by Mark Chandik | May 19, 2025

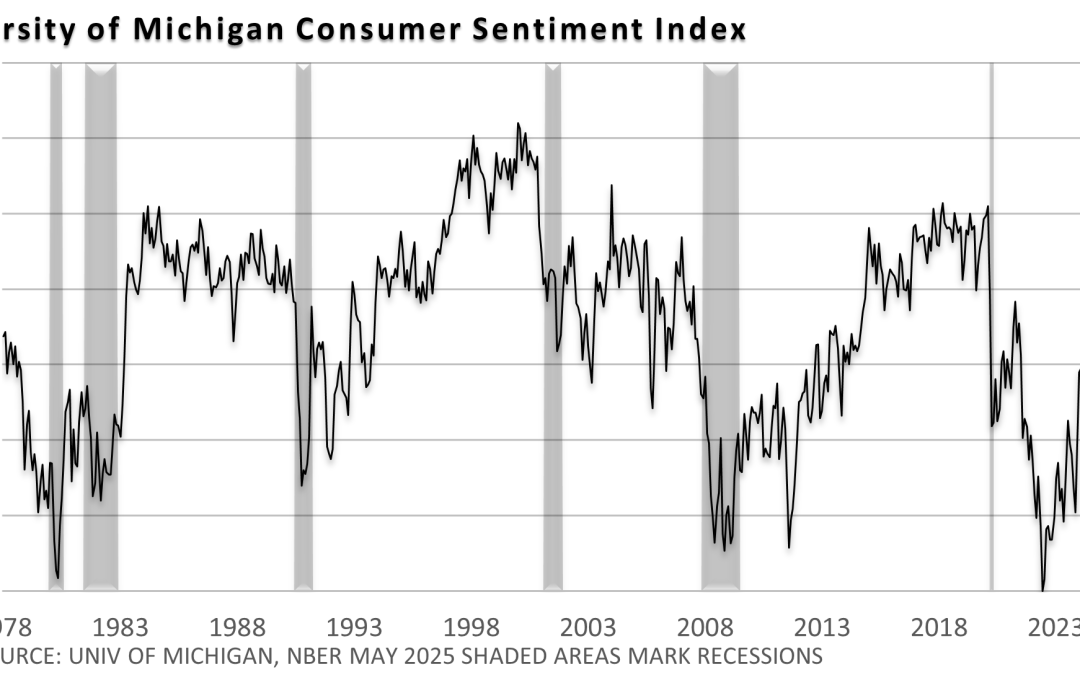

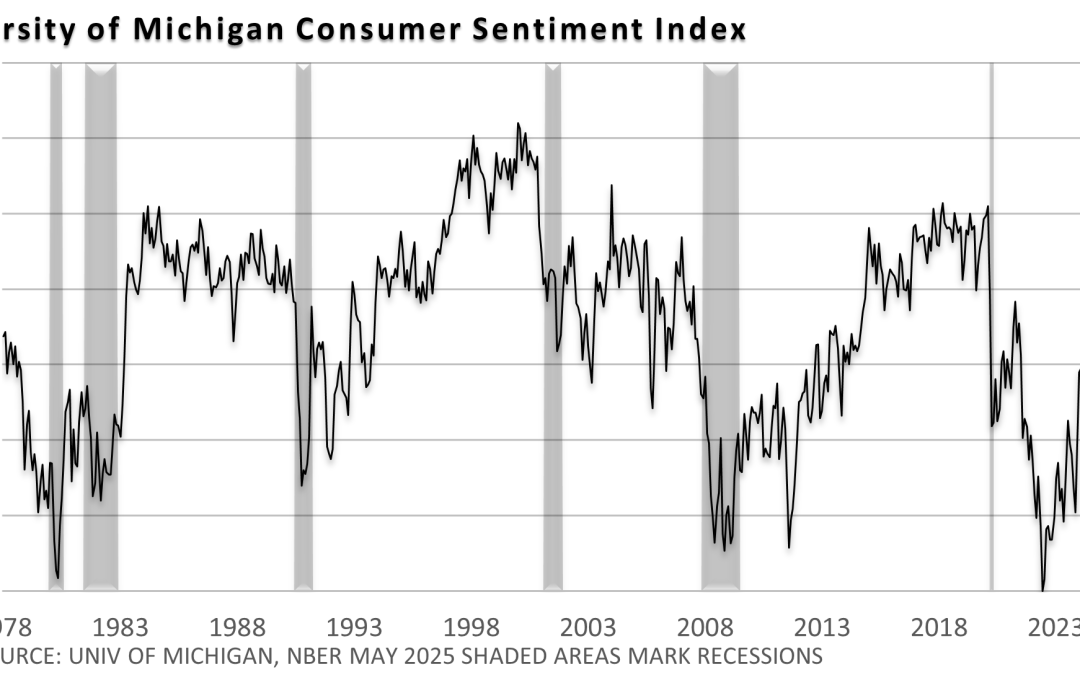

On Friday, the University of Michigan reported that the Consumer Sentiment Index for the U.S. fell to the second-lowest reading on record, with the mid-May level falling to 50.8 from April’s 52.2. “Tariffs were spontaneously mentioned by nearly three-quarters of...

