Weekly Market Commentary

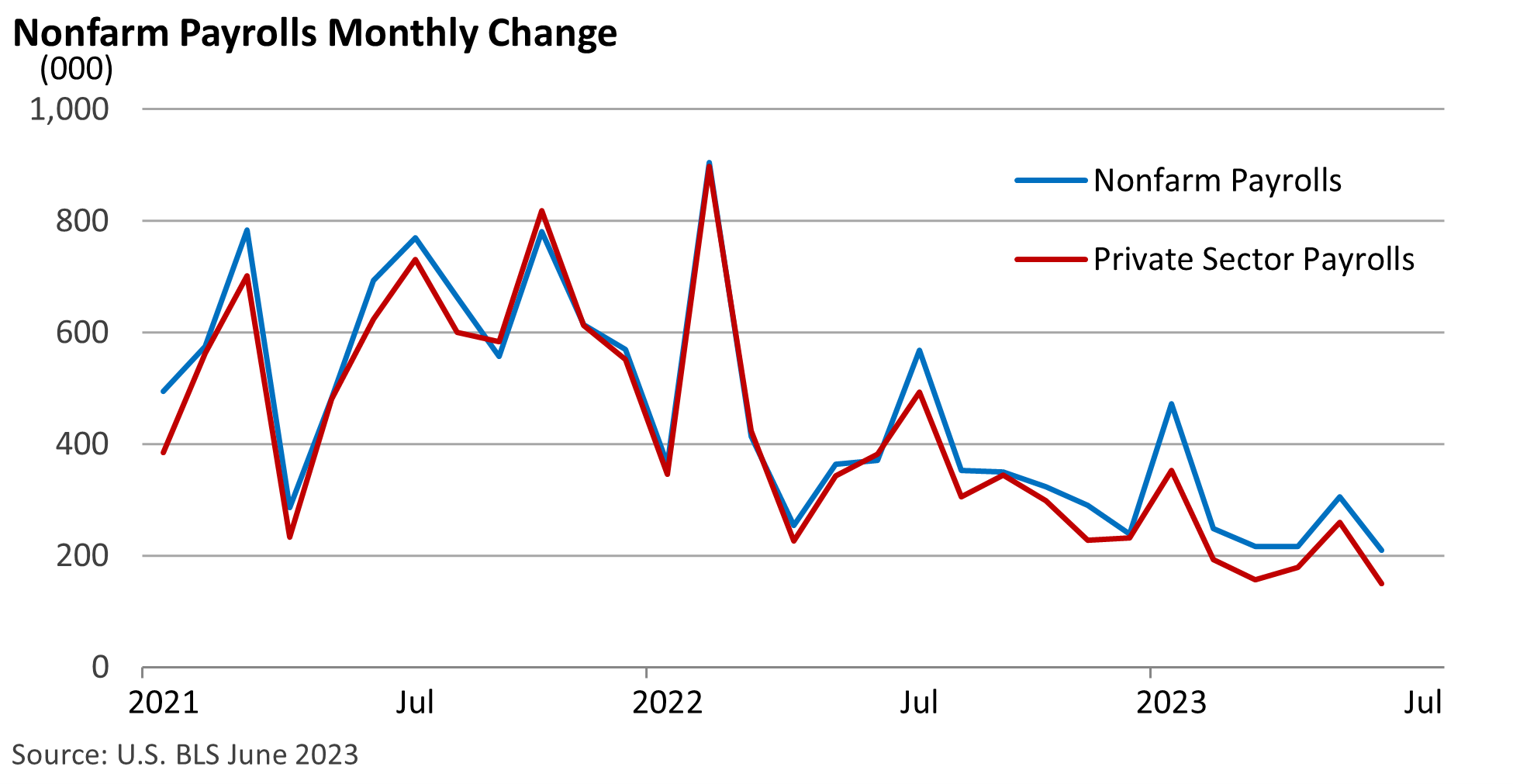

It has been a surprising year for the labor market, as job growth has been much more resilient than anticipated.

According to CNBC, the U.S. Bureau of Labor Statistics’ monthly nonfarm payrolls report has surpassed analyst expectations for 14-straight months, that is, until June’s report came up short.

Nonfarm payrolls in June increased by 209,000, which was lower than the forecast of 240,000 (CNBC). Additionally, the figures for April and May were revised down by 110,000.

Although the figure of 209,000 was shy of expectations, the overall headline number is respectable. Further analysis shows that growth was aided by government employment (federal, state, local, and education), which increased by 60,000 in June.

That translates into 149,000 new private-sector jobs, marking the weakest reading since a 268,000 pandemic-influenced drop in December 2020.

It’s worth providing some context for June’s private-sector number. The 149,000 increase was the lowest monthly reading since December 2019 (excluding the shutdown in early 2020 and the decline in December of the same year), which saw a rise of 93,000.

With the revisions, private sector jobs have been below 200,000 in four of the last five months. At no time during 2021 and 2022 did private-sector payroll growth slip below 200,000.

It is not recessionary, nor does it signal that the economy is on the cusp of a recession, but job growth is finally slowing down.

Despite economic uncertainty, the economy has managed to avoid a downturn. However, it seems that the Fed could be approaching a peak in rates as payroll growth begins to slow down.

A more rapid decrease in the rate of inflation would further support this notion. However, it may require a recession or significant economic slowdown to prompt rate cuts.