by Mark Chandik | Dec 11, 2023

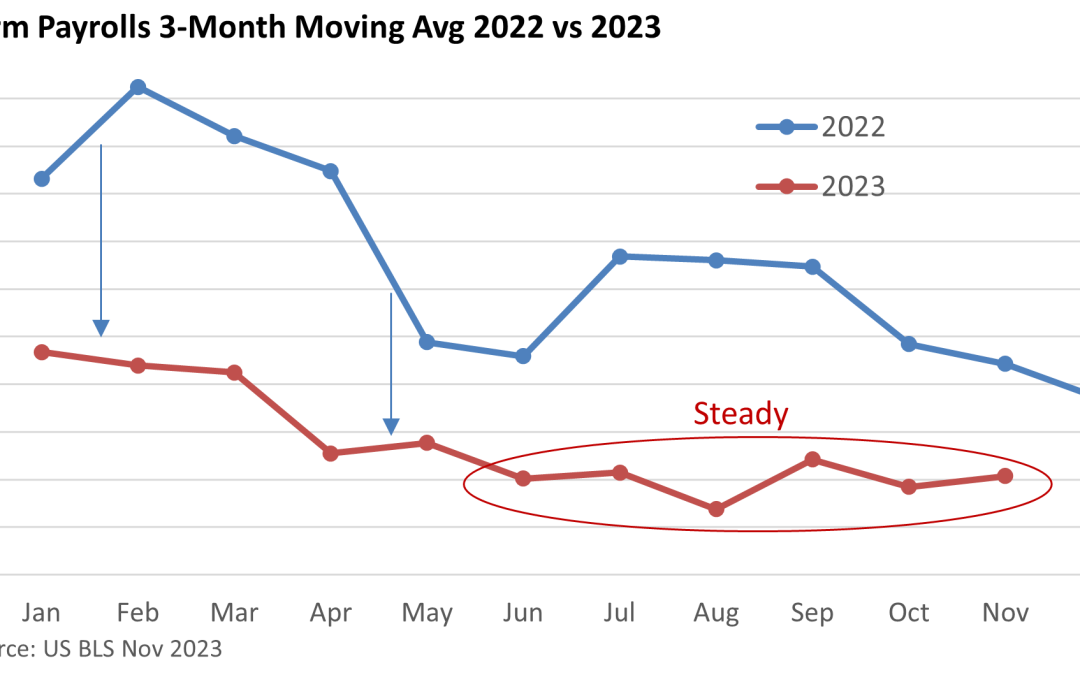

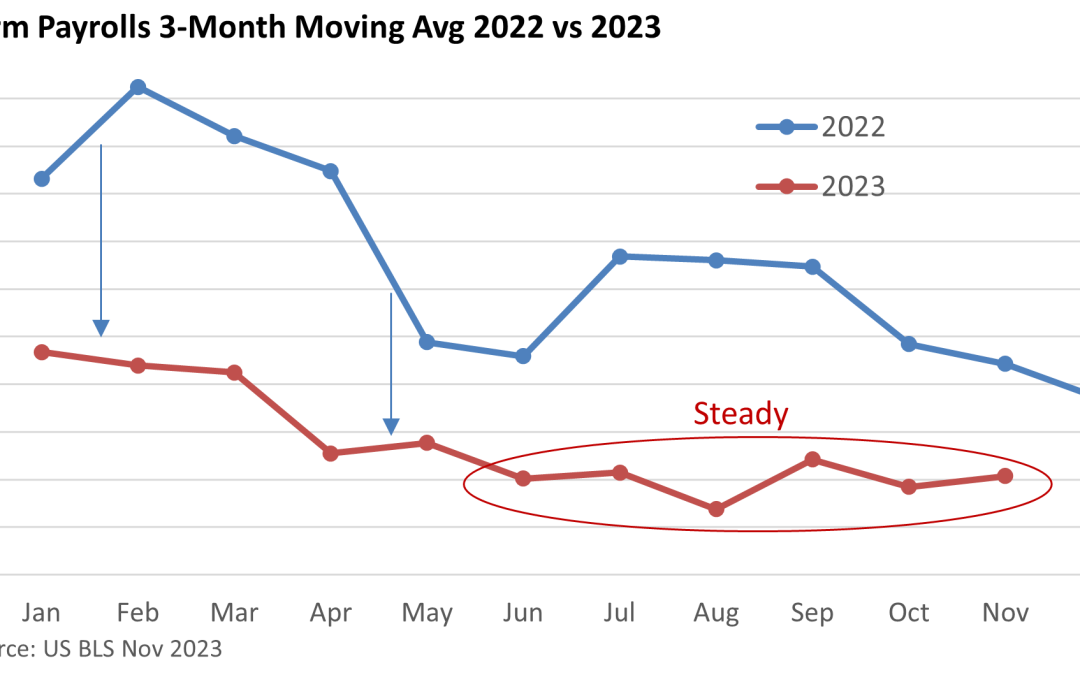

Weekly Market Commentary The latest jobs report did little to alter the economic outlook. Instead, it was a steady-as-she-goes report. Nonfarm payrolls grew by 199,000 in November, according to the U.S. Bureau of Labor Statistics (BLS). It was nearly in line with the...

