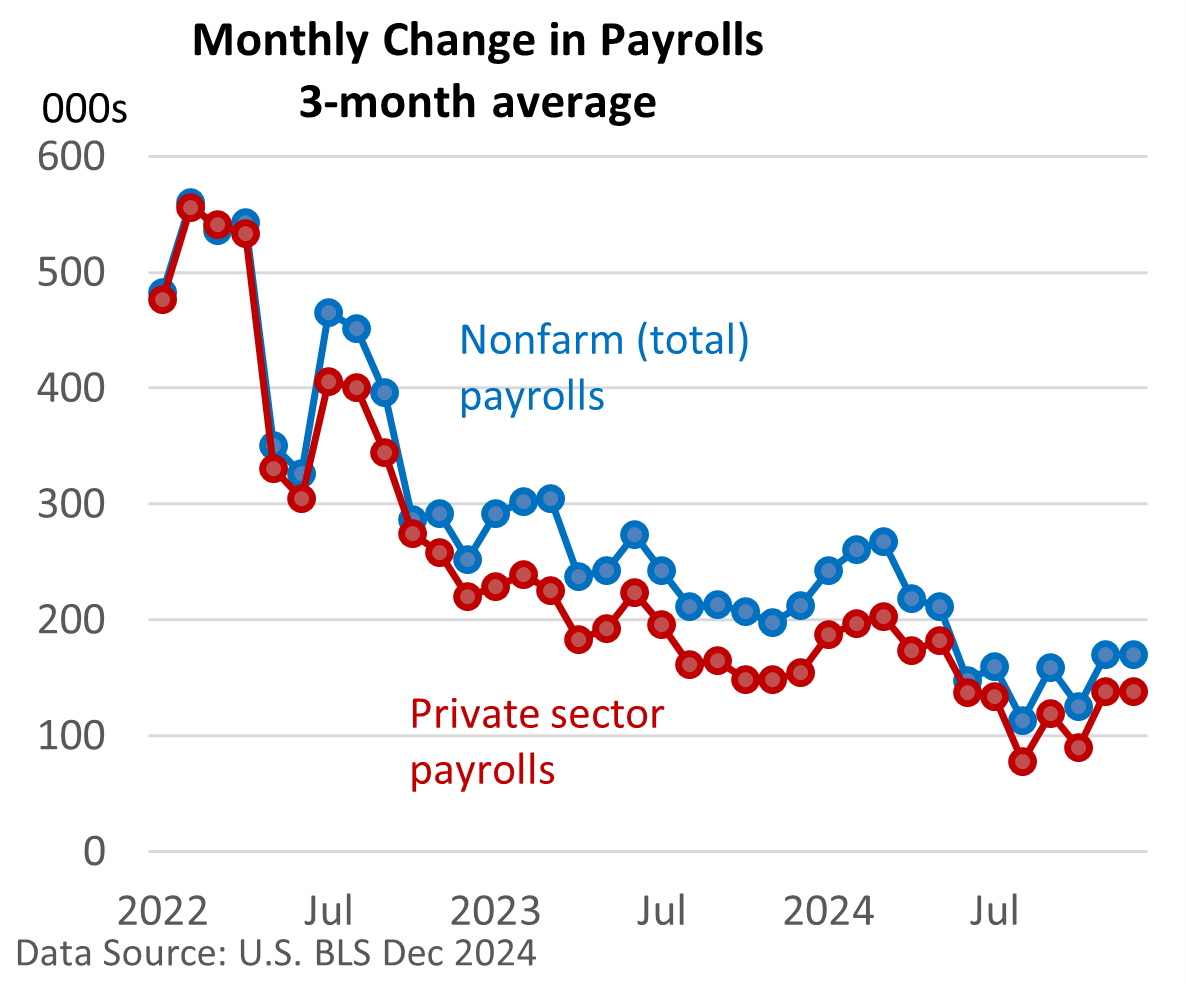

On Friday, the U.S. Bureau of Labor Statistics reported that nonfarm payrolls grew by 256,000 in December, easily surpassing analyst expectations of a more modest increase of 155,000 (Wall Street Journal).

The unemployment rate eased to 4.1% last month from 4.2% in November. The unemployment ratehas been hovering in a narrow range of 4.1 – 4.2% since June.

On Friday, it was “good news is bad news” for investors.

First, let’s review Wall Street’s reaction. According to CNBC, the Dow fell 1.6% (697 points), and the S&P 500 Index lost 1.5% (91 points) amid rising bond yields and interest rate worries.

A stronger economy and a strong job market (good news) diminish the odds that the Fed will lower interest rates this year (bad news).

Although a closely followed gauge by the CME Group currently puts the odds of a 2025 rate hike at 0%, a few are whispering about the possibility of a rate hike in 2025, especially if inflation ticks higher.

But what about Main Street? Main Street celebrates a strong economy and abundant jobs.

We’re not seeing it in every sector, such as information technology and the financial sectors, as the Wall Street Journal reported last week.

But overall, the jobless rate is low, and the economy is creating employment opportunities.

Sure, job growth is down from unsustainably strong levels when the economy was re-opening, but growth is respectable.

When markets are priced for perfection, any disappointment can lead to a reset of expectations and a decline in stock prices, as we have previously observed and discussed.

Yet, a strong jobs report reflects a strong economy. Any pullback resulting from a strong economy is preferred over a pullback stemming from unexpected economic weakness.

Furthermore, an upbeat economy underpins corporate profits (good news), and rising profits have historically lent support to stocks.

It is not always an immediate tailwind for equities, and rate worries are on the front burner right now, but historically, profit growth has been a long-term driver of stocks.