Weekly Market Commentary

The road to price stability has been long and arduous. Inflation doesn’t just impact investors. It impacts everyone, from shoppers to travelers to those on a fixed income.

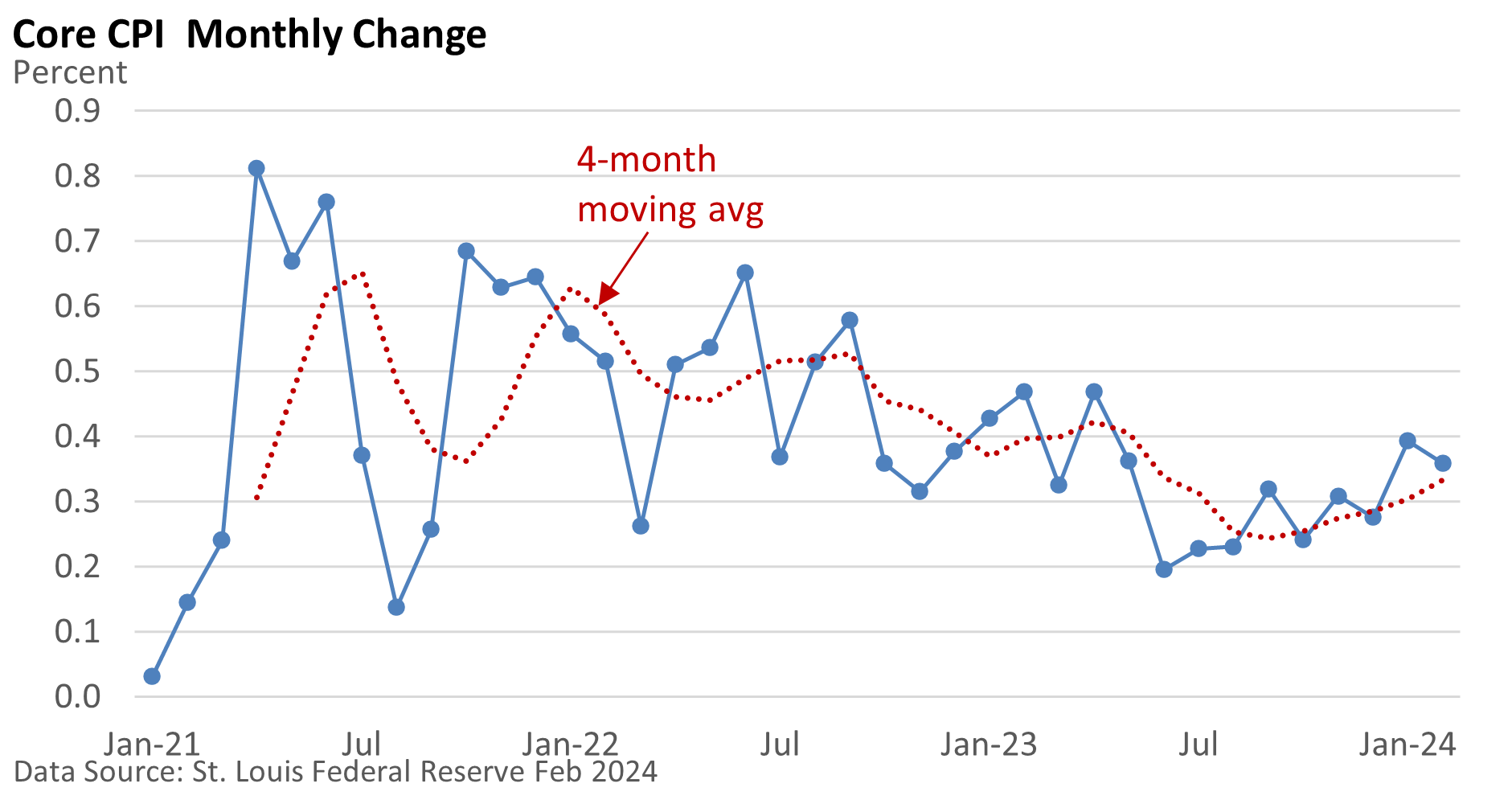

February’s Consumer Price Index (CPI) marks the second straight month of stronger-than-expected inflation. The core CPI, which excludes food and energy, rose 0.4% in both January and February (U.S. Bureau of Labor Statistics). The CPI rose 0.4% in February and 0.3% in January.

We hope it’s a temporary setback, but the last two months signal that the road to price stability is taking an unexpected detour in the new year.

