As we approached the early April selloff, much of the data suggested that economic activity was expanding. Let’s examine two important pieces of data.

Led by a 5.3% surge in auto sales, retail sales rose a strong 1.4% in March.

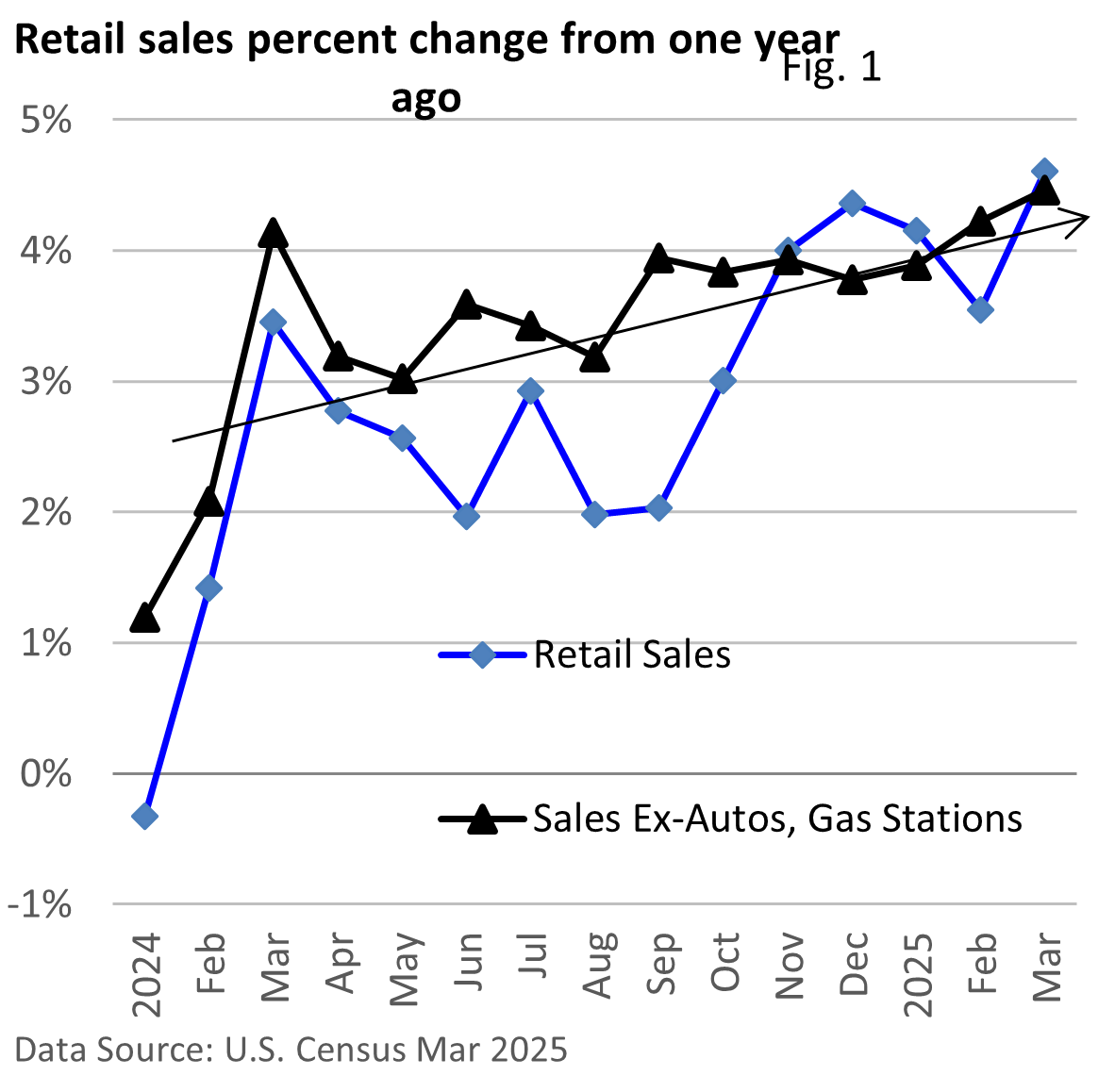

While some buyers were hoping to jump in front of any tariffs (especially autos), February’s numbers were also respectable. As Figure 1 indicates, sales have been trending higher.

In their quarterly earnings releases, the major banks acknowledged that consumers are spending, according to the Wall Street Journal.

Moreover, in its quarterly report, the CEO of American Express (AXP $251) said recent metrics are “in many cases, better than what we saw in 2024.”

But economic growth extends beyond just the ‘stuff’ you and I buy.