by Mark Chandik | May 5, 2025

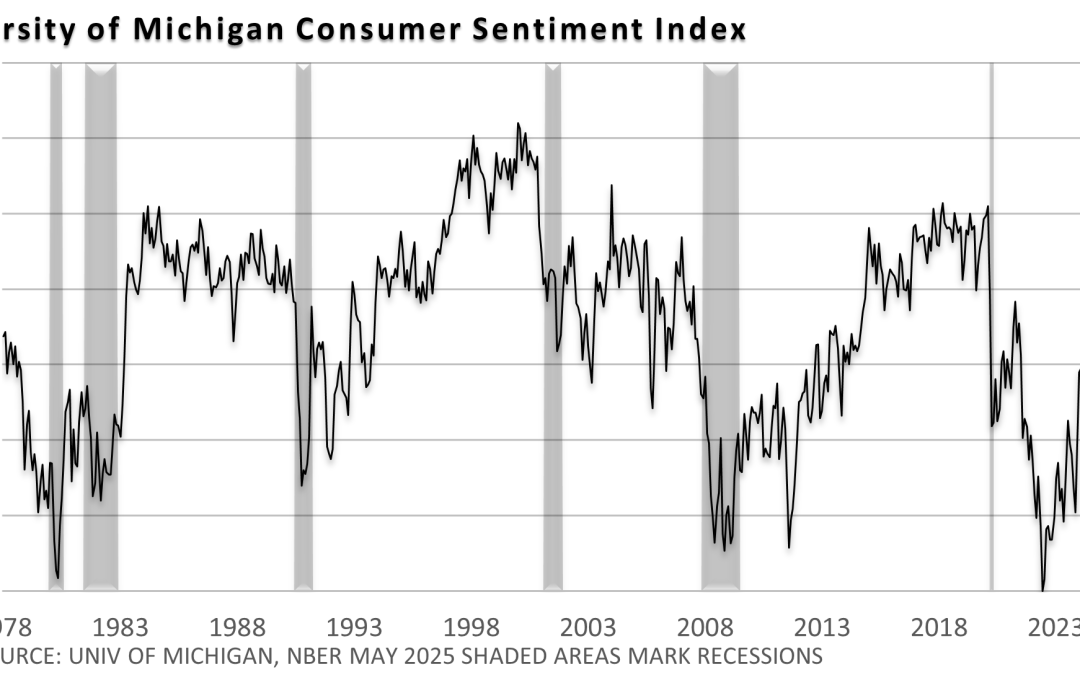

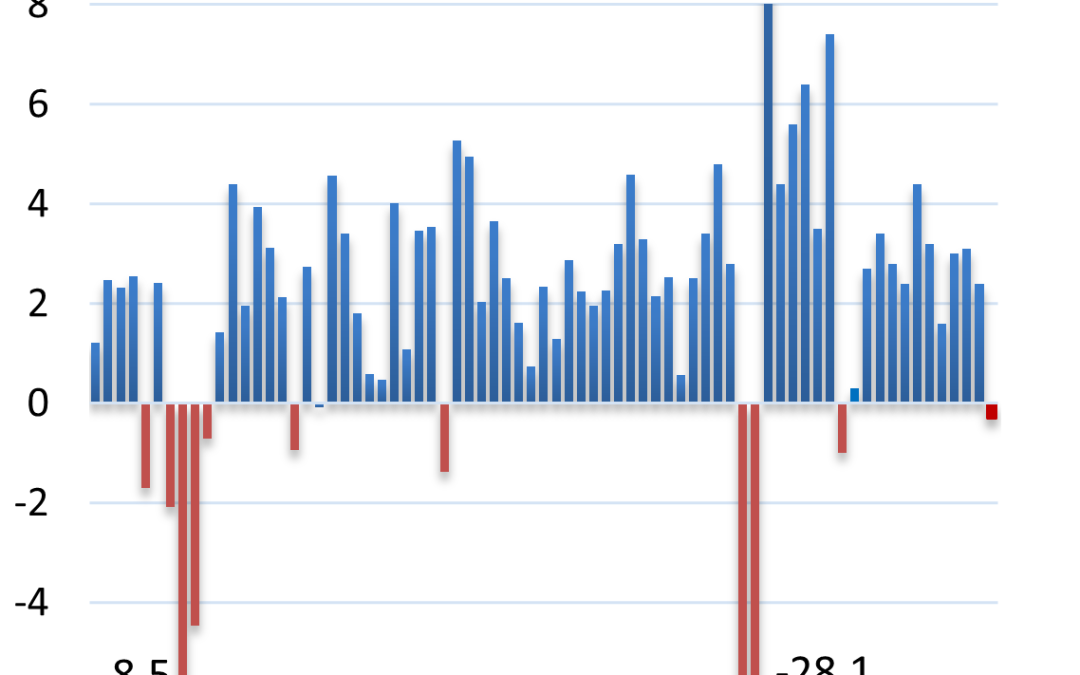

The U.S. Bureau of Economic Analysis (BEA) reported that first quarter Gross Domestic Product (GDP), which is the broadest measure of economic activity, fell at an annualized pace of 0.3%. Yet, a closer look reveals that the economy didn’t shrink in Q1. What happened?...