by Mark Chandik | Dec 4, 2023

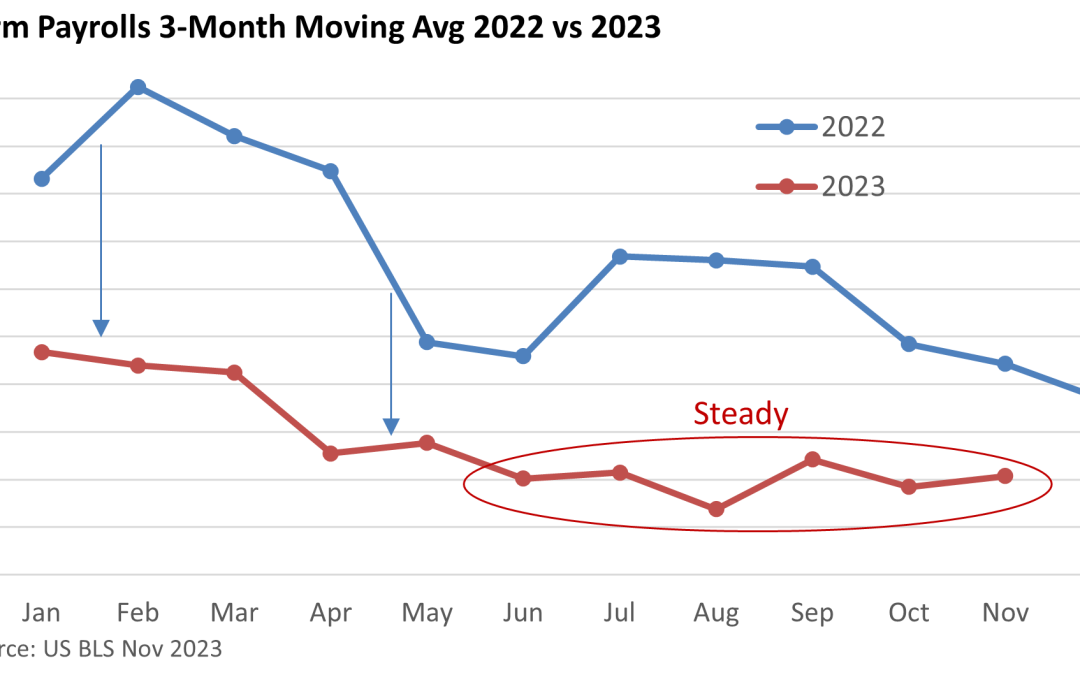

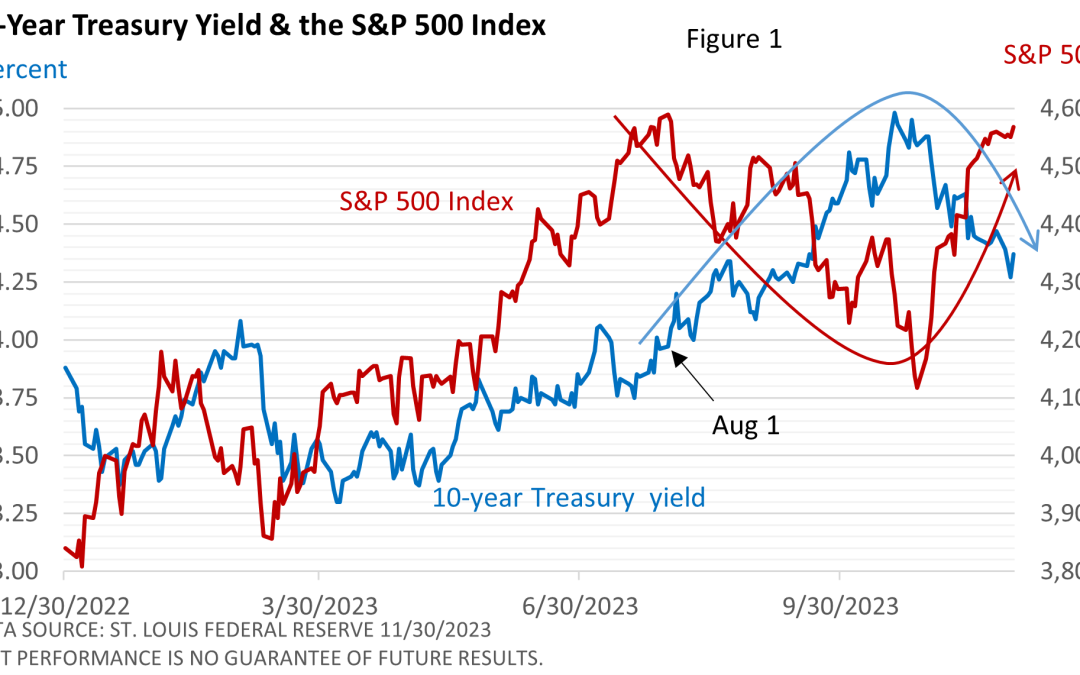

Weekly Market Commentary Many things influence the direction of stocks. Corporate profits, economic growth, general market sentiment, inflation, and interest rates are among those variables. At any given point, the influence of various factors on stocks will...

