by Mark Chandik | Feb 12, 2024

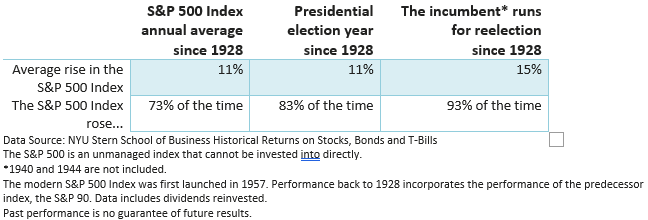

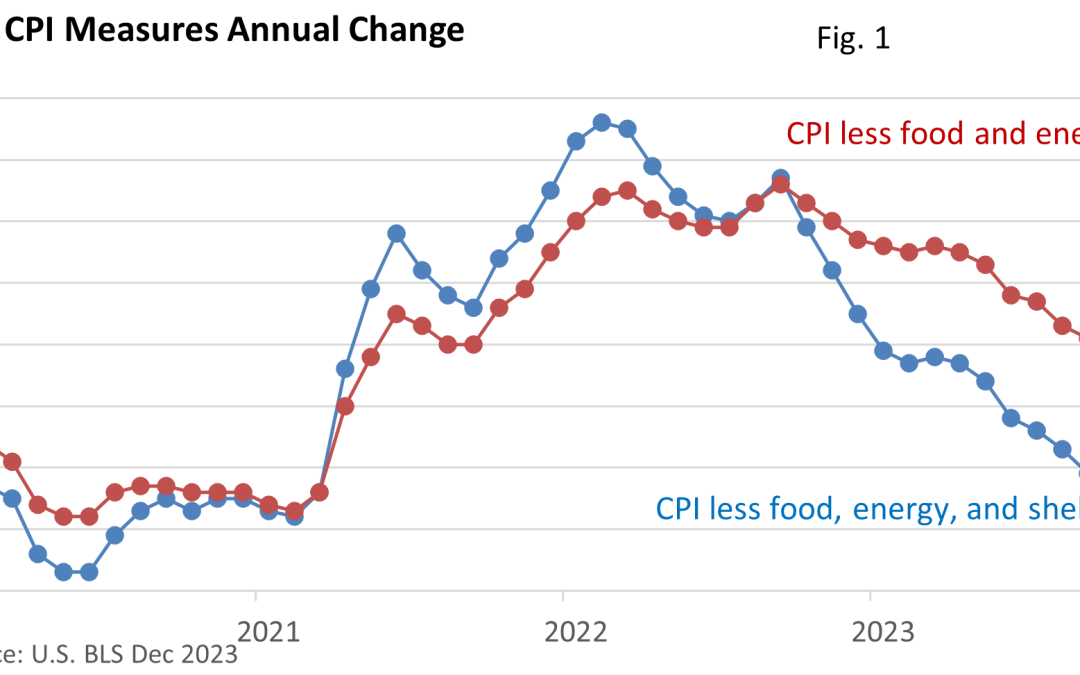

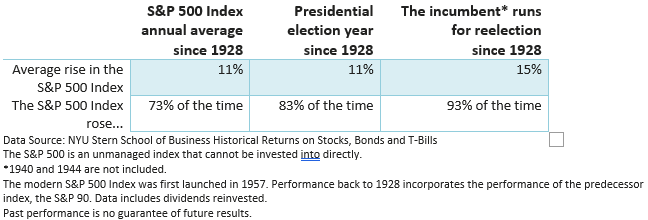

Weekly Market Commentary Last week, we examined the relationship between interest rates and stocks. This week, we will analyze market performance during presidential election years. So, what might we expect based on historical returns during a presidential election...

