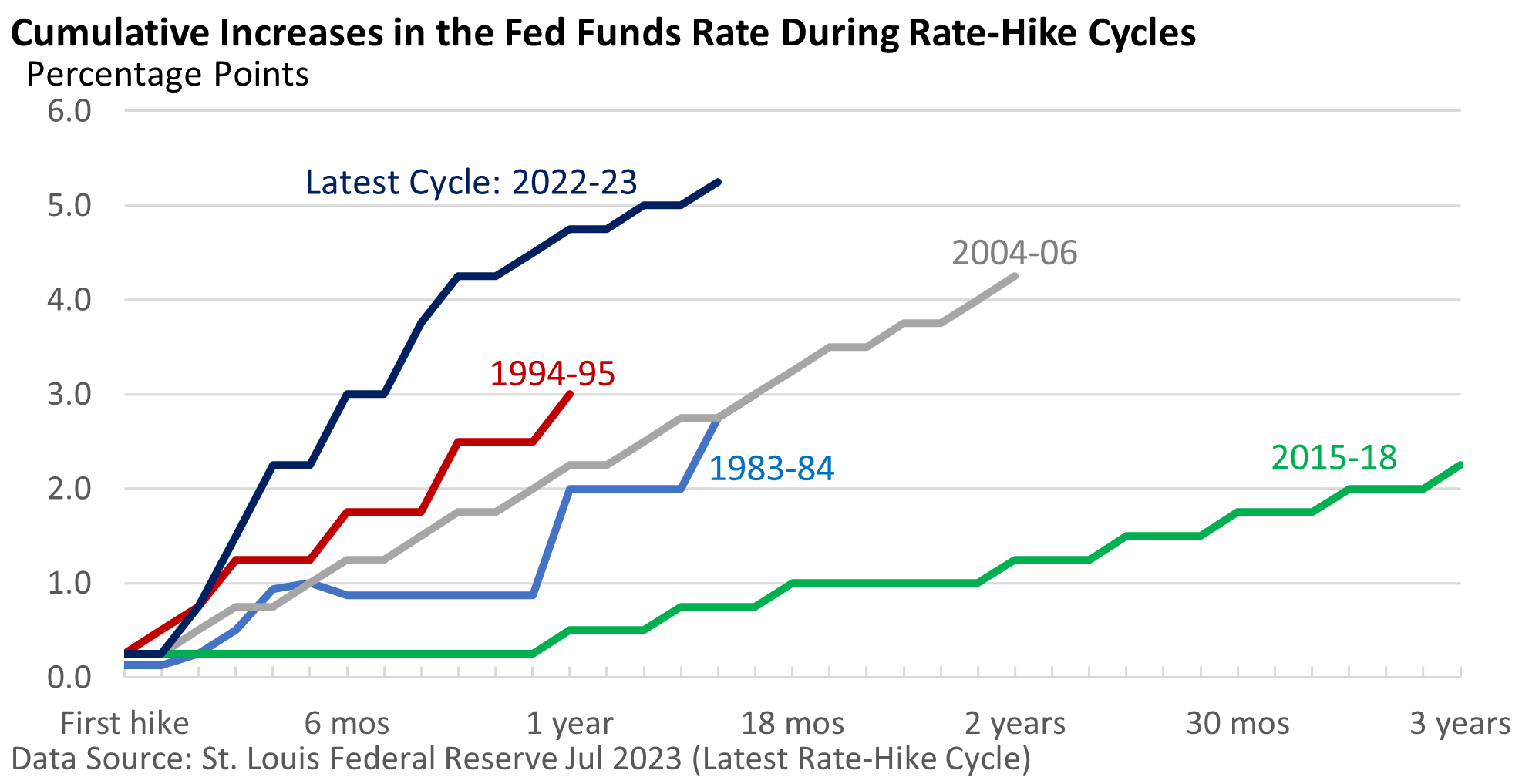

On Wednesday, the Federal Reserve announced a 50-basis point (bp, 1 bp = 0.01%) rate cut for the fed funds rate to 4.75 – 5.00%, its first reduction since 2020. The announcement marks the end of the most aggressive rate-hike cycle since 1980 when the Fed funds rate rose a whopping 11 percentage points (1,100 bps) in just 6 months.

Outside the 1980 experience and 2022-23, 1994-95 has been the fastest, and 2004-06 has been the steepest.

Why did the Fed decide to go big and opt for 50 bps rather than a more modest 25? The decision is aimed at reducing borrowing costs, which supports economic activity. Yet, Fed Chief Powell pointed out during his press conference that the “economy is in good shape.” So, does it need 50?

Well, he used the term “risk management,” which implies the larger rate cut is a pre-emptive move. It’s insurance against an economic slowdown.

“The economy is in a good place, and our decision today is designed to keep it there,” he said.

But he pointed out that the last two employment reports were lackluster, and a recent report highlighted a sharp downward revision of about 800,000 to payroll growth over the last year. He also strongly implied that more rate cuts are in the pipeline.

“So, we’re not waiting for (rising layoffs), because there is thinking that the time to support the labor market is when it’s strong, and not when we begin to see… layoffs.”

Theory (or jumping into the weeds)

Monetary policy works with a lag. In other words, changes in rates today might not materially affect the economy for an estimated nine to eighteen months. It’s a wide range because each economic cycle is different, and economists can’t directly measure the precise impact of rate changes.

Put another way, the policymakers at the Fed are estimating (some would say ‘guestimating’) what economic conditions will look like a year from now.

Get it right and inflation continues to ease, and the economy creates jobs. Reduce rates too slowly, and recession risks may rise. Cut too quickly, and there’s a risk inflation could pick up. While economic variables are in doubt, we control what we can control: the investment portfolio.

We can’t guarantee there won’t be any volatility, but the investment plan helps reduce risk and gives you the best chance of reaching your financial goals.

A year from now, 25 or 50 bps won’t really matter. But the initial market reaction was favorable. Investors pushed the Dow and S&P 500 Index to new highs on Thursday (MarketWatch), taking Powell at his word that the economic soft landing is still in play.