At a minimum, it suggests the Fed can be patient as it hopes to start lowering rates later this year. It could also bolster the idea that today’s interest rates may not be as restrictive as they would otherwise appear.

The graphic below illustrates that progress has stalled. But it also shows that the rate of price hikes has gradually risen since the middle of 2023.

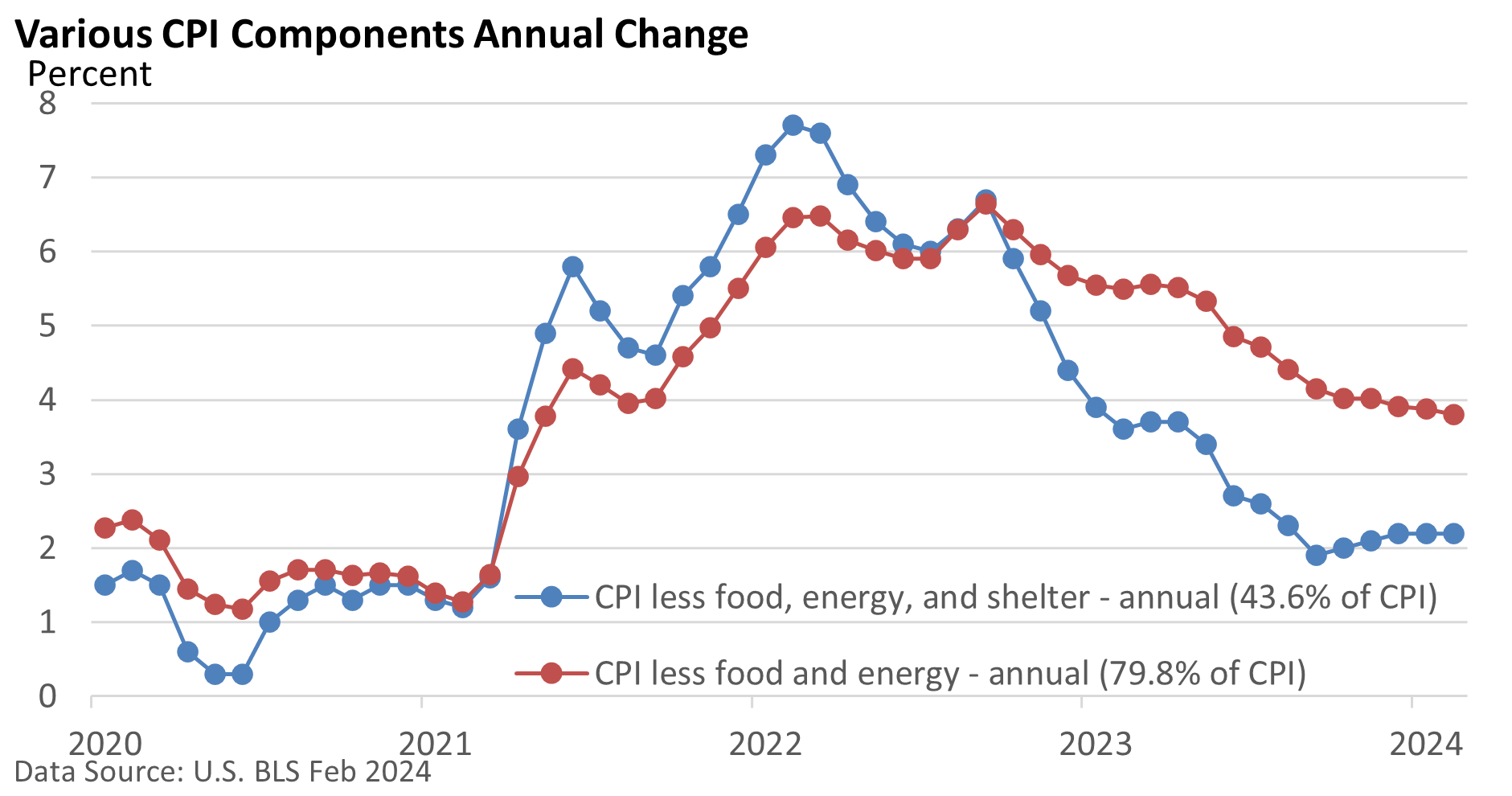

Others argue that the CPI’s shelter component does not correctly capture what’s happening to rent. They contend the shelter component is currently overstating costs. If shelter is removed from core inflation, prices are much more stable, rising at 2.2% annually over the last three months.

The bottom line is that investors are eyeing interest rates. If inflation remains elevated, any near-term reduction in rates is less likely.