It’s prudent to cautiously eye rapid changes in market sentiment caused by short-term traders.

A week ago, our summary focused on a strong jobs report, rising bond yields, and general concerns about inflation. There was a sense of despair among traders at week’s end.

With the arrival of a new week, investors shifted their focus from what felt like a suspenseful thriller to a lighthearted, family-friendly feature that even concluded with a Hallmark ending.

What happened?

Short-term traders were on the edge of their seats on Wednesday, awaiting the release of the December Consumer Price Index (CPI) by the U.S. Bureau of Labor Statistics.

While the headline CPI rose a slightly higher than expected 0.4%, the core CPI, which excludes food and energy, rose a slightly smaller than expected 0.2%.

Major news outlets, including the Wall Street Journal, published the consensus forecast.

Call it a major relief rally, as longer-term Treasury bond yields plummeted, and stocks rallied sharply.

The headline CPI is important, but investors were solely focused on the core CPI.

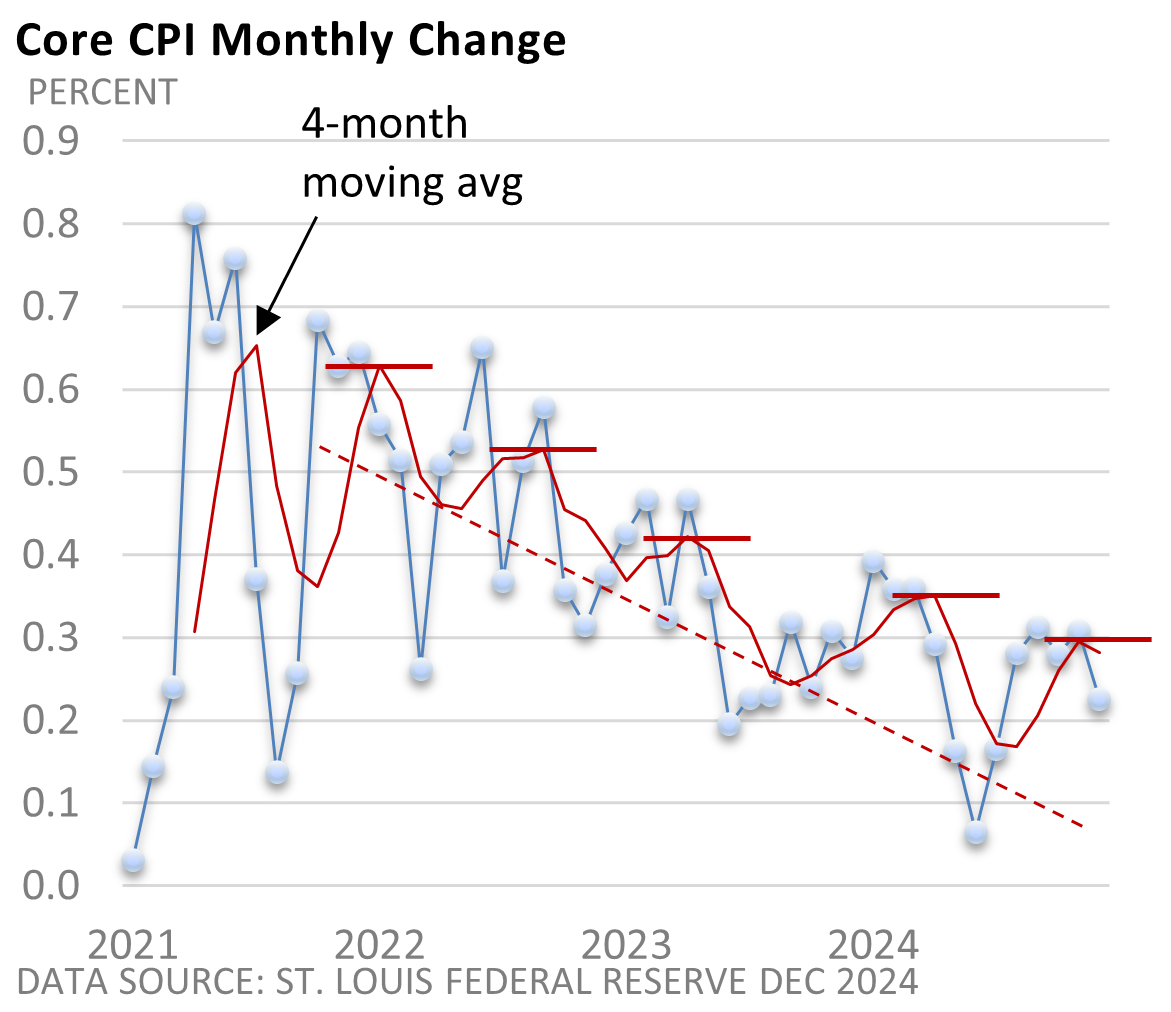

As the graphic below illustrates, the road to a lower inflation rate has been bumpy.

While progress has slowed, the peaks and valleys in the 4-month moving average remain in a downward trend.

Further, last week was the unofficial kickoff to Q4 earnings season.

According to LSEG, the early read is favorable, as companies, on average, are topping analyst estimates by a wide margin.

Separately, the inauguration of Donald Trump on Monday marks the beginning of a new chapter for our nation.

It’s early, but the new president could issue a flurry of executive orders, which may support (deregulation) or dampen enthusiasm (hefty tariffs) for equities, at least in the short term.

Over the longer term, however, it’s the economic fundamentals— including the economy, corporate earnings, and interest rates—that influence markets.

Ultimately, it’s important to stay focused on your financial goals, maintain diversification, understand your financial comfort zone, and be mindful that volatility, when it arises, shouldn’t distract you from your unique investment plan and goals.