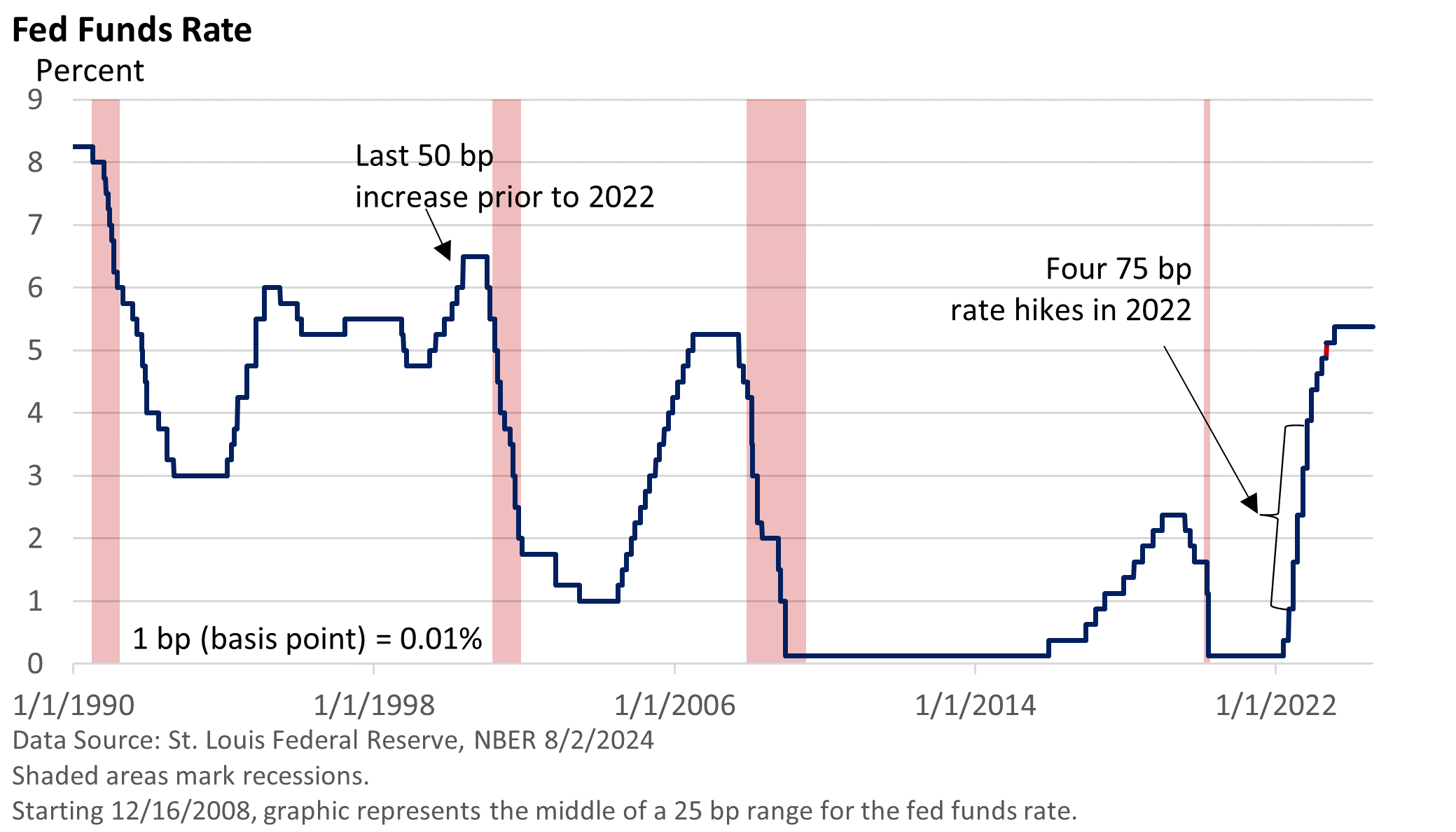

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice-mentioned that a September rate cut is on the table at his press conference.

The Federal Reserve is shifting its focus from singularly fighting inflation by acknowledging the softening job market and stressing that maintaining full employment remains an important goal.

As reported Friday, nonfarm payrolls grew by a softer-than-expected 114,000 in July, according to the U.S. Bureau of Labor Statistics (BLS).

Private-sector payrolls grew by 97,000, including 64,000 in health care and social assistance—just 33,000 for the remainder of the private sector.

While price increases remain above the Fed’s target, monetary policy has helped rein in inflation. As the rate of inflation has slowed, labor market metrics have come into balance.

But the pendulum swings slowly, and the Fed is becoming increasingly sensitive to the risk that the pendulum might swing too far, i.e., a surplus in labor that could exceed labor demand.

