Weekly Market Commentary

The days of pulling up to a gas station, rolling down the window, and asking the attendant to fill ‘er up are long gone. Nowadays, the responsibility falls on someone in the car to pump the gas.

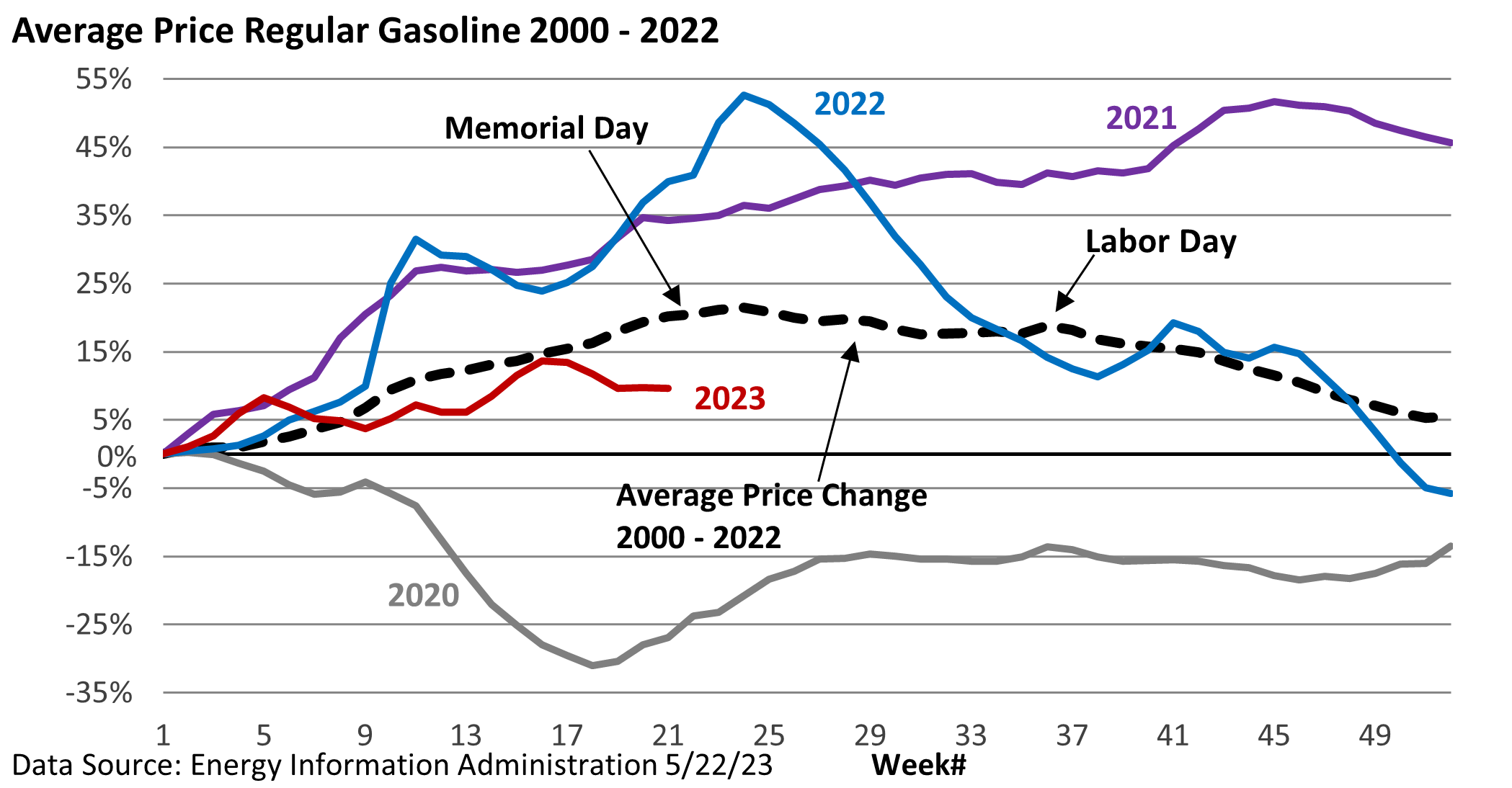

As we head into the summer season, it’s no coincidence that the price of gasoline tends to increase, especially as we approach Memorial Day weekend.

From 2000 to 2022, the average cost of regular gasoline has increased by roughly 20% from the start of the year through Memorial Day.

However, it’s important to note that gasoline prices vary significantly from year to year, with the cost typically dropping after Labor Day.

In 2020, the price of gas collapsed in response to the pandemic.

As demand recovered, prices jumped in 2021 and remained high into the fall. Markets were further destabilized by Russia’s invasion of Ukraine in 2022, leading to another sharp rise in energy costs.

This year economic uncertainty, which could hamper demand, has pressured prices heading into the holiday weekend. The rise in price this year is about half the longer-term average.

What’s behind the typical pattern? Retail gasoline prices tend to rise in the spring and peak in the summer when people drive more frequently. Gasoline specifications and formulations also change seasonally and fuel higher prices.

According to the Energy Information Administration (EIA), environmental regulations require that gasoline sold in the summer be less prone to evaporate during warm weather.

This requirement means that refiners must replace winter gasoline, which is more prone to evaporate, with less evaporative but more expensive components for summer usage.

From 2000 through 2022, the average monthly price of regular gasoline in August was about 39 cents per gallon higher than the average price in January, according to the EIA.

Although filling up in the summer is usually less budget-friendly, there are valid reasons for the rise in prices.