Weekly Market Commentary

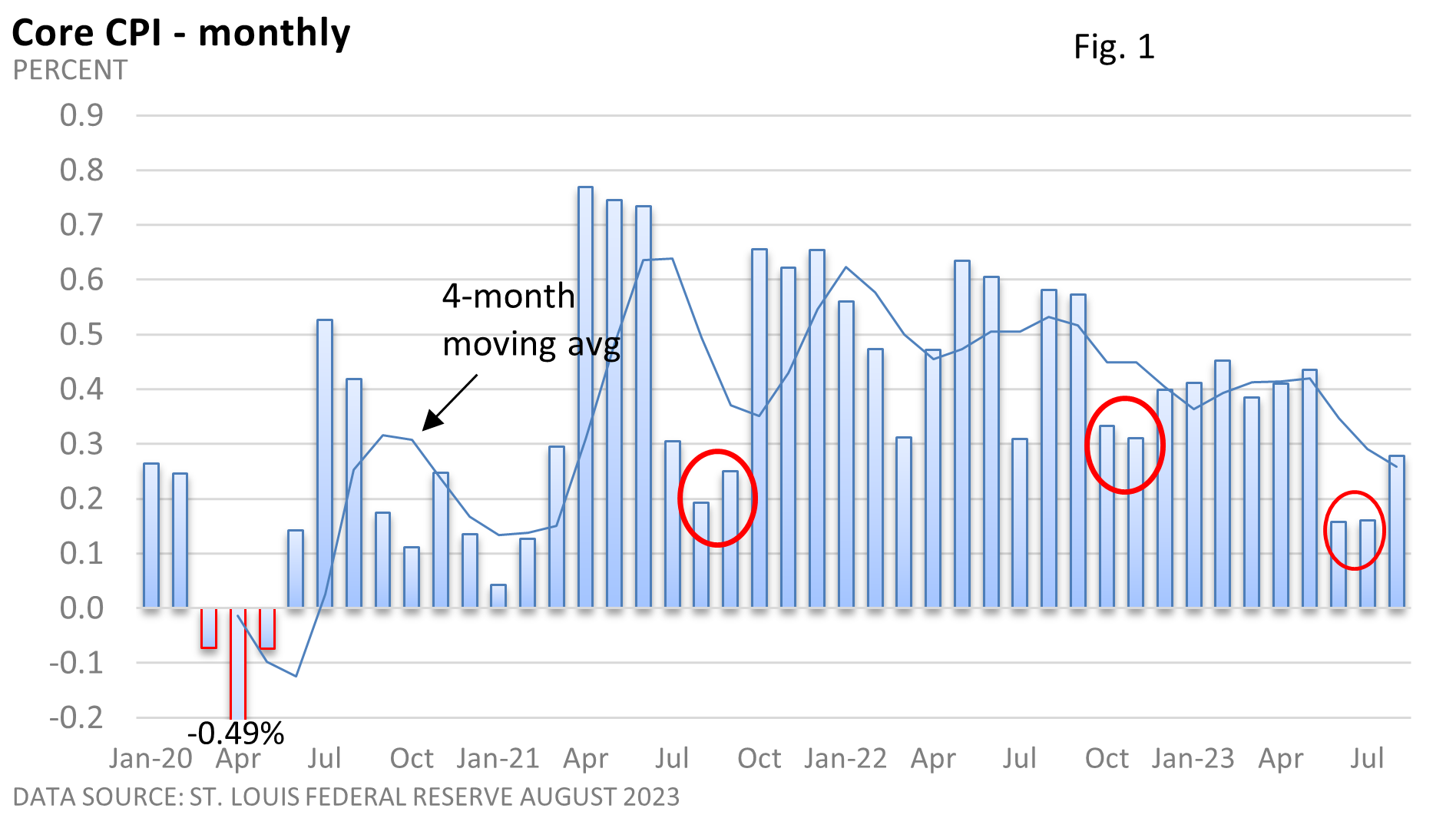

Progress on inflation won’t be in a straight line. That’s to be expected. Following two low readings in June and July, the number picked up in August.

It wasn’t unusually concerning. But following a 0.2% monthly increase in the Consumer Price Index (CPI) in June and July, the CPI rose 0.6% in August, as gasoline prices surged 10.6%, according to the U.S. Bureau of Labor Statistics.

The core CPI, which excludes food and energy, was also up 0.2% in June and July. It increased a more modest 0.3% last month.

Figure 1 illustrates the trend in the core rate of inflation. Progress has been uneven, as highlighted by the four-month average. Note the three instances (data circled in red) when inflation slowed but was followed by an acceleration.

While the Fed will probably look past the jump in the headline CPI, which was driven primarily by energy, the modest uptick in the core CPI highlights that progress on inflation is taking time. It adds ammunition to the idea that interest rates could stay higher for longer.

Interest Rates

Last month, Fed Chief Jerome Powell reiterated, “It is the Fed’s job to bring inflation down to our 2 percent (annual) goal, and we will do so.”

Last year, when inflation was galloping ahead, the Fed’s bite was as bad as its bark.

This year, anti-inflation rhetoric hasn’t subsided, but the rate of inflation has slowed, and there seems to be less urgency to get inflation back to 2%, especially if it means a recession.

From March through September 2022, the Fed raised the fed funds rate by 300 basis points (1 basis point = 0.01%).

This year, the Fed has raised its key rate by 100 basis points through July. A closely watched gauge from the CME Group puts odds at 97% (as of Sep 15, 2023) that the Fed will hold its key rate at 5.25-5.50% at this week’s meeting. A November increase can’t be ruled out.

There’s no guarantee the slowdown in the rate of inflation will continue, but the recent moderation in rate hikes is tied to several issues, including the fear of overtightening.