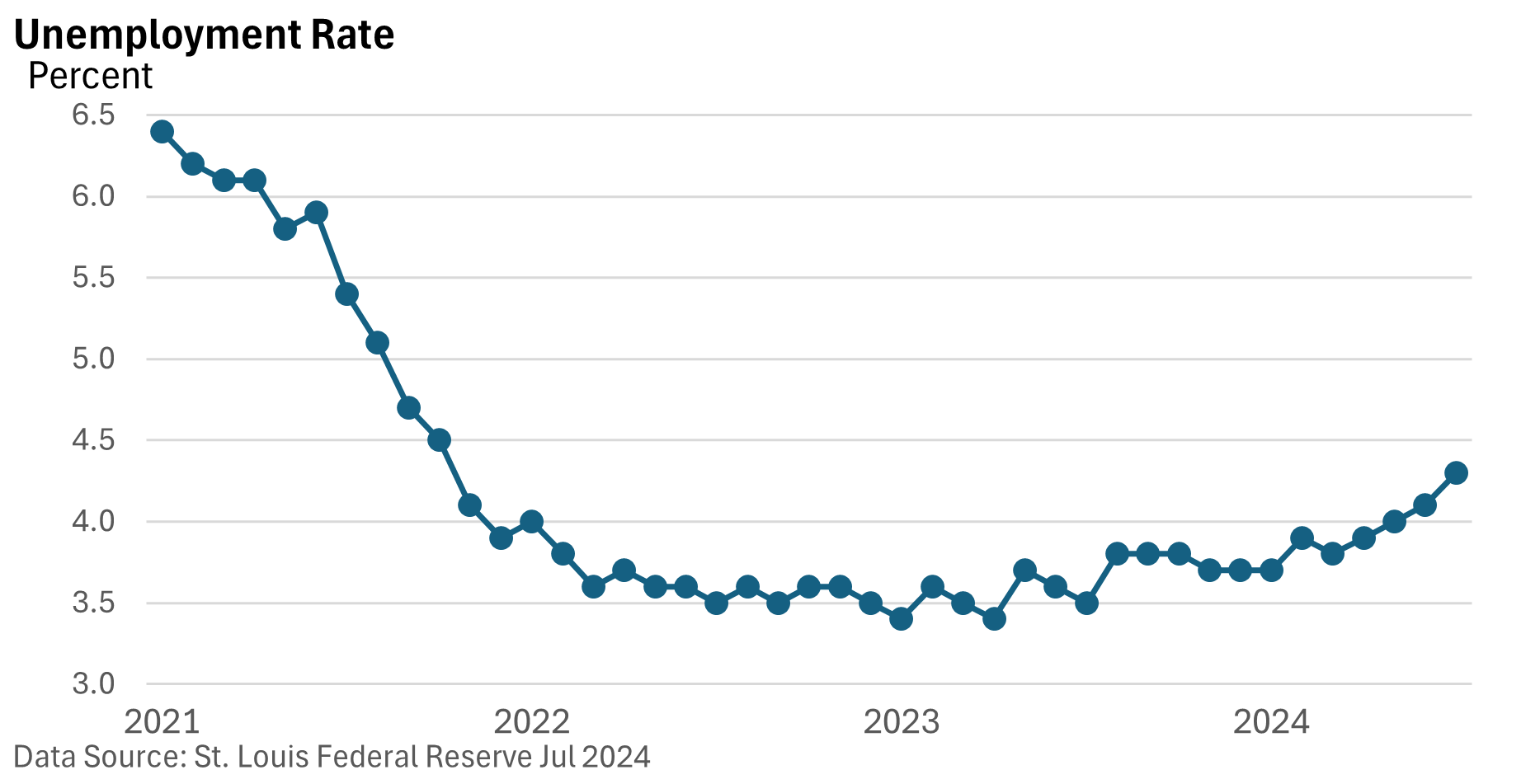

You see, the Fed can’t fine-tune the labor market. For that matter, no one can. The labor market is much more balanced today than two years ago, as higher rates have helped significantly lower job openings. But layoffs haven’t been completely avoided, and the unemployment rate is rising.

In July, the jobless rate rose to 4.3% from June’s 4.1%. In any other cycle, a 0.9 percentage point rise in the jobless rate from its cyclical low of 3.4% would signal a recession has already begun.

In today’s environment, a rise from January’s 3.7% jobless rate to 4.3% in July has been accompanied by a 1.4 million rise in nonfarm payrolls during the same period, per the U.S. BLS. In part, the two data points are derived from two separate surveys.

Bad news is bad news

Bad economic news quickly became bad news for investors. Previously, softer economic news was seen as an encouragement for the Fed to cut rates.

Today, rate cuts are priced in, but a sharp economic slowdown or recession isn’t. Consequently, stocks and Treasury yields fell over the last couple of days, as investors priced in new data.

Stocks are up sharply this year, and volatility can never be ruled out. Stocks trend upward in the long run, and temporary declines are to be expected. A well-diversified financial plan takes volatility into account.

That said, most economic indicators aren’t signaling an immediate recession. Last week’s Q2 GDP report suggested the economy entered Q3 with some momentum.

It’s possible we’re simply seeing seasonal quirks that are overstating a labor market slowdown. It’s possible that US BLS data exaggerated job growth earlier in the year, and we’re seeing some giveback today. August’s report will be revised in September and October.

Be that as it may, the just-concluded Fed meeting and a cooler labor market strongly suggest we’ll see a rate cut at the September meeting. It’s a major reason why Treasury bond prices rallied last week (bond prices and yields move in the opposite direction).