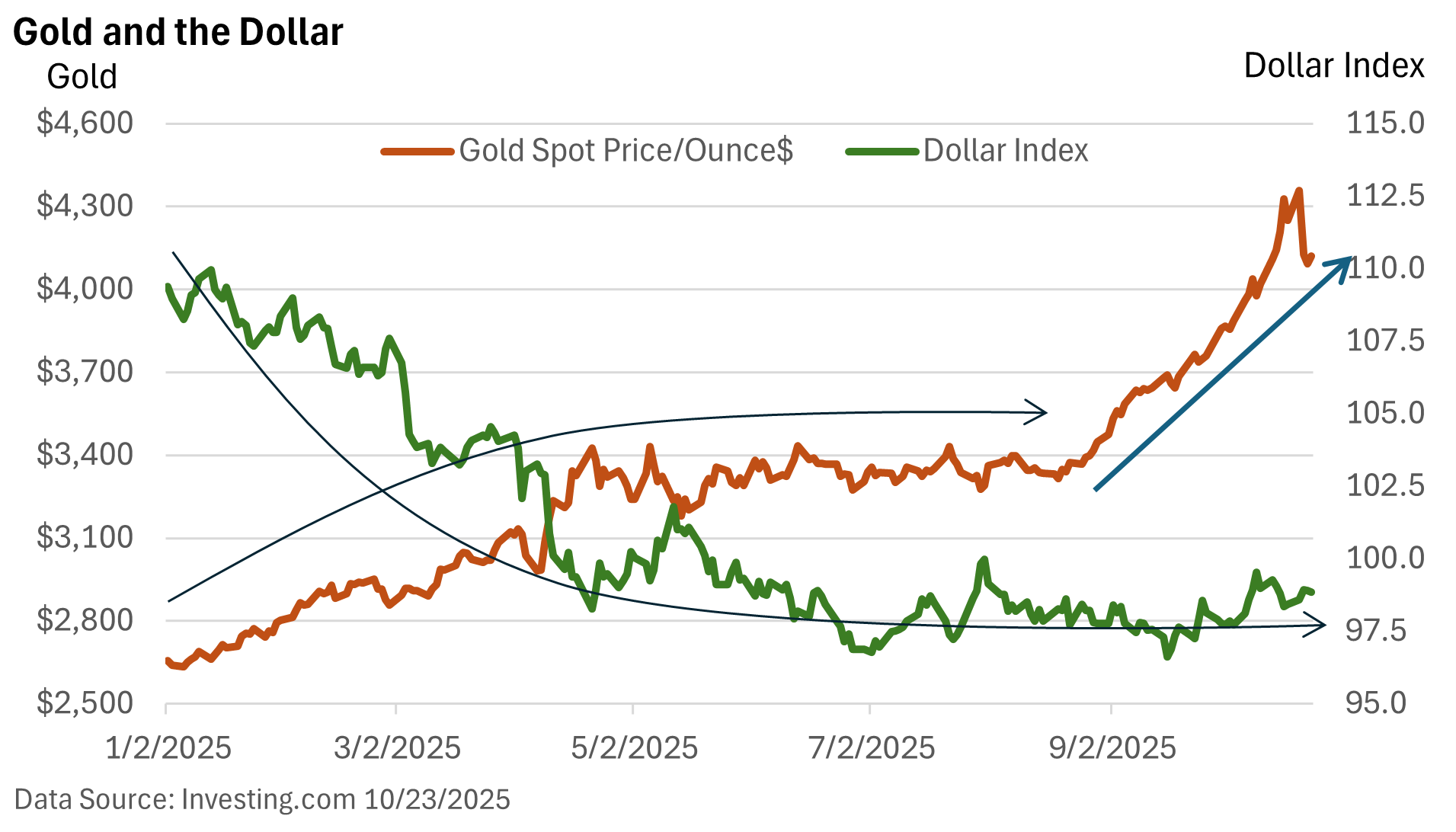

Globally, gold is priced in dollars. A rising dollar has historically provided a stiff headwind for gold. And the opposite is true. A weak dollar has historically been supportive of gold.

That pattern played out during the first eight months of the year. As the dollar slipped during the first four months, gold rallied.

But the dollar’s stabilization put a lid on gold, at least through the end of August.

A meteoric rise

Despite a stable dollar, gold has soared over the past couple of months, surpassing $4,000 per ounce for the first time.

Why has the price of gold surged? There are several reasons, including—

- Purchases of the metal by global central banks, as they gradually diversify away from the dollar.

- Tariffs and trade uncertainty may also be encouraging some investors to look at gold. Economic uncertainty has historically aided gold.

- The large federal deficit is viewed as unsustainable. It contributes to economic uncertainty, currency debasement, and investor distrust in traditional financial instruments.

- Expected rate cuts by the Federal Reserve support gold. In part, gold does not pay a dividend (obviously), and falling rates may make it more appealing.

- Higher inflation is seen as supporting gold; however, as we’ve observed before, other factors can outweigh changes in inflation. Gold was weak in 2022 despite high inflation. It has surged in 2025, even as the inflation rate has remained relatively steady.

- Lastly, success begets success. Let’s call it momentum. The run-up in price, especially over the last two months, has encouraged speculators to add to their positions. In other words, it’s FOMO—the Fear of Missing Out.

But gold is very speculative and can be volatile. Last week, gold saw its biggest one-day selloff in more than a decade, according to the Wall Street Journal.

Such a decline probably wasn’t surprising, at least in hindsight. But timing a move like that is all but impossible.