by Mark Chandik | Nov 20, 2023

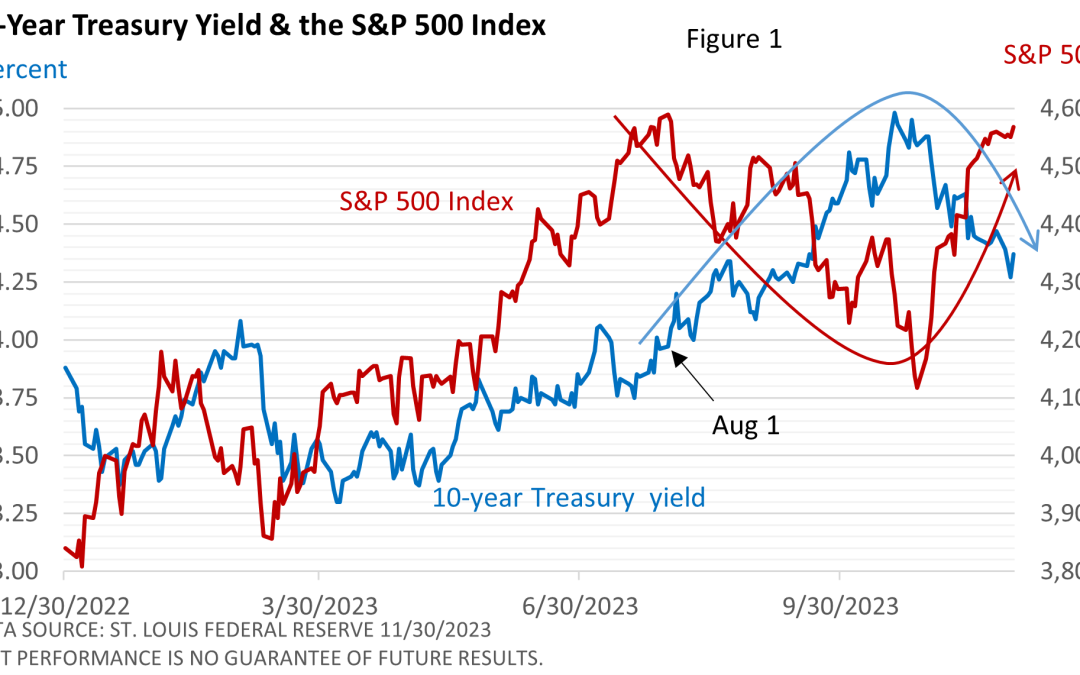

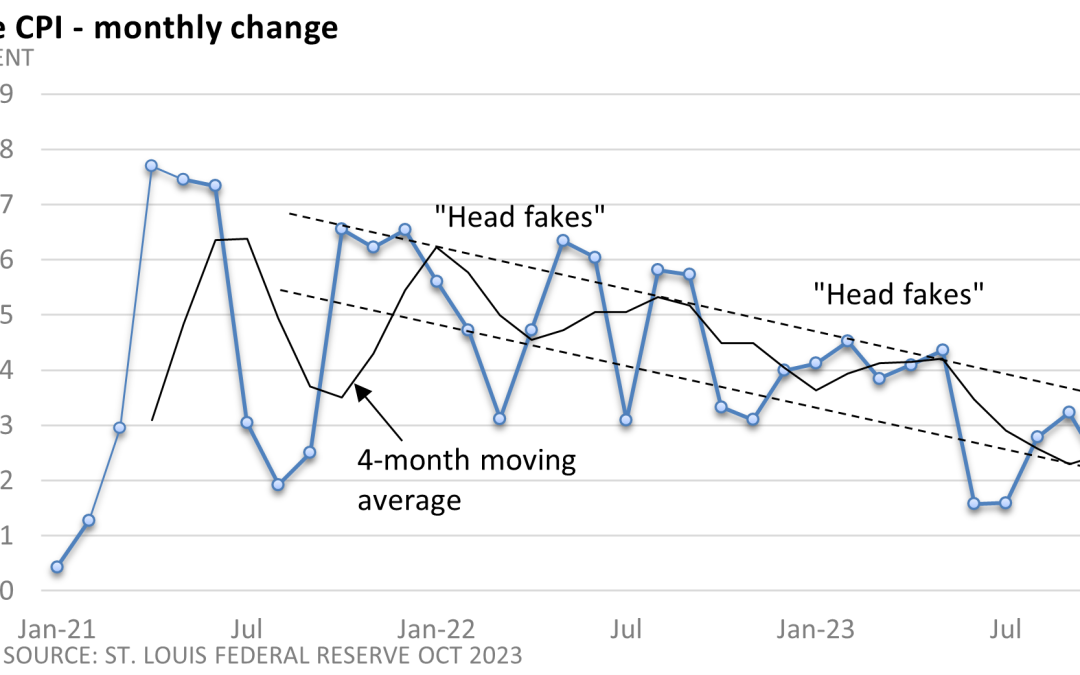

Weekly Market Commentary The U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was unchanged in October from the prior month. It is up 3.2% from a year ago. Excluding volatile food and energy prices, the core CPI rose 0.2%. The core...

