There are times when the economic data is strong, and when considered together, the economic reports surpass expectations. Such cycles run their course, and the economic reports turn softer. That overperform/underperform cycle can repeat itself multiple times during an economic expansion until the economy finally rolls over, and we land in a recession.

Currently, economic growth appears to be moderating, but more data is needed before we can draw a definitive conclusion. Let’s review one key metric for the economy: consumer spending.

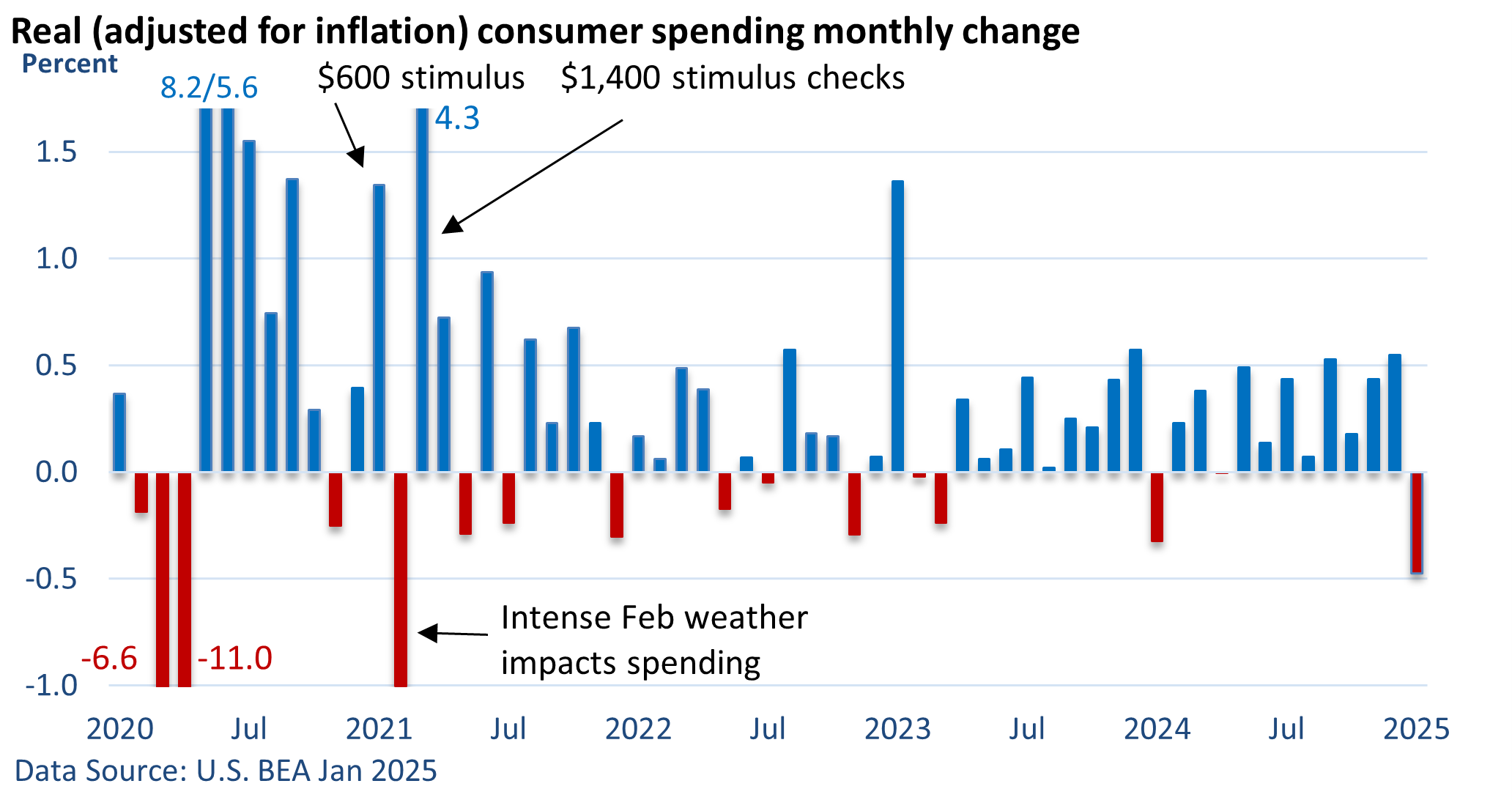

The graphic below illustrates the monthly change in real (adjusted for inflation) consumer spending. Spending in January tumbled 0.5%, the worst reading in nearly four years.

Following eight straight increases, one month’s decline isn’t unusual. Occasional declines are to be expected. Sales may have been hurt by cold weather across much of the country in January.

