On January 13th, the Wall Street Journal published an article entitled “Investors Hope Earnings Season Can Revive Faltering Stock Rally—With the Fed unlikely to cut interest rates as quickly as hoped, corporate earnings growth becomes even more critical.”

It’s not unusual to see a financial website write a story expressing concerns about the upcoming earnings season—in this case, Q4 2024.

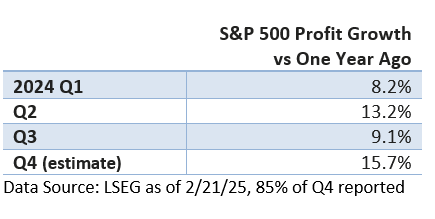

As the season unfolds, we typically see firms top conservative profit estimates, and Q4 was no exception, per LSEG.

As the new year began, LSEG expected S&P 500 companies to report a 9.6% rise in profits compared to one year ago (estimate published by LSEG as of January 1).

With 85% of companies having reported Q4 results, LSEG’s survey pegs Q4 profit growth at 15.7%, the best showing in three years. That’s well ahead of the early forecast.

In part, strength in profits among some of the large tech firms is helping drive earnings growth. In part, the economy is expanding, and the public is spending money, which also supports corporate profits.

Stronger profits contributed to rising stocks during the current earnings season, and the S&P 500 Index achieved record closes last Tuesday and Wednesday, according to MarketWatch.

These records occurred before a selloff at the end of the week.

Other factors also influence the direction of equities, such as interest rates and the economic outlook.

Furthermore, developments related to tariffs may affect the economic outlook. Anxieties about tariffs have been an on-again, off-again headwind over the last month.

While the movement in stocks doesn’t have an immediate one-to-one correlation to corporate earnings, over a longer period, earnings have a significant impact on stocks.