In late 2022, a new bull market emerged from the ashes of a nine-month bear market, leading to 2023’s impressive rise of over 26% for the closely followed S&P 500 Index, according to S&P Global (including dividends reinvested).

Cautious sentiment that characterized early 2024 did not hinder another impressive year, as the S&P 500 posted an advance of 23.31%, including 57 record closes (Wall Street Journal).

Reinvesting dividends, the S&P 500 rose 25%. As we saw in 2023, seven large-cap tech names, dubbed the Magnificent 7, accounted for more than half of the S&P 500’s advance, according to Dow Jones Market Data and Barron’s.

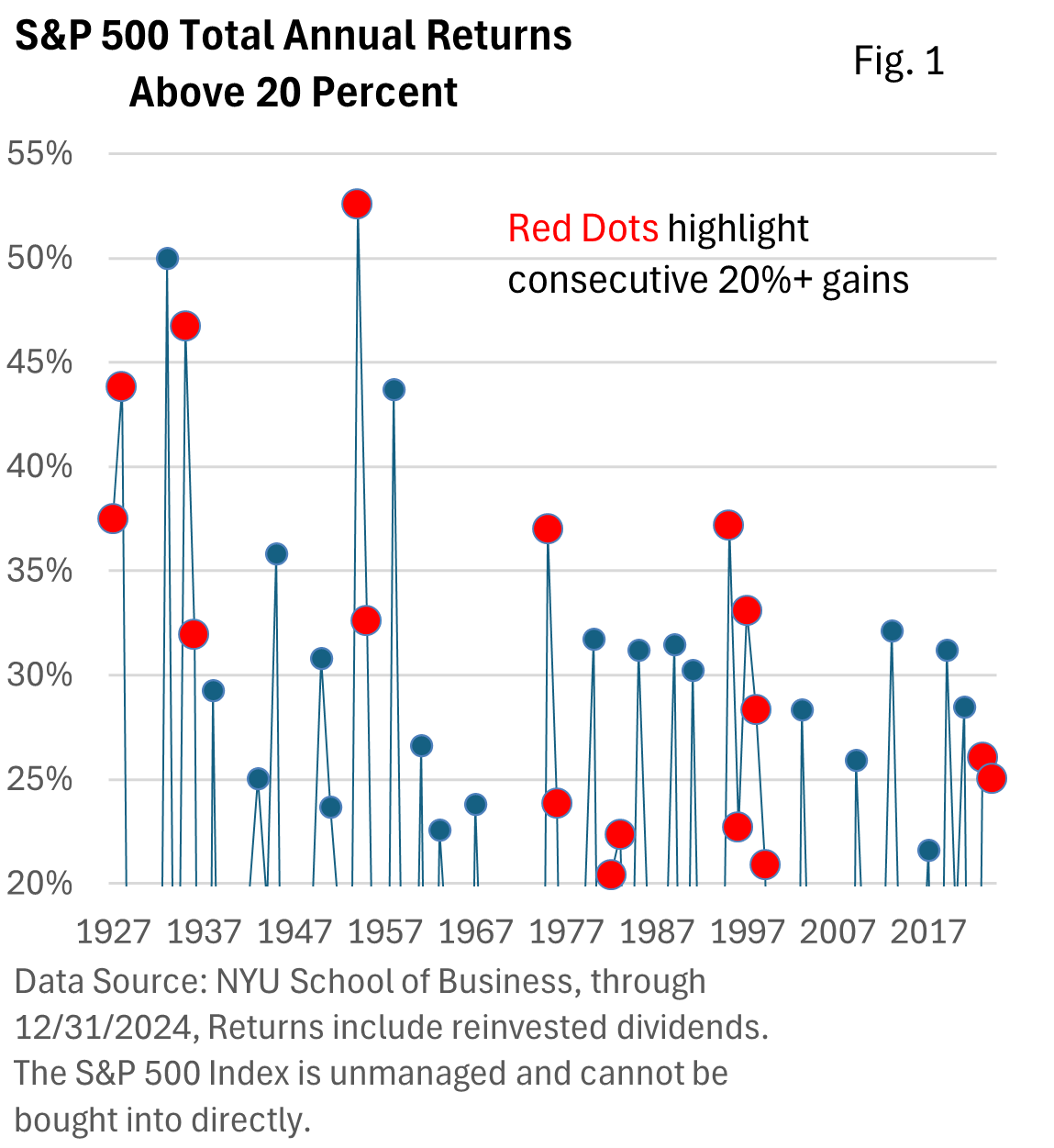

Since 1926, the S&P 500 has managed back-to-back annual gains above 20% only seven times, including 2023-2024 (Figure 1).