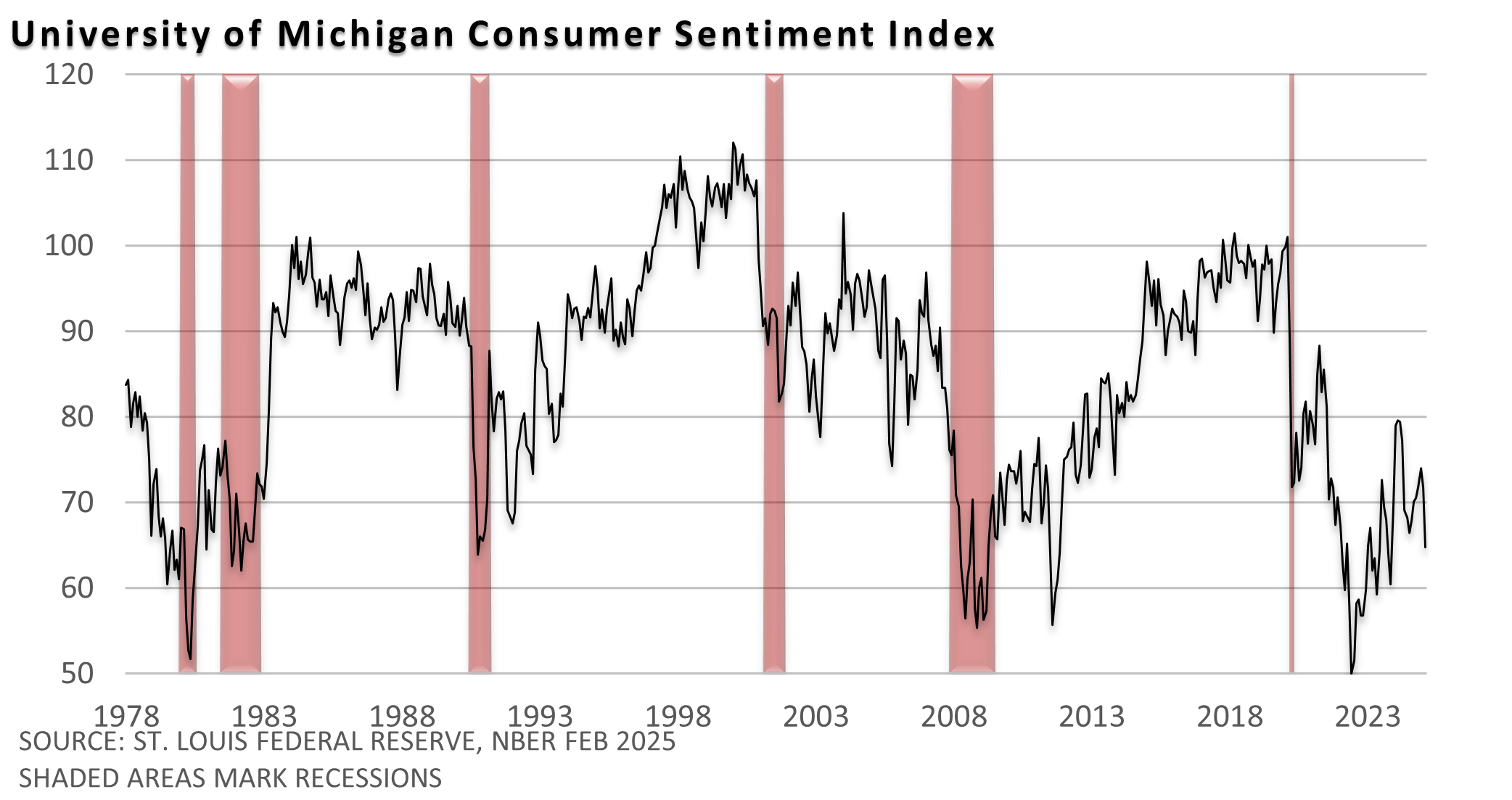

Yet, in February, consumer confidence took a hit amid concerns over tariffs and higher prices. In February, consumer sentiment fell 7 points to 64.7.

However, shifts in consumer sentiment do not always lead to immediate changes in behavior. A couple of years ago, the survey reached a record low, yet a recession did not ensue. High prices darkened the mood—considerably darkened the mood—but most people kept on spending.

Nevertheless, some economic uncertainty has crept into the picture.

The president says he will enact new tariffs against China, Mexico, and Canada this week, and we are seeing some volatility in the market.

Major market indexes are near their all-time highs, and it is not surprising that volatility surfaces from time to time. Recent economic uncertainty may be temporary, but the current economic situation bears watching.