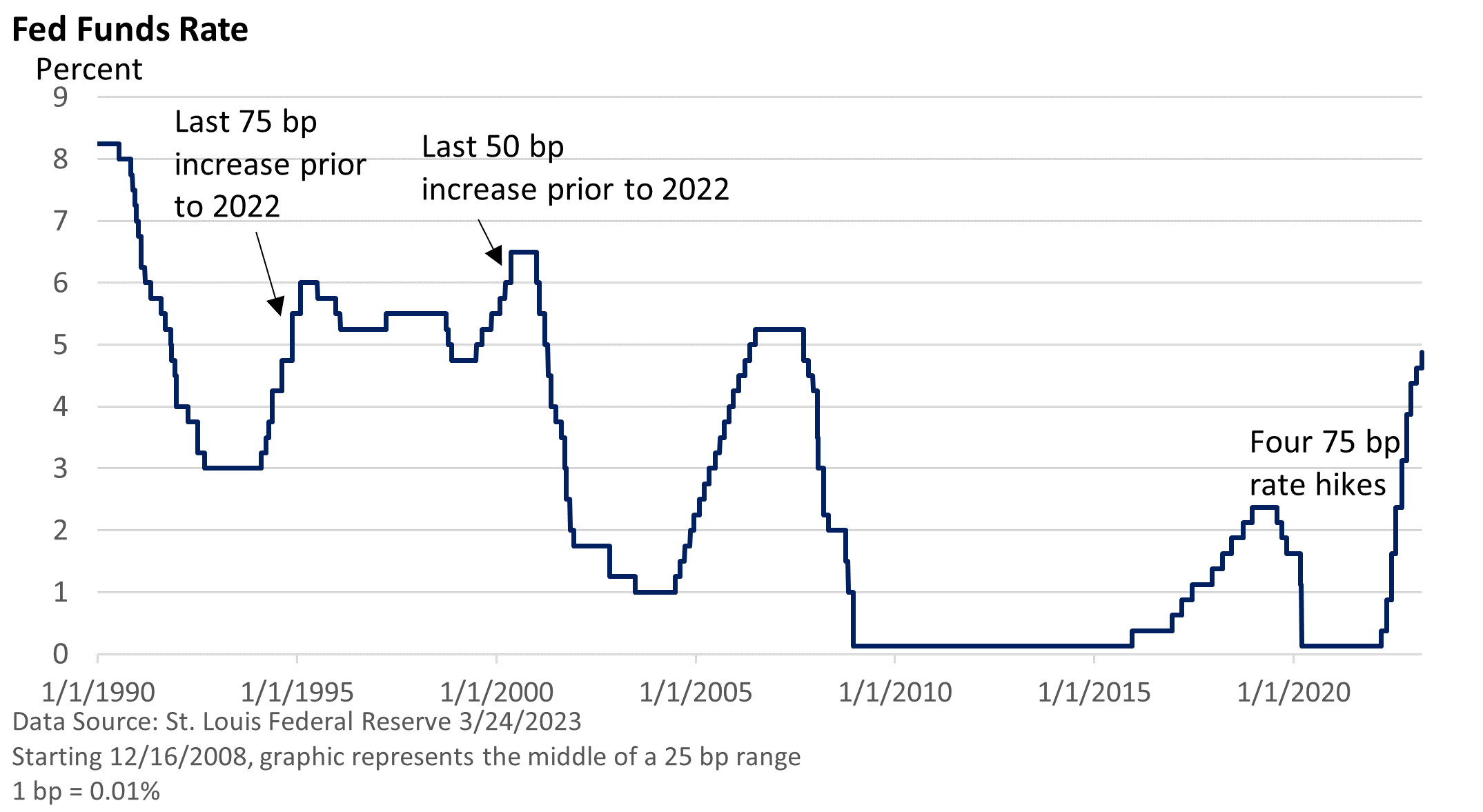

The Federal Reserve raised its key lending rate, the fed funds rate, by 25 basis points (bp, 1 bp = 0.01%) to a range of 4.75 – 5.00%, as most observers had expected. A few saw no change. Before the failure of Silicon Valley Bank (SVB), a consensus had been building for 50 bp.

The Fed and Fed Chief Jay Powell’s goal was to walk a very narrow tightrope between two conflicting goals: fighting inflation and ensuring the stability of the banking system.

Raise rates aggressively and you create unwanted banking stress. Loosen policy to support banks and the Fed gives up on its inflation fight, at least that’s how the Fed views it.

There was little from the Fed that would suggest it will go on hold nor was there any talk of a possible rate cut this year, but the shift in its language was telling. “Additional policy firming MAY (my emphasis) be appropriate” is a pretty wishy-washy way of saying we might see one more rate hike. It’s a shift away from the last meeting when the Fed said, “Ongoing increases (plural) in the fed funds rate WILL (my emphasis) be appropriate.”

The fed funds rate and Treasury yields remain below the annual Consumer Price Index (6% in February per the U.S. BLS). On the surface, that would sound like today’s rates are still supporting economic growth, despite last year’s super-aggressive series of rate hikes. But that is a pre-crisis analysis.

Anxieties over a small number of banks have caused a big shift in sentiment. Lending standards had already tightened before SVB’s failure, according to the Fed’s Survey on Bank Lending.

While Powell addressed the current problems that exist with a small number of banks, it’s unclear how much current anxieties might add to pressure on bank lending.

If it becomes harder for businesses and consumers to get credit, the banking crisis does the Fed’s job for it, and it no longer needs to raise interest rates. But if credit tightens too much, it risks tipping the economy into a recession. It would ease inflation, but the cost is jobs.

Before we conclude a near-term recession is inevitable, excess savings from pandemic stimulus and recent cost-of-living adjustments, which both underpin spending, and continued government outlays are still tailwinds for growth. Yes, there are plenty of moving parts.