With the exception of five straight annual increases above 20% starting in 1995, the S&P 500 has never achieved three consecutive year-over-year gains greater than 20% (dating to 1926: up 11%).

The best and brightest didn’t foresee a blockbuster 2024, according to the 2024 CNBC Market Strategists survey.

In hindsight, it’s not difficult to Monday-morning quarterback the year.

The S&P 500 Index finished 2024 at 5,882. The average forecast among 13 well-respected analysts was 4,880, which, if realized, would have amounted to a rise of just 2.3%.

Instead, analysts played catchup as they revised forecasts higher during the year.

For 2023, analysts had expected a minor decline, according to CNBC.

Instead, the market roared. For 2022, the average forecast called for a gain of 5% for the S&P 500 (CNBC survey). Yet, the index lost nearly 20%.

As we’ve demonstrated, forecasts don’t always pan out. Still, market strategists bring unique observations to our attention. We are better informed thanks to their due diligence and insights.

Before we glimpse into 2025, let’s review the key themes that fueled last year’s advance.

1-The Federal Reserve reduced interest rates. While 2022 was a notable exception, rate hikes usually don’t kill bull markets, as we saw during the 2004 – 2006 and 2015 – 2018 rate hike cycles.

Conversely, easing cycles by the Fed don’t always fuel bull markets, including 2001 and 2008.

However, when rate cuts are accompanied by economic growth, they can create significant market tailwinds, as was experienced last year.