by Mark Chandik | Apr 28, 2025

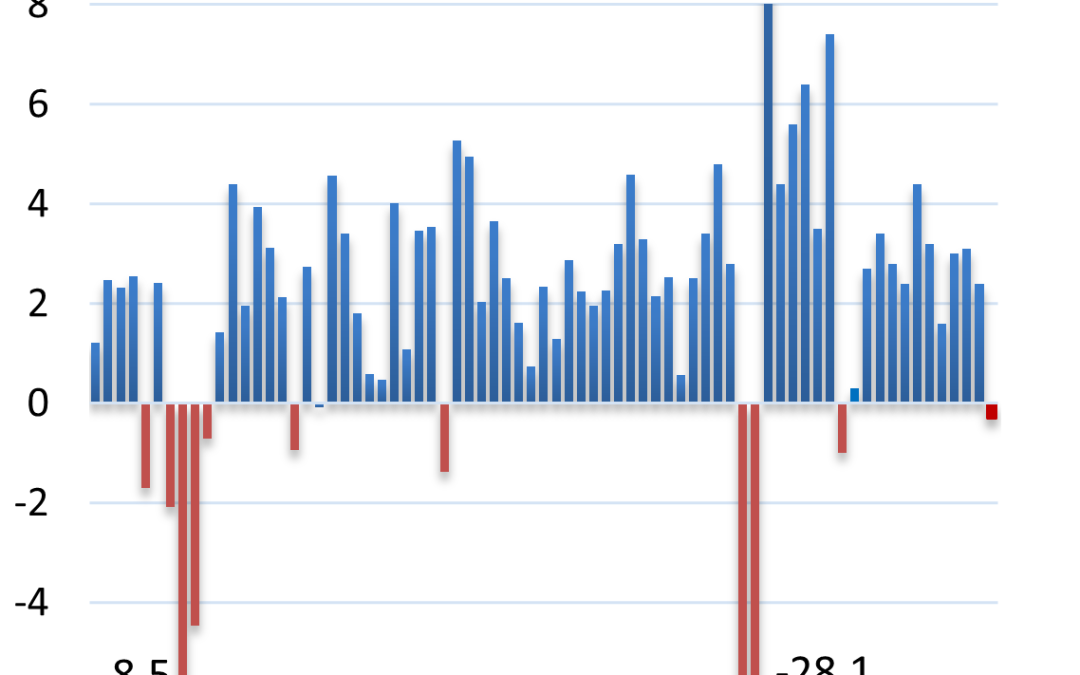

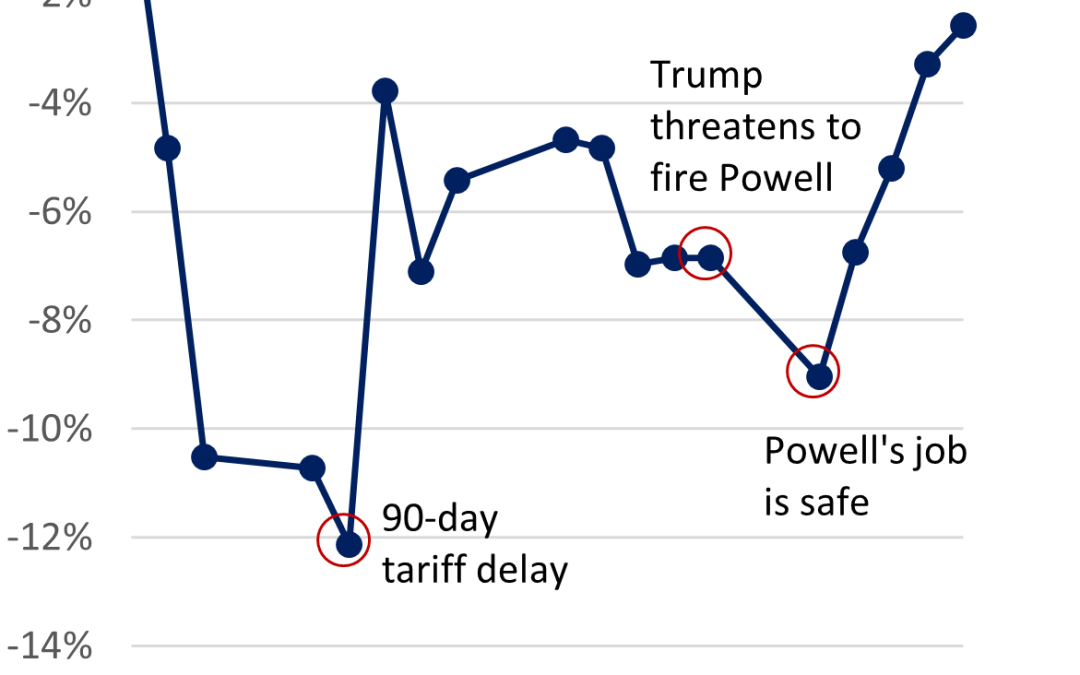

The graphic below chronicles trading in the S&P 500 Index following the late-day announcement on April 2, referred to as “Liberation Day” by the president, regarding reciprocal tariffs. What’s behind last week’s choppy action? Early in the week, investors...

