Weekly Market Commentary

Mortgage rates have soared, and home sales are down sharply. Conventional wisdom would suggest that prices should be down. But housing prices have defied expectations, rising to record heights and locking first-time buyers out of the market.

First of all, real estate is local. What’s happening in one market may not mirror what’s occurring in another market.

For example, a recent story on CNBC cites a big drop in prices in Austin, Texas. But that is the exception, not the rule.

Why have prices defied gravity? During the financial crisis, home prices fell sharply, as sales dried up and buyers defaulted on mortgages, flooding the market with unsold homes.

Sales of existing homes (homes that are owned and occupied before being put on the market) are down close to 40% from the peak, according to the National Association of Realtors.

They account for roughly 90% of all housing sales. New builds account for the rest.

During the 2000s, builders threw caution to the wind and churned out new homes at a torrid pace. Once bitten twice shy, builders turned cautious after the crisis, limiting supply. Moreover, much tougher lending standards reduce the risk of default.

But paradoxically, the rise in mortgage rates has also discouraged those who want to move simply because they are reluctant to trade a low mortgage rate for a much higher one.

That has reduced the supply of homes available for sale, forcing buyers to compete for the limited supply that remains.

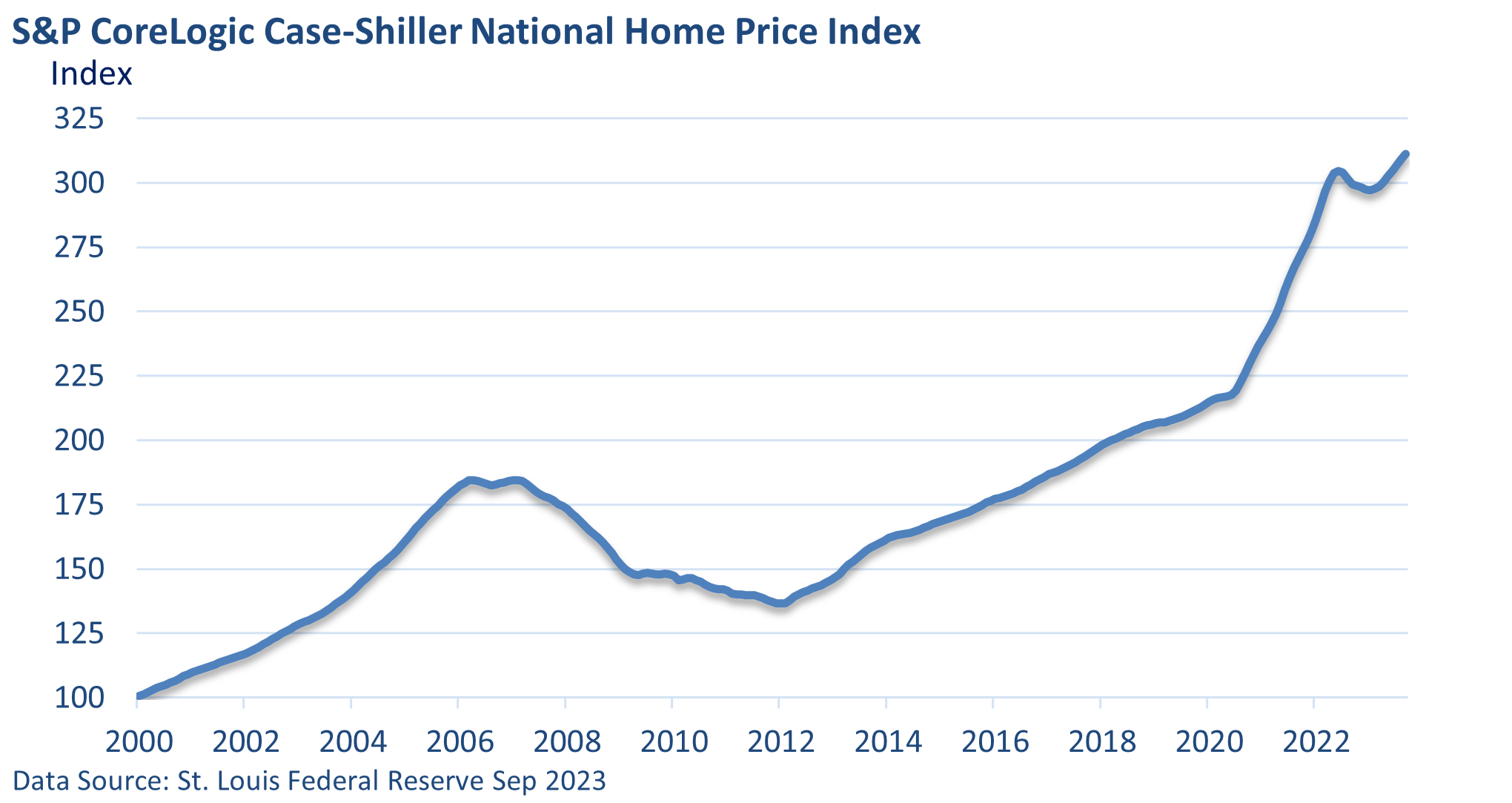

The graphic below illustrates that the National Home Price Index is at a record high.

Notably, rock-bottom mortgage rates during 2020 and most of 2021 boosted demand and accelerated price gains. However, the recent increase in rates had only a short-lived and limited negative impact on prices.

The 30-the fixed mortgage rate averaged 6.67% in the week ending December 21, down from the peak two months ago of 7.79%. As expectations reset, that may bring some new buyers into the market. It could also slowly encourage reluctant sellers to list their homes.