by Mark Chandik | Jan 22, 2024

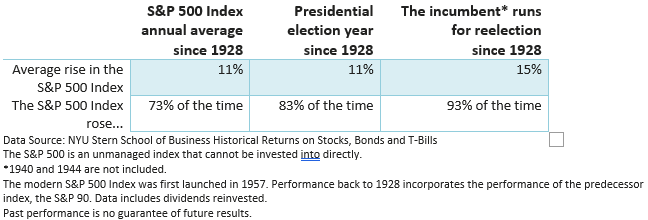

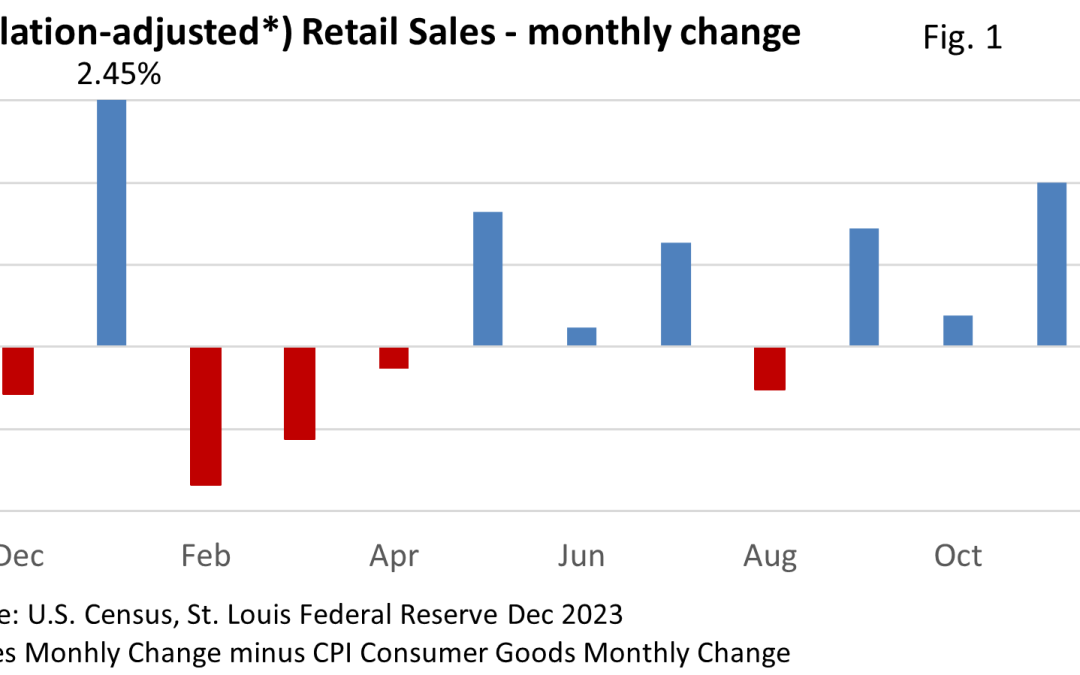

Weekly Market Commentary Economists have been warning for quite some time that Fed rate hikes will slow economic growth. Whether it results in a soft landing, which is the preferred outcome for investors, or a hard landing (recession), the rate hikes would be expected...