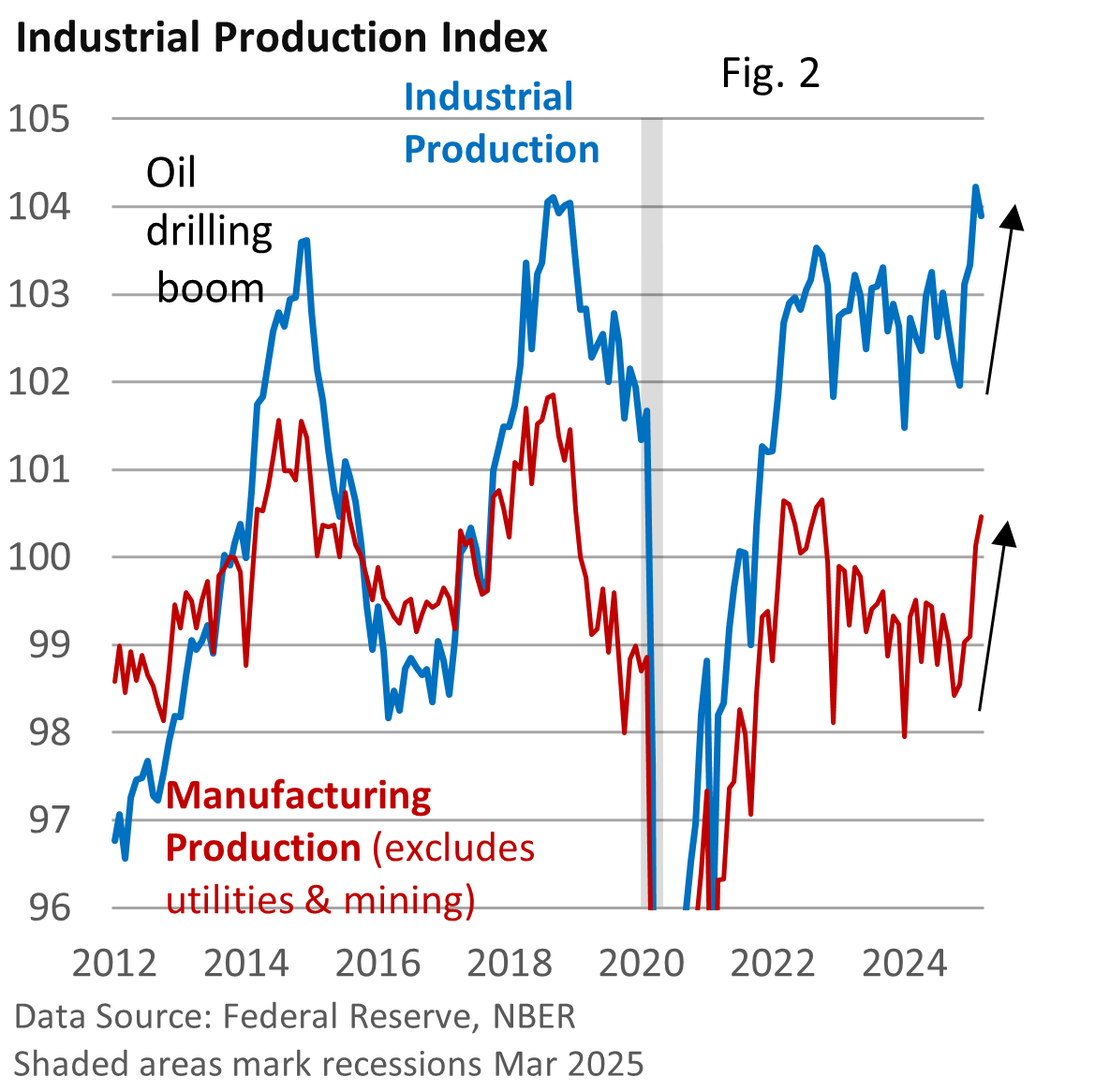

After being stuck in a sideways pattern for over two years, life is returning to the industrial sector as evidenced by Figure 2.

The only reason industrial production was down 0.3% in March: a 6% decline in output from utilities.

Otherwise, manufacturing rose for the 5th month in a row, gaining 0.3% in March.

Given a massive surge in imports over the last couple of months (U.S. Census), as companies hoped to jump ahead of any tariffs that might be imposed, Gross Domestic Product may be weak or decline in the first quarter (a surge in imports subtracts from GDP).

Meanwhile, Dept. of Labor data points to a low level of layoffs, and job growth has been solid, according to the U.S. Bureau of Labor Statistics.

It added up to economic momentum heading into the recent market turmoil.