Weekly Market Commentary

I recognize we’re getting a bit granular reviewing just one week of market action, but quickly, last week’s volatility was tied primarily to worries about rising bond yields amid a continued stream of strong economic data, not what’s happening in the Middle East.

It’s the upbeat economic data that leads to this week’s topic. Economic activity has been surprisingly robust over the last couple of months. Yet, there’s a notable disconnect between the economic data and consumer confidence.

Let’s briefly review.

- Job growth is strong, with nonfarm payroll growth averaging 260,000 per month this year, according to U.S. Bureau of Labor Statistics (BLS) data through September.

- The unemployment rate has been below 4% for 20 straight months, per the U.S. BLS.

- Job openings remain elevated (U.S. BLS data).

- Layoffs measured by first-time jobless claims are the lowest in a year (Dept. Labor).

- Q3 GDP is tracking at a robust 5.4%, per the Atlanta Federal Reserve’s GDPNow model, as of October 18.

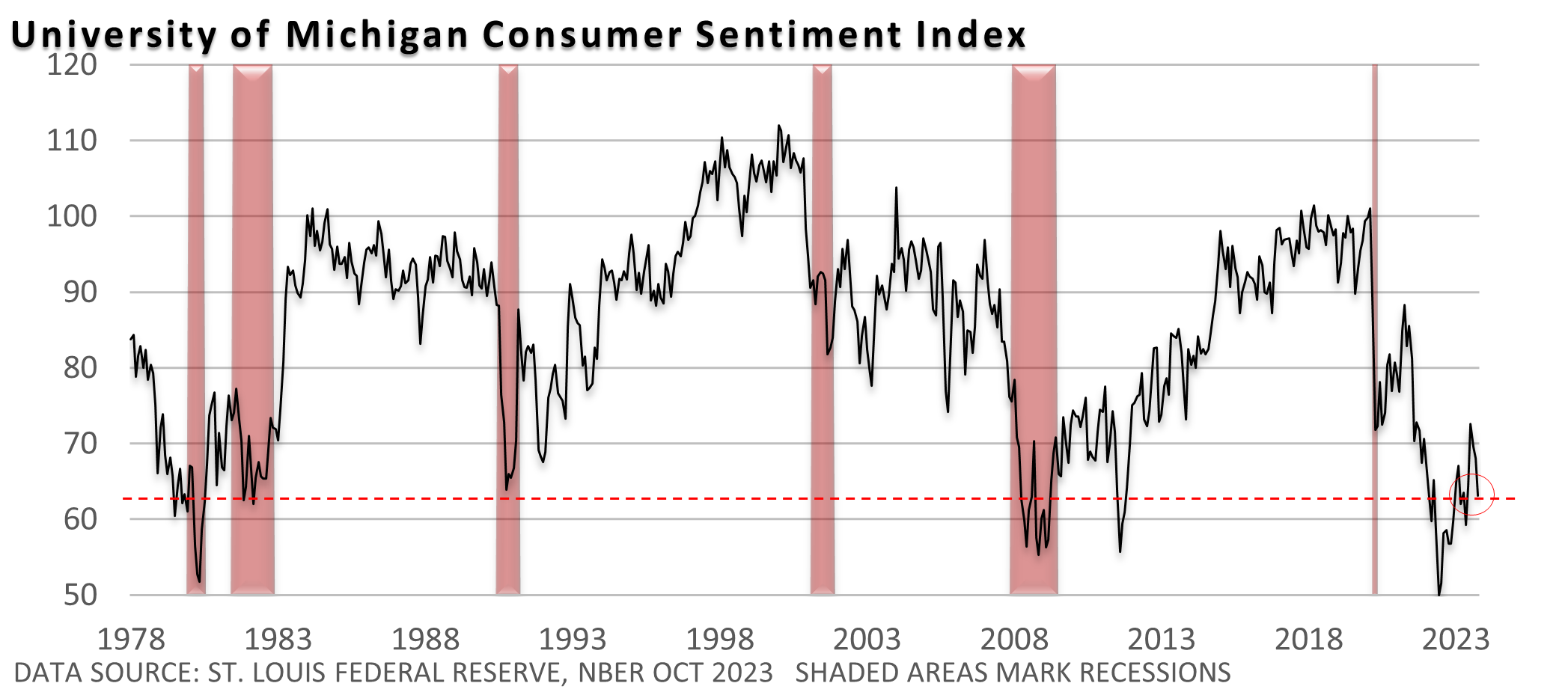

But a quick review of the Consumer Sentiment Index paints a different picture. Why?

Fed Chief Jay Powell summed it up well at his September press conference when he stressed, “People hate inflation—hate it. And that, that causes people to say, ‘The economy’s terrible.’ But at the same time, they’re spending money.”

Economists focus on the slowdown in the rate of inflation. The average person, however, sees the current price of goods and services, and they are high and still going higher.

On top of that, jobs are plentiful, and companies are hiring, but many of the openings are in lower-paid service jobs, hotels, and restaurants. As the Wall Street Journal pointed out a couple of weeks ago, “Underneath blockbuster top-line data about new jobs is a not-so-rosy reality: white-collar jobs are getting tougher to land.”

According to U.S. BLS data, wages have struggled to keep up with inflation since the pandemic started. Rents are high, and high home prices and mortgage rates have priced many first-time buyers out of the market.

The economy is solid today, but there are valid reasons good vibes aren’t reflected in the data.