by Mark Chandik | Jan 16, 2024

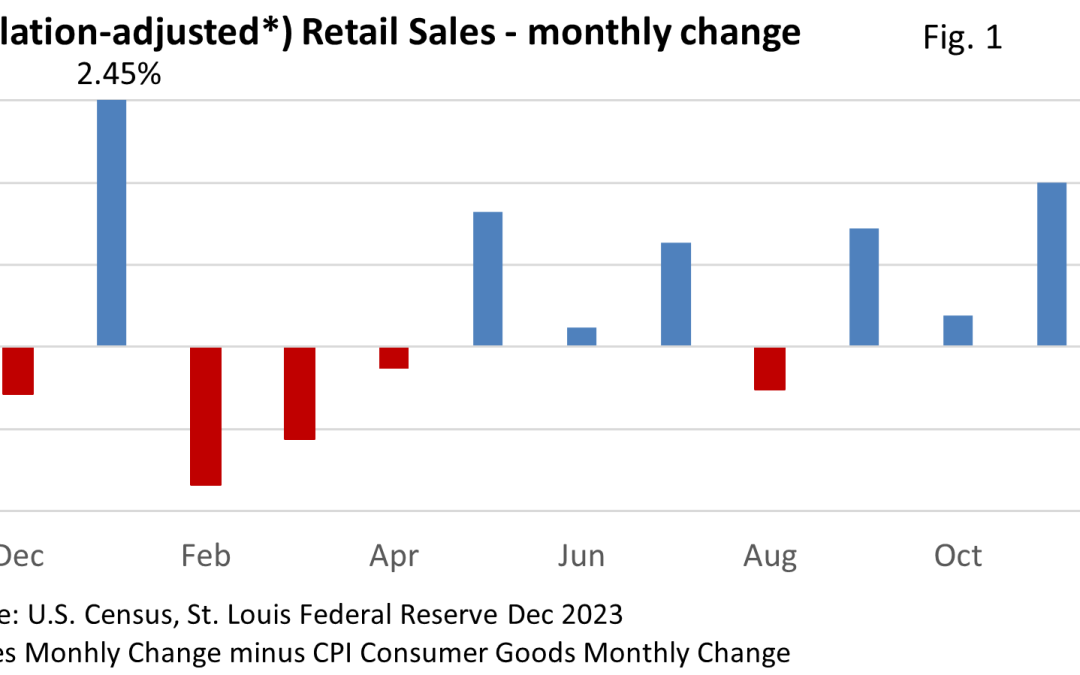

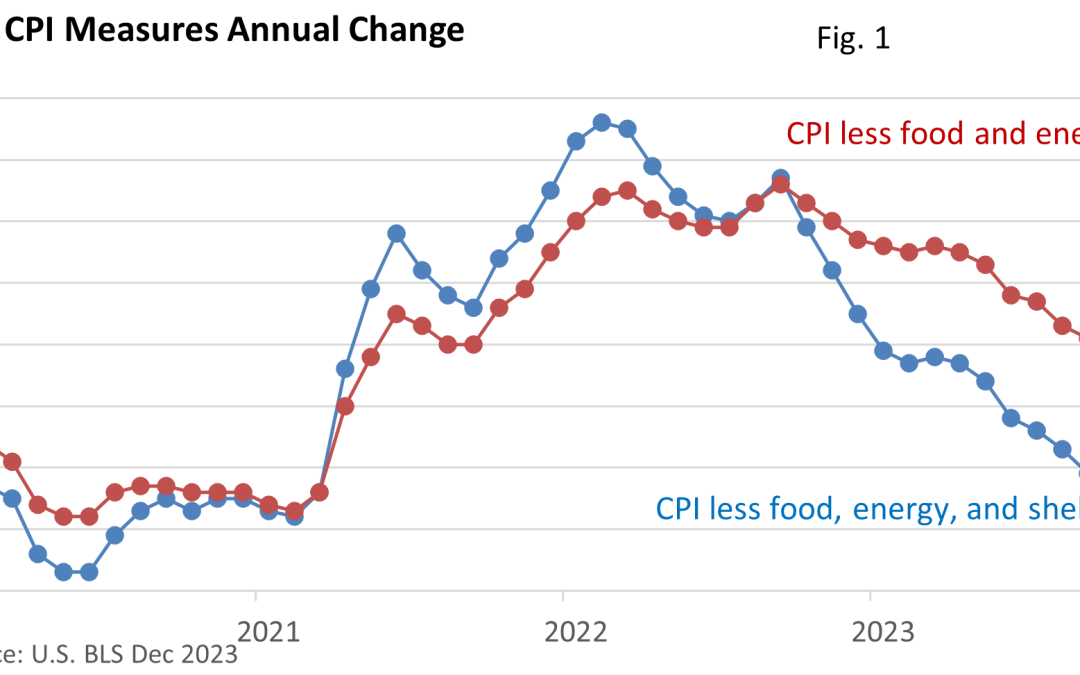

Weekly Market Commentary Investors eagerly anticipate the government’s monthly release of the CPI (Consumer Price Index). Why? Inflation affects everyone, and investors are no exception. The Federal Reserve’s efforts to curb inflation led to a bear market in 2022....