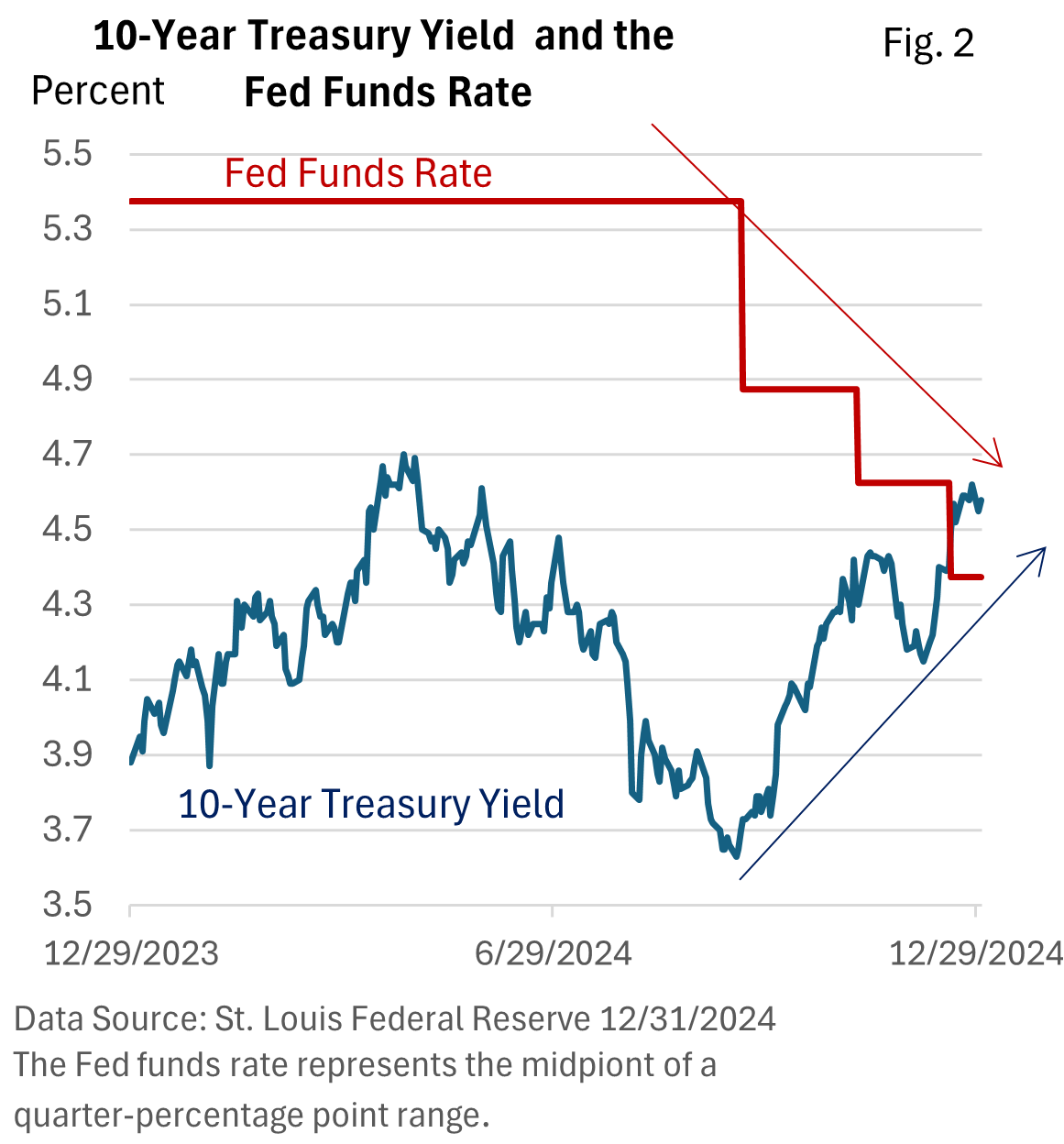

Through much of 2024, the Fed signaled plans to reduce rates, and the Fed didn’t disappoint, as it implemented three rate cuts in the second half of 2024, totaling a full percentage point.

2-Next, while the rate of inflation remains elevated, it has slowed, which encouraged the Fed to take its foot off the monetary brakes.

3-Moreover, economic growth has remained robust. While U.S. Gross Domestic Product (GDP), the broadest measure of economic activity, temporarily slowed to an annual pace of 1.6% in the first quarter (U.S. BEA), it accelerated to 3.0% in Q2 and 3.1% in Q3.

GDP has been 3% or higher over four of the last five quarters, averaging 2.7% since Q3 2023.

The economic soft landing that many had predicted was a no-show. Instead, let’s call it the ‘no-landing’ economy.

4-And that leads us to S&P 500 corporate profits, which have topped 10% annual growth over two of the last four quarters (through Q3 2024, LSEG).

A peek ahead

As we look ahead to 2025, the outlook remains positive. Before examining potential market risks, let’s first identify possible market catalysts.

These include economic growth, profit growth, a Fed that’s still eyeing rate cuts, deregulation, which aids both the economy and profits, a possible pick up in mergers and acquisitions, potential for lower corporate taxes, rising corporate stock buybacks, and US exceptionalism.

That totals eight potential catalysts that could underpin and support stocks in 2025.

Ultimately, much will likely depend on what happens to the economy.

The average forecast among 15 analysts places the S&P 500 for year-end 2025 at 6,643 per the CNBC 2025 survey.

That’s about a 13% advance from the 2024 year-end closing price of 5,882.

But strategists grapple with human behavior and the unknown. As noted above, forecasts don’t always pan out.

Although a bullish case can be advanced for 2025, too much optimism doesn’t leave much room for disappointment.

Stocks are richly valued. When markets are priced for perfection, minor disappointments can lead to volatility.

Let’s review some of the risks.

1-A rebound in inflation forces the Fed to raise interest rates. But here’s where it gets tricky.

2-If we turn the coin over, a more cautious Fed misjudges the economy, and the economic outlook deteriorates.

Although the odds of a recession are low, economic forecasting is an inexact science.

3-There has been no shortage of optimism that the incoming Trump administration will usher in business-friendly policies.

But his pledge to enact sweeping tariffs could raise prices and slow economic growth.

In 2018, he selectively imposed tariffs, which generated market volatility and uncertainty.

4-Despite multiple Fed rate cuts, longer-term bond yields turned significantly higher over the last three months amid slower progress on inflation, upbeat economic growth, and a stubbornly high federal deficit.

A continued rise in yields risks stiffer headwinds for stocks.

As we wrap up the year, let’s make one final observation.