by Mark Chandik | Nov 13, 2023

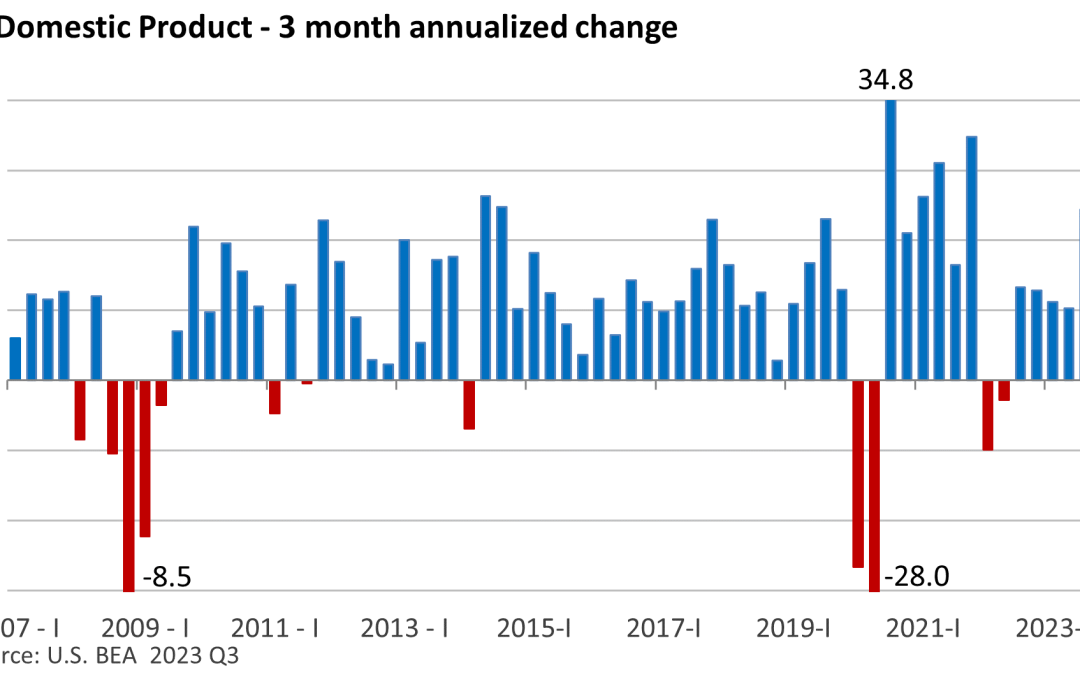

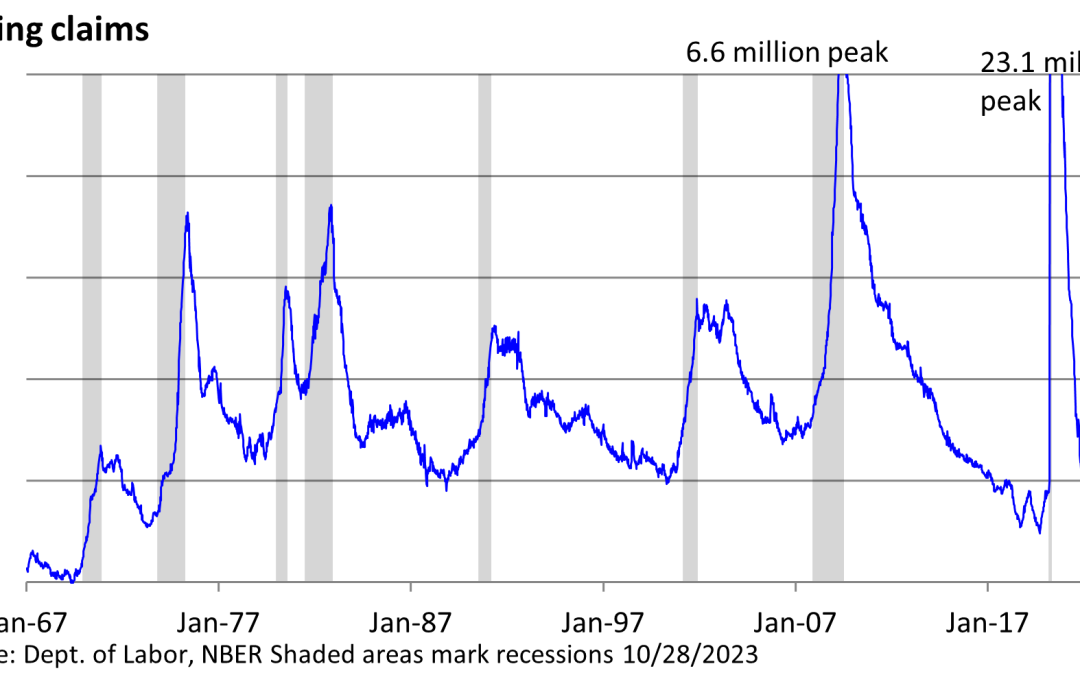

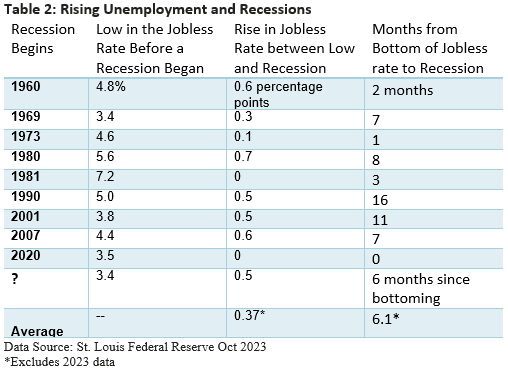

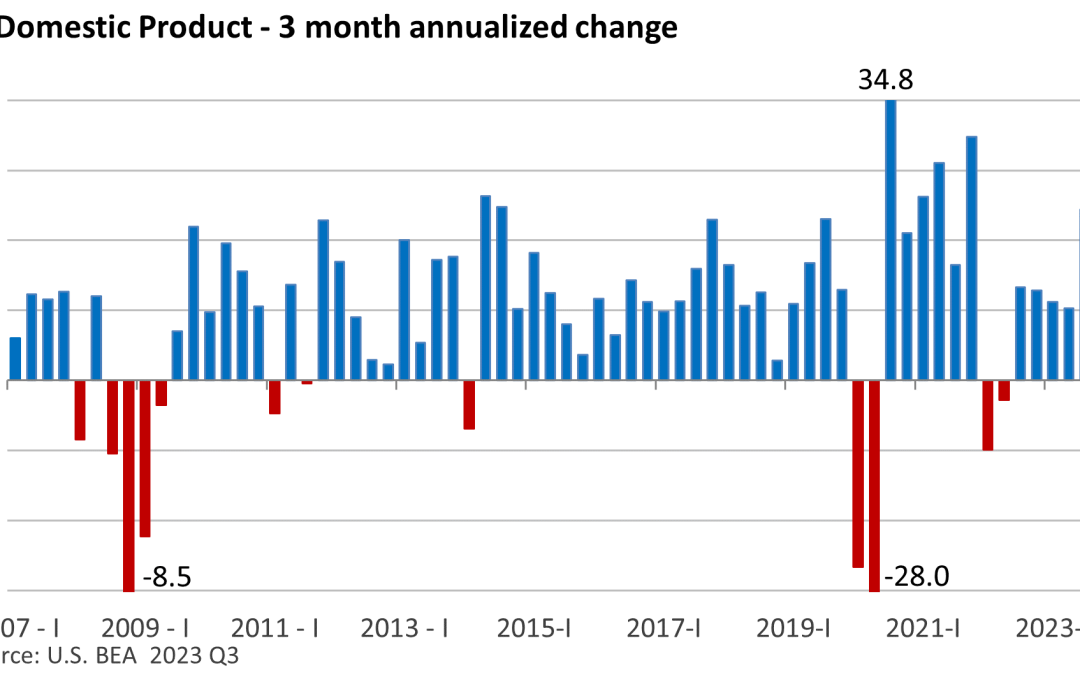

Weekly Market Commentary U.S. economic growth in the third quarter accelerated sharply, growing at an annual pace of 4.9%, according to last month’s report by the U.S. Bureau of Economic Analysis. But GDP (Gross Domestic Product) data are backward-looking. It’s a...