by Mark Chandik | Jan 8, 2024

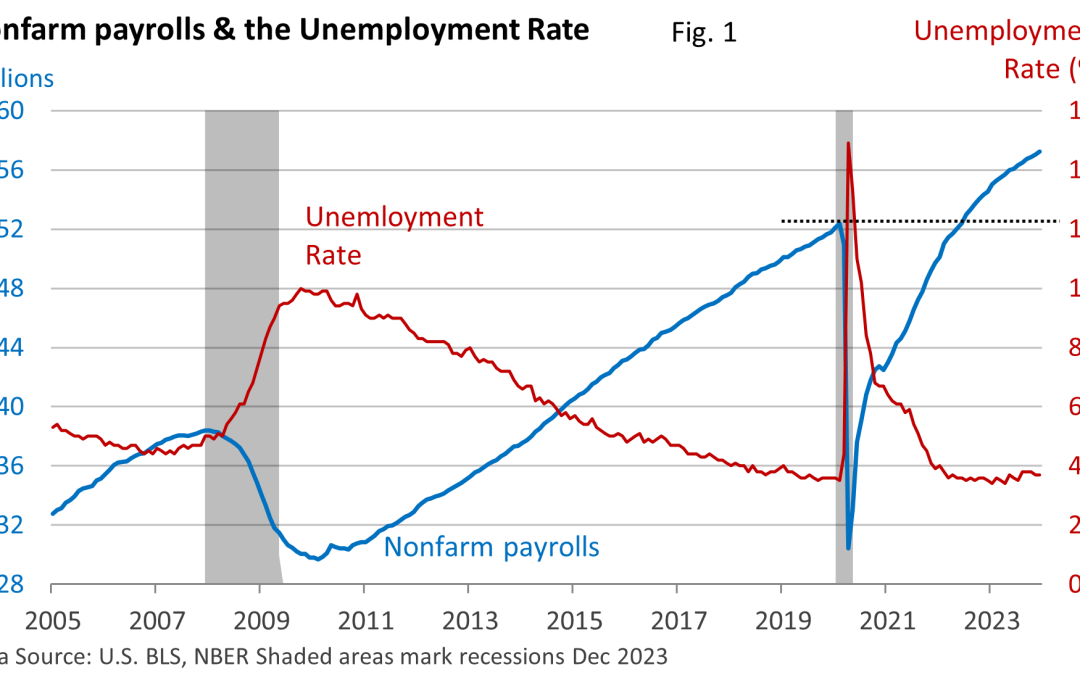

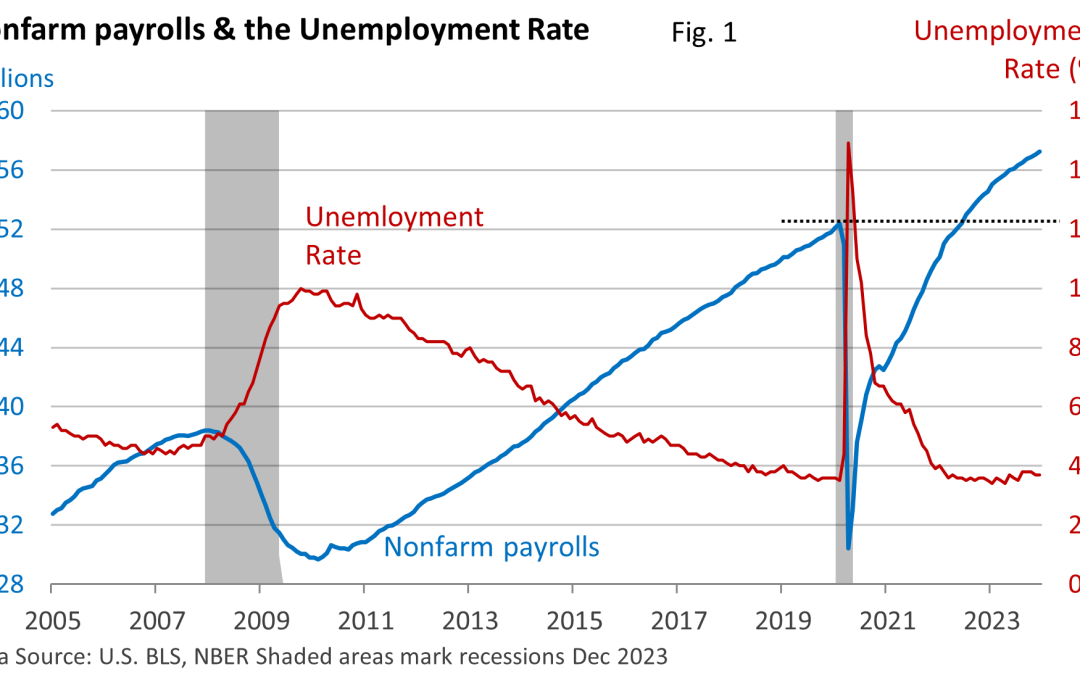

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls rose by 216,000 in December, while October and November were revised down by a total of 71,000. The unemployment rate held steady at 3.7% in December. The economy is...

by Mark Chandik | Jan 4, 2024

IRVINE, CA – [January 4, 2024] – A leading wealth advisory firm in Southern California, FDP Wealth Management today declared its evolution into Prosperity Partners Private Wealth Management, effective January 1, 2024. This change signifies the company’s...