Weekly Market Commentary

What happens when mortgage rates tumble below 3% and then spike above 7%? Unintended consequences are bound to play out. In hindsight, they aren’t difficult to spot.

You’re a winner if you have no intention of moving and were lucky enough to lock in ultra-cheap rates just a few years ago. Those who want to move or renters who want to buy are less fortunate.

Those who want to move feel trapped in their homes, as they are reluctant to trade in their cheap mortgage for a pricier one.

Yet, high rates were expected to lower housing prices, but that’s not happening.

A couple of weeks ago, the National Association of Realtors (NAR) reported that the median existing U.S. home price hit a record in May of $419,300. That’s up from $266,300 in January 2020.

Eventually, some homeowners who need to relocate will put their homes on the market and trade in their dirt-cheap mortgage for the prevailing rate.

Until then, those who stay put are limiting the supply available, according to the NAR. And that limited supply is keeping prices high. It’s an unintended consequence of high rates. It’s the opposite of what was anticipated when rates jumped.

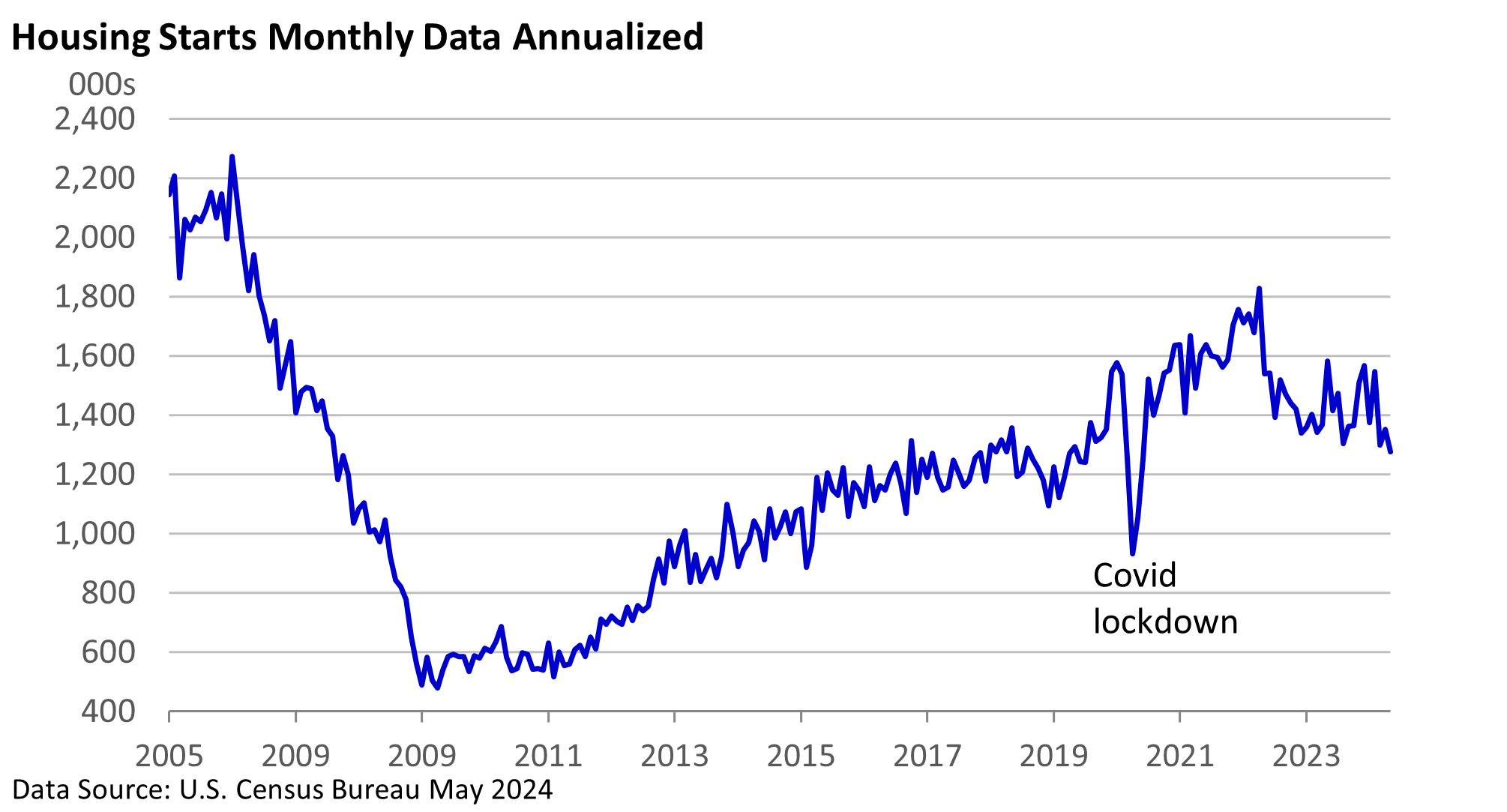

Yet, you might expect that a shortage of homes would spark a building boom.

It hasn’t.

Moreover, spending tied to real estate is down as fewer people renovate their homes before a sale. With sales down, fewer folks embark on projects after purchasing a home. And, of course, real estate agents, mortgage brokers, and others linked to the industry feel the pain.

So far, however, most of the pain has been limited to housing, as the economy has managed to shrug off the industry’s woes.