Weekly Market Commentary

Chatter that the rate of inflation was on a downward path appears to have hit a snag after the August release of the Consumer Price Index (CPI).

Following July’s unchanged reading in the CPI, prices rose just 0.1% in August thanks to another big decline in gasoline prices, according to the U.S. Bureau of Labor Statistics. But the increase topped the consensus forecast among analysts of a 0.1% drop per MarketWatch.

The core CPI, which strips out food and energy, jumped 0.6%, double the consensus of 0.3%. In July, the core CPI rose 0.3%.

On an annualized basis, the CPI slowed from 8.5% in July to 8.3% in August, while the core CPI accelerated from 5.9% to 6.3%.

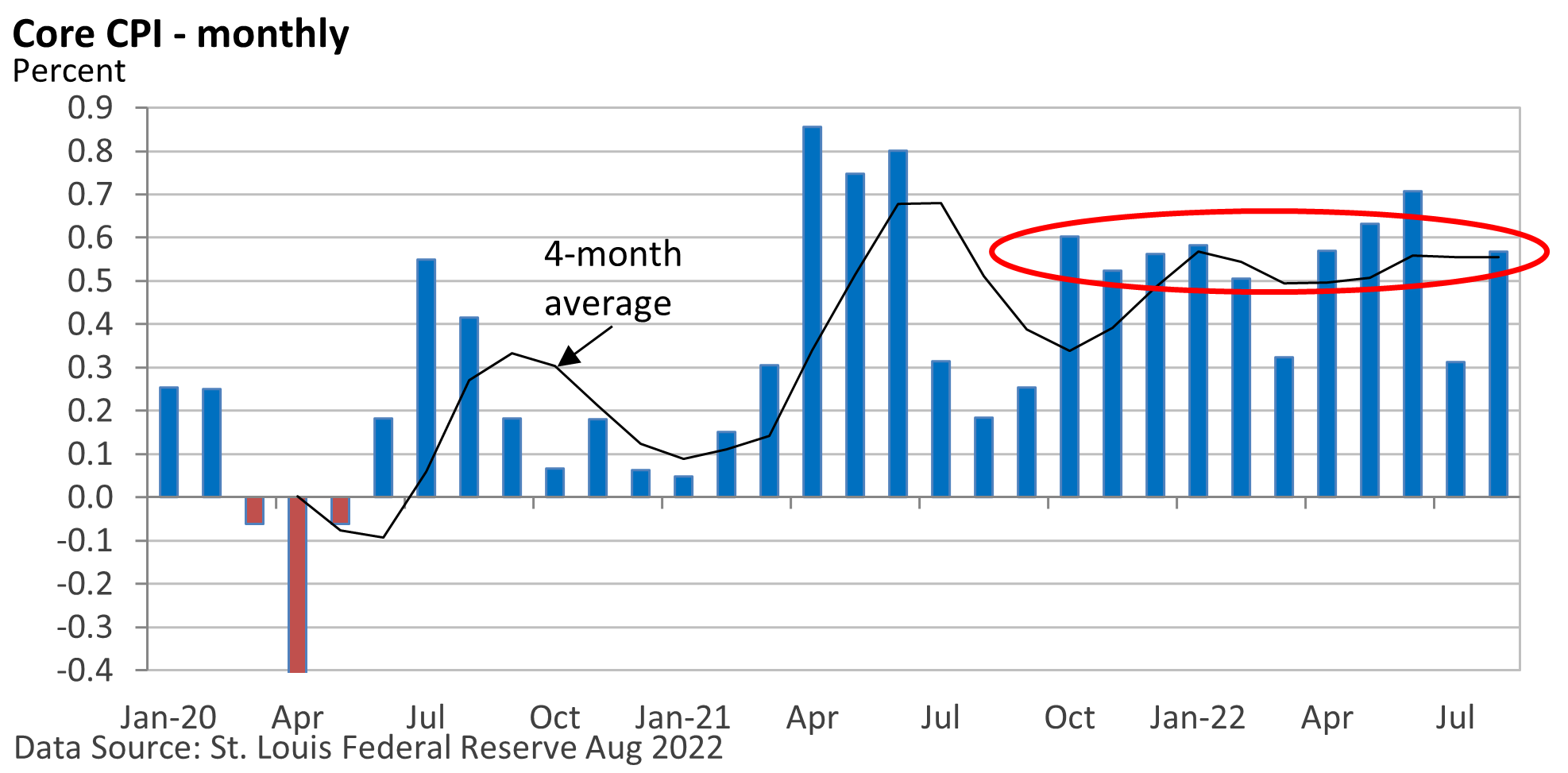

Core inflation isn’t rising on a monthly basis, but it isn’t slowing either. As the graphic below suggests, it’s been a long plateau.

Breaking down the numbers, core inflation averaged 0.54% per month over the last 11 months and has run between 0.5% and 0.6% in 8 of the last 11 months. In contrast, the core CPI averaged 0.15% per month between 2010—2019, according to the St. Louis Federal Reserve.

It doesn’t seem to matter that wholesale price increases have slowed (U.S. BLS), and, thanks to the strong dollar, the price of imported goods has actually fallen (U.S. BLS).

Final Thoughts

Aided by falling gasoline prices, the headline CPI probably has peaked, but bringing inflation down has been challenging.

The unexpectedly large rise was met by a selloff on Tuesday, as it raised the idea that the Fed will have to hike rates longer and higher than expected. Higher and longer also raises odds the economy could fall into a recession, which added to last week’s downbeat mood.

According to Fed rhetoric, a slowdown in inflation isn’t enough. The Fed wants “compelling evidence that inflation is moving down, consistent with inflation returning to 2% (annually).”

We may have a different conversation next year and Fed talk could shift, but today’s remarks from the Fed show it will continue to tighten until its goals are achieved.

If you have questions or would like to discuss any other matters, please let me know.