Weekly Market Commentary

Government shutdowns make for good political drama. Nonessential workers are furloughed, travel plans to national parks could be interrupted, and some services are limited. A shutdown also increases investor anxiety.

But should sentiment take a beating? Historically, the short answer has been no.

According to CNN Business, shutdowns have lasted roughly a week on average. The most recent one stretched over 34 days.

While there is a disruption in some government services, the longer-term impact on the economy is almost zero.

When the shutdown ends, government workers receive backpay, and government-contract work resumes.

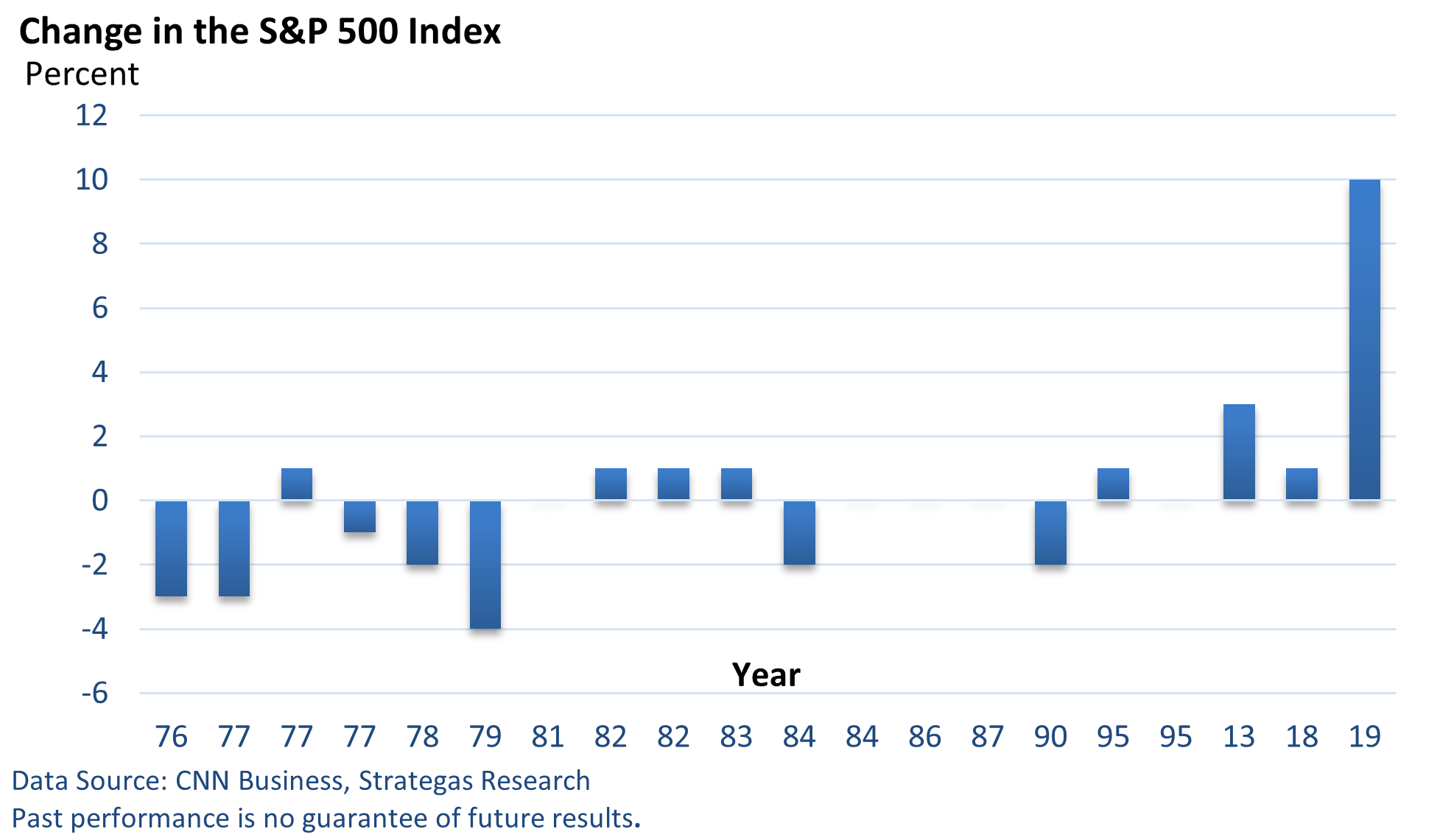

If a shutdown has virtually no impact on the economy, it stands to reason that it would probably have little medium- and longer-term impact on stocks. As the graphic above highlights, the short-term effect has historically been minimal.

That’s not to say that we might not see some short-term volatility, as we saw last week. Some of that was likely tied to short-term traders taking a more cautious approach.

Any extended shutdown would also lead to a delay in some economic reports amid worker furloughs.

In addition, a shutdown might reduce the odds of a November rate increase as the view of the economy is muddied.

However this eventually plays out (an agreement could limit, delay, or prevent a shutdown), the historical data suggest that investors with a long-term view should not let short-term uncertainties affect their investment strategy.

The deadline to avoid a shutdown is October 1.