The Consumer Prices Index, as reported by the U.S. Bureau of Labor Statistics (BLS), rose 0.5% in January; the annual rate is up 3.0% versus 2.9% in December.

The closely followed core CPI, which excludes food and energy, rose 0.4% (0.446%, nearly rounded to 0.5%), the biggest increase since April 2023. On an annual basis, the core rate rose to 3.3% in January vs 3.2% in December. It has been stuck between 3.2% and 3.3% for eight months.

On the surface, it was a discouraging report, but if we look deeper, we find some unique factors that contributed to the hotter-than-expected numbers.

To begin with, companies focus on price hikes near the beginning of the year—let’s call it the calendar effect.

We observed it last year, and it was evident in 2023 as well. We also noticed it during the low inflation years of the 2010s, as we’ll demonstrate below.

With that in mind, let’s examine the data by sorting through what the U.S. BLS and economists refer to as seasonally adjusted (SA) and nonseasonally adjusted (NSA) data.

Almost all reports, including the CPI, are published on a seasonally adjusted basis.

Why?

Factors such as the change in seasons, production cycles, model transitions, and holidays can lead to seasonal price variations.

According to the U.S. BLS, seasonal adjustments eliminate the effects of recurring seasonal influences from many economic series, including inflation, allowing analysts to identify new trends more accurately.

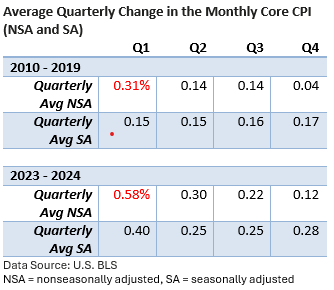

Let’s review the data from 2010 to 2019 and 2023 to 2024 (three years of the pandemic and supply chain distortions are excluded). While the latter includes only two periods of data, elevated inflation is a new phenomenon in the modern era. It’s all we have to work with.

NSA price increases in Q1 are about double Q2 price hikes for both the 2010 to 2019 and 2023 to 2024 data sets.

But inflation is much higher today than it was during 2010. So, early-year price hikes are larger today.

For 2023 to 2024, we observe both a significant increase early in the year in the NSA data as well a large increase in the SA data.

If the pattern persists, expect February and March to register uncomfortably large increases followed by a moderation in price hikes in the spring and summer.

Of course, significant increases in tariffs or other economic factors could alter the pattern.

While investors are currently looking beyond what appear to be seasonal influences on the CPI, persistently high inflation could postpone or hinder further rate cuts unless an unexpected economic slowdown occurs.