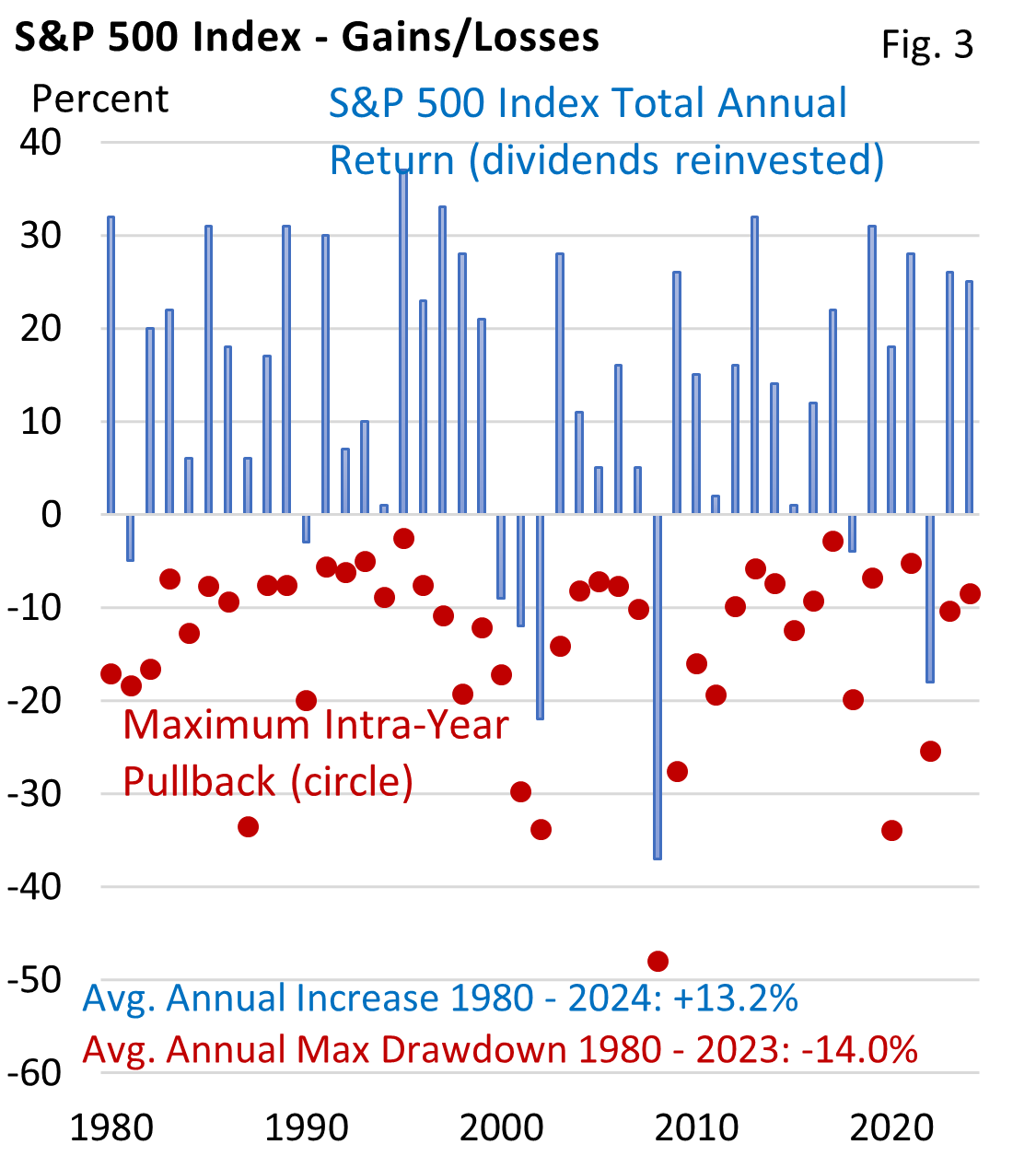

Figure 3 is an excellent reminder that stocks have a favorable long-term track record, but the ride higher has not been without bumps, pullbacks, and bear markets.

The average annual rise since 1980 for the S&P 500 Index was 13.2% (Figure 3).

Yet, during the year, the average maximum pullback was 14.0%.

Since 1980, the S&P 500 Index finished higher 82% of the time.

When the index ended the year in positive territory, the average gain was almost 19%. When the index finished lower, the average loss was nearly 14%.

While we cannot predict with certainty what 2025 will bring, early indications are cautiously optimistic, and the historical performance of stocks has been impressive.

As we bid farewell to 2024, may the New Year bring you prosperity, excitement, adventure, and fulfillment. May 2025 create cherished memories and be filled with joy. Happy New Year!