by Mark Chandik | Apr 21, 2025

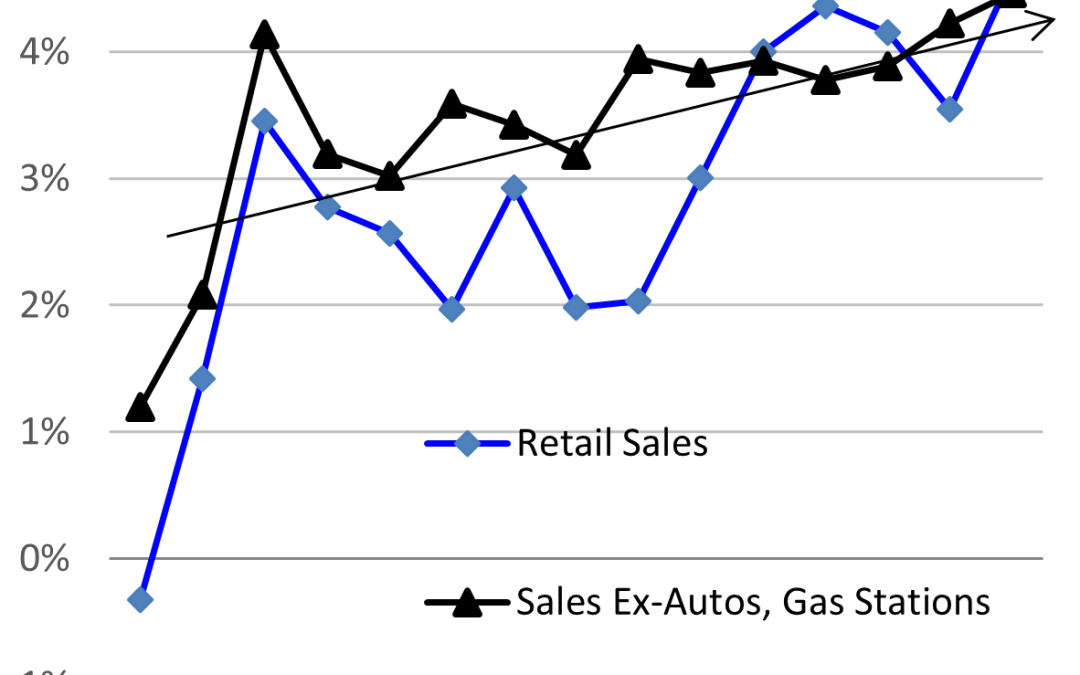

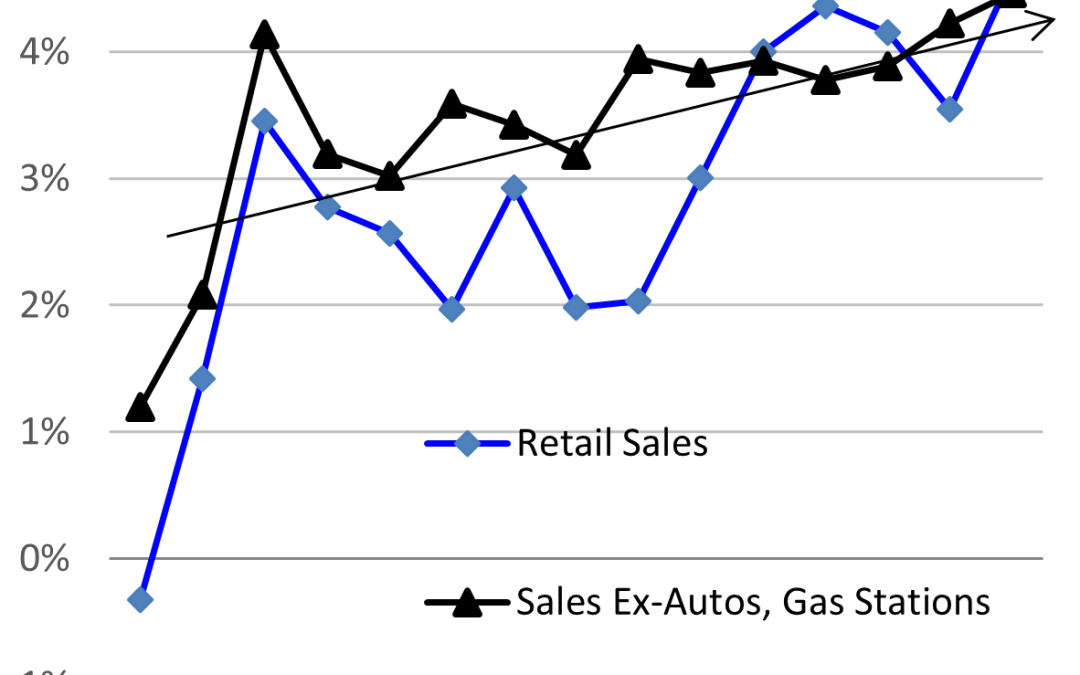

As we approached the early April selloff, much of the data suggested that economic activity was expanding. Let’s examine two important pieces of data. Led by a 5.3% surge in auto sales, retail sales rose a strong 1.4% in March. While some buyers were hoping to jump in...

by Mark Chandik | Apr 14, 2025

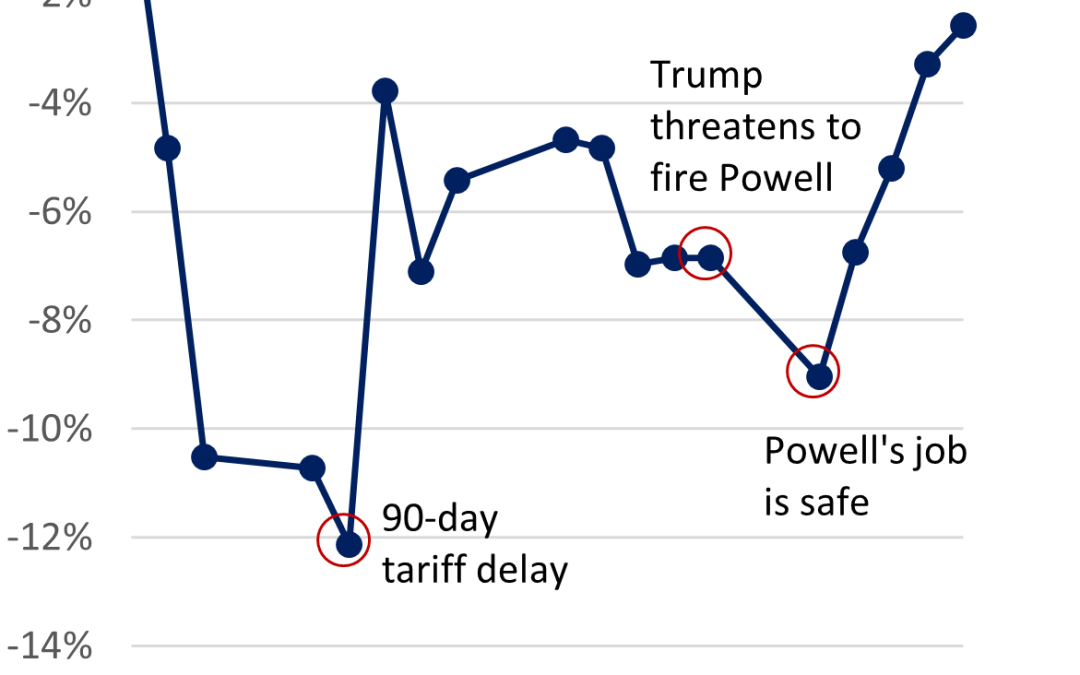

On Wednesday, President Trump put reciprocal tariffs on hold for 90 days (except China), fueling the third-best daily gain (9.5%) in the S&P 500 Index since WWII, according to Bloomberg. On Thursday, the president said the pause could be extended. However, a...

by Mark Chandik | Apr 7, 2025

Reciprocal tariffs were announced Wednesday afternoon. In most cases, they are far higher than expected and varied considerably. Vietnam at 46%, the European Union at 20%, China at 54% (20% existing + 34% reciprocal), and the United Kingdom at 10%, according to the...