by Mark Chandik | Nov 8, 2023

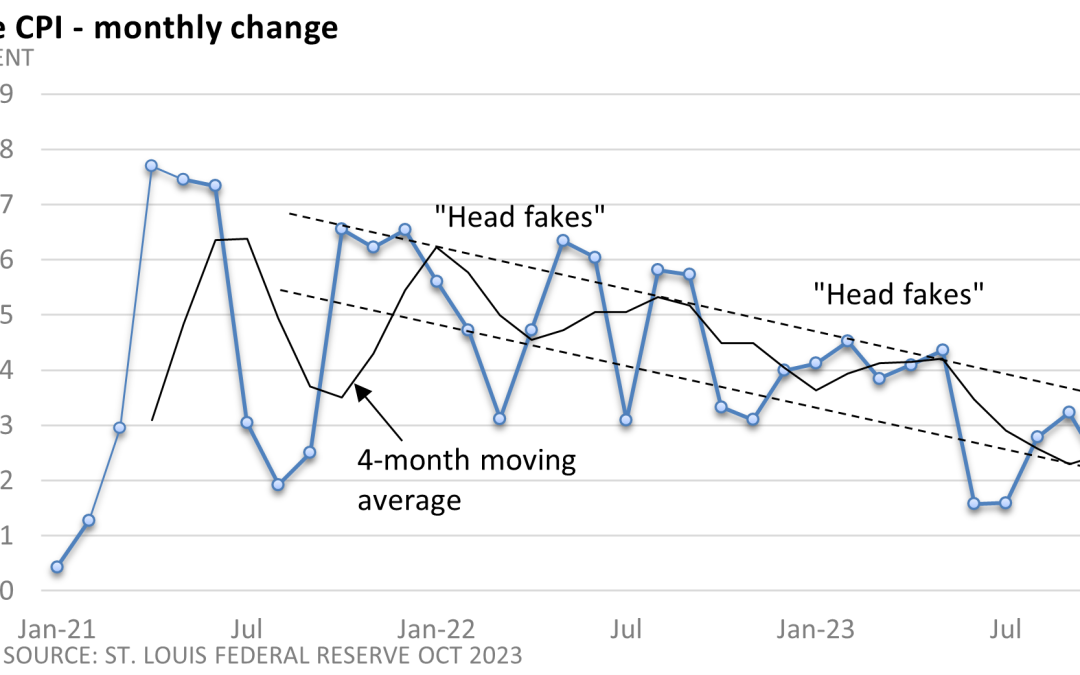

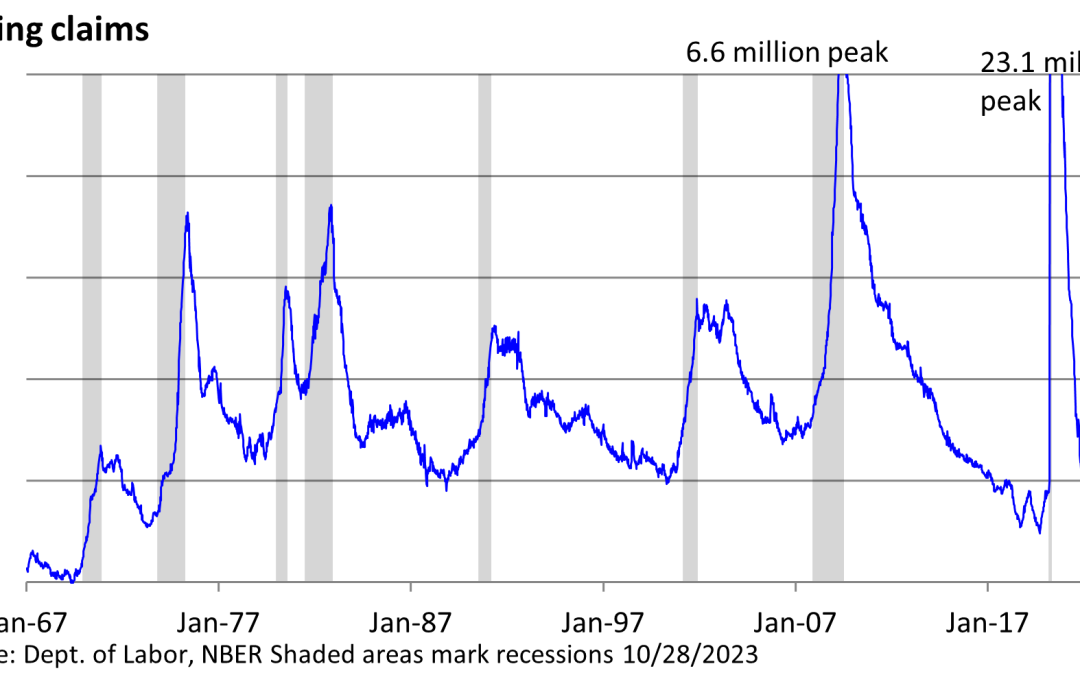

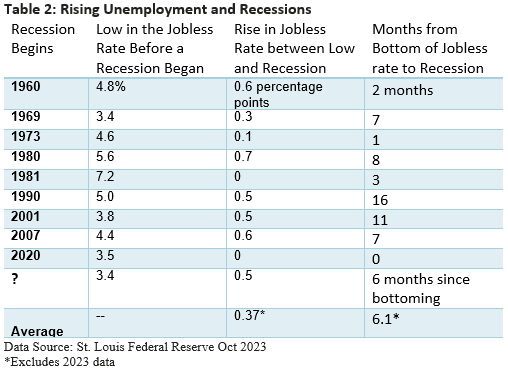

Weekly Market Commentary So far this year, forecasts for a recession or a soft landing have failed to materialize. What is a soft landing? Economic growth slows, the rate of inflation slows, but the economy stays out of a recession. In other words, the economy is not...

by Mark Chandik | Oct 30, 2023

Weekly Market Commentary The U.S. Bureau of Economic Analysis (BEA) reported last week that Gross Domestic Product (GDP), which is the largest measure of goods and services for the economy, expanded at an annual pace of 4.9% in the third